First Alliance Credit Union is thrilled to introduce, My Money, the newest feature available in its robust and easy-to-use Online Banking platform. The new My Money tool is built right into your First Alliance Credit Union Online Banking account; no additional logins needed or complicated enrollment processes to go through.

What is My Money from First Alliance Credit Union?

With the My Money tool you can get a complete picture of your finances by pulling in the information from all your accounts into the easy-to-use My Money online tool. Our powerful new software allows you to collect your account data from other financial institutions, credit cards, investment accounts, mortgage and insurance accounts into one place. Then, with all your financial information at your fingertips, the My Money tools help you analyze your spending, track your investment portfolios, reach savings goals and take control of your finances.

Watch the complete My Money tutorial video to learn about all the important features and benefits!

My Money is a robust, online personal finance management tool that lets you:

- Manage ALL of your savings accounts, checking accounts, and loans in one place (not just your First Alliance ones!)

- Create and monitor your personalized budget

- Set and visualize financial goals for yourself

- Monitor and review transactions from ALL your financial accounts in one place (again, not just your First Alliance ones!)

- Receive and monitor your Zillow real estate values

- Keep track of ALL your investments and insurance accounts from multiple sources in one place (not just your First Alliance ones!)

Let’s take a closer look at each feature in the My Money tool and review the benefits of using each part of your new My Money tool to manage your personal finances.

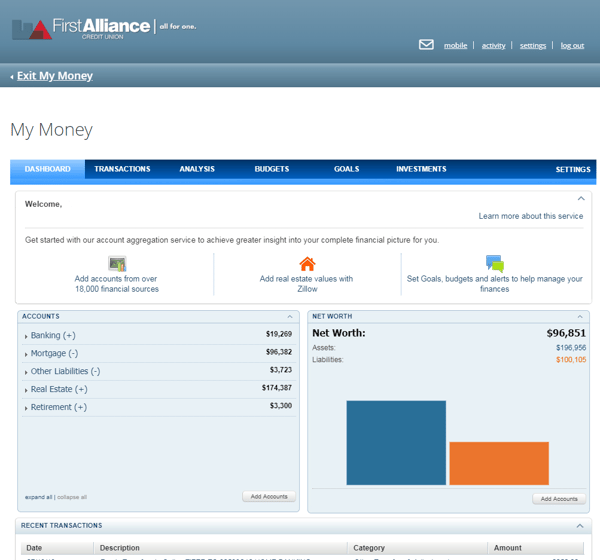

My Money Tool – Dashboard Feature

Your personalized My Money Dashboard screen is a snapshot of your current financial landscape. It will provide you with a quick look at your account totals, net worth, most recent transactions and any important alerts you need to know.

The Benefit to You: The Dashboard allows you to save time by having a convenient quick view of your current financial picture. No more logging into multiple online accounts or reviewing excel spreadsheets to understand your finances.

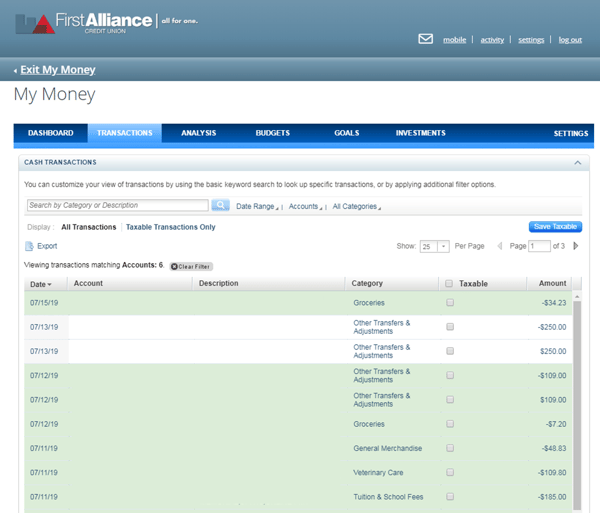

My Money Tool – Transactions Feature

The My Money Transactions screen is where you can review all transaction activity from all of your financial accounts, both from First Alliance Credit Union and any other banking accounts you’ve added into the My Money tool. You can quickly categorize your transactions to help you analyze your spending and saving habits.

