For those new to online banking: click here to get started.

Simplify your First Alliance Loan Payments with MessagePay

At First Alliance Credit Union, we believe managing your finances should be seamless, stress-free, and secure. That's why we're thrilled to introduce MessagePay—your new way to make your First Alliance Credit Union loan payments convenient and quick. With MessagePay, you can now pay your First Alliance Credit Union loan payments from anywhere.

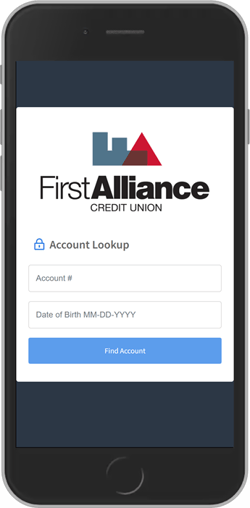

Step 1: Verify Your Account

Click the link, and you’ll be taken to our secure portal. Enter your First Alliance Credit Union membership account number and date of birth to verify your account.

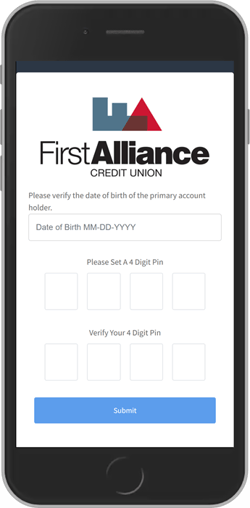

Step 2: Create a PIN

For added security, you'll be prompted to create a 4-digit PIN during your first verification. Keep this PIN safe, as you’ll need it for future payments.

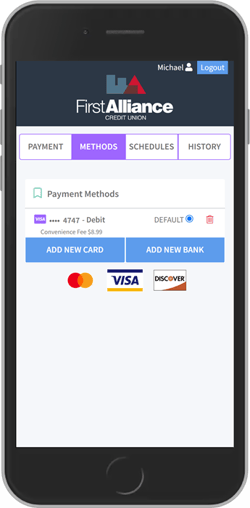

Step 3: Set up Your Payment Method

Add your preferred payment method by selecting:

-

ADD NEW CARD

-

ADD NEW BANK ACCOUNT

Follow the prompts on our secure website. Once completed, you’ll see a “Payment Method Success” message and be redirected to the payment portal.

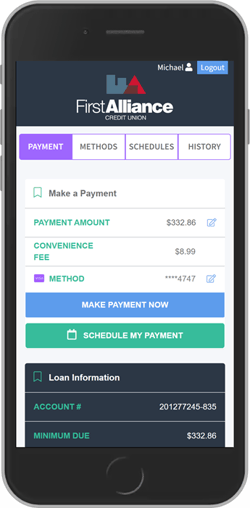

Step 4: Make a Payment

In the payment portal, you can:

-

Check the Payment Amount: Easily view the amount due.

-

Convenience Fee: Know the fee associated with your payment method.

-

Select Your Payment Method: Choose how you want to pay.

-

Make the Payment: Select "Make Payment Now" to complete your payment immediately.

-

Schedule a Payment: Choose "Schedule My Payment" to set up a payment for a future date.

-

Fees: The transaction fee is $1.99 for ACH transactions from a checking account or $8.99 for debit card payments.

More Info About MessagePay

-

Frequently Asked Questions

Will I be able to make my First Alliance credit card payment using MessagePay?

Yes, a member can pay their First Alliance credit card with MessagePay.

Can I make a payment on my loans through my First Alliance CU online and mobile banking?

Yes, you can use our online and mobile banking through your smartphone, tablet, or desktop to make your First Alliance Credit Union loan payments. However, in order, to use online and mobile banking to make your First Alliance Credit Union loan payment you must have a First Alliance savings or checking account.

What if I get locked out?

You can contact our contact center to get your pin reset.

How long until the payment goes through?

Your payment is effective almost immediately.

What if I don't have enough money in my other banking account when my payment processes?

For any ACH payment that is unable to be processed a $30 returned payment fee will be assessed to the member's main savings account.

If you have any questions regarding the MessagePay portal please contact us at 1(800)866-8199. We would be happy to help.

-

What You Should Know

-

The link will take you to a portal where you will be asked to verify your account number and date of birth.

-

When you verify your account for the first time you will have to set up the following:

-

4 digit pin: once you have entered your account number and date of birth, it will prompt you to create a 4 digit pin. Store this information in a secure place as you will need this pin number to verify future payments

-

Preferred method of payment : to make a payment you will have to add your payment portal. You can do this by selecting ADD NEW DEBIT CARD or ADD New BANK ACCOUNT which will prompt a secure website for you to input your information . if done correctly, there will be message stating ‘Payment Method Success’ and you will be redirected to the payment portal.

-

-

Once your account has been successfully verified, you will be directed to the payment portal where you’ll be able to see all of your loans and will also be able to select your preferred payment method.

-

-

Member Benefits

-

The transaction fee for ACH transaction (taken directly from a checking account) is $1.99 or you can choose a debit card and pay a debit card transaction fee of $8.99.

-

Encryption guarantees your info is