The Benefit to You: The Transactions tab allows you simplify your life and helps you gain control over all of your financial accounts by providing you a clear, detailed view of all your transactions from multiple financial institutions in one place.

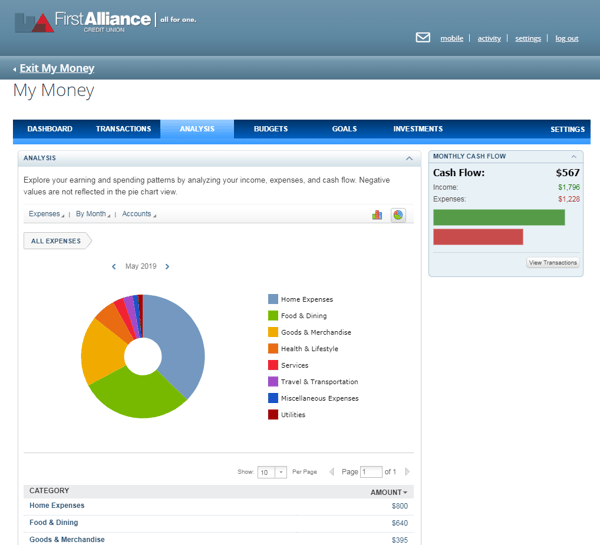

My Money Tool – Analysis Feature

The My Money Analysis screen is where you’ll find a breakdown of your expenses by category and cash flow. You’ll be able to drill down into your expenses by category, month, and accounts to help you gain understanding over how you are spending your money each month.

The Benefit to You: With the Analysis tab you’ll quickly find opportunities for financial growth as you explore your spending patterns with the colorful, easy to understand charts and cash flow summary.

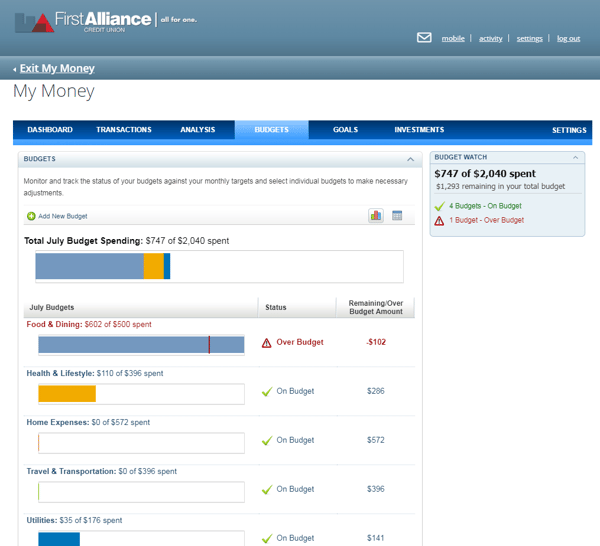

My Money Tool – Budgets Feature

The My Money Budget screen is where you can create and monitor your personalized budget based on your actual spending. It will show you areas where you’re rocking it, and areas where you could cut back. You can set your own budgets, or use national averages if you’re not sure where to start.

The Benefit to You: In the Budget tab you’ll gain control over your finances with the ability to see your spending by category and help you focus your money into the areas that are most important to you, and help you stop overspending the less important areas.

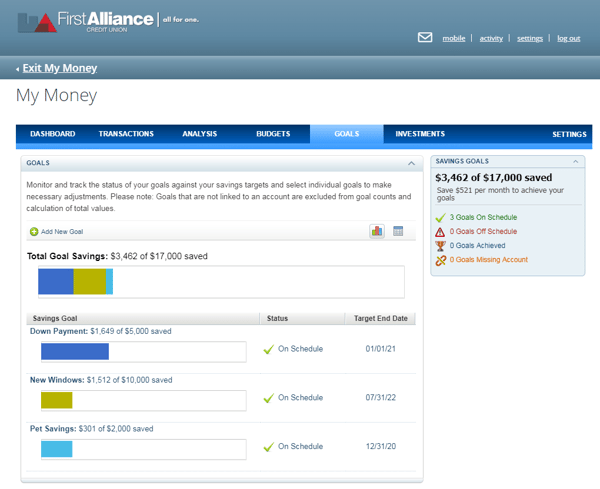

My Money Tool – Goals Feature

The My Money Goals screen is where you will be able to set and monitor progress for your personal financial goals. Whether your goal is to save more money for a new car or to fund your Pet Savings Account you can use the Goals tool to help you stay on track.

The Benefit to You: With the Goals tab you’ll gain control over your money and meet your financial goals faster than ever before. Having your financial goals visually available to you with up-to-date progress will allow you to stay motivated and feel less stressed about your finances.

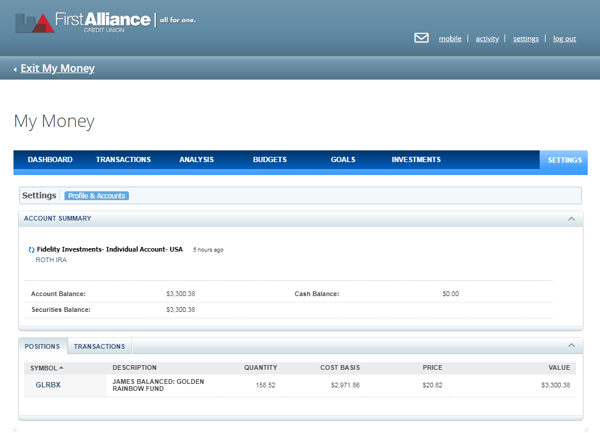

My Money Tool – Investments Feature

The My Money Investments screen allows you to review all of your financial investments in one place. You can view each investment with individual details or at a high level overview of all your accounts. No matter if you have a widely diversified portfolios or are just starting to save for retirement, this tool will help to keep your investments at the front and center of your financial picture.

The Benefit To You: You’ll save more money having your investment accounts in front of you on a regular basis by using the Investments tab. Regularly paying attention to your investment accounts is a great way to keep focused on achieving your long-term financial goals.

Use the My Money Tool to Make Good Money Moves

Having access to the My Money feature in your First Alliance Credit Union Online Banking portal is a great step toward making good money moves. The benefits you’ll receive from having up-to-date account information from all of your online banking accounts in one place are life changing.

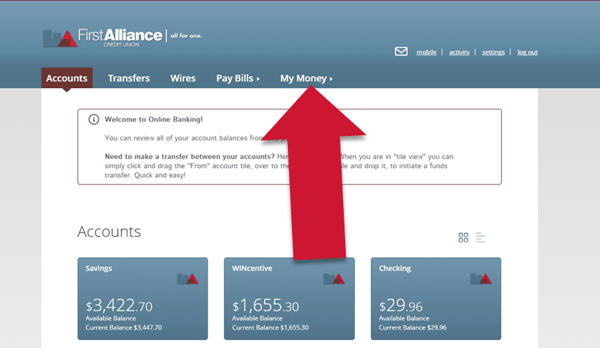

To get started using the new My Money tool, simply login to your Online Banking account at First Alliance Credit Union and click “My Money”. There will be no new logins to remember or complicated enrollment process to go through. You’ll be prompted to enter your Online Banking login credentials and that’s it!

If you have questions, check out the FAQs and scroll back up to watch the complete tutorial video. Or if want helping getting your My Money tool configured, just let us know! We’re here to help you make good money moves and achieve financial success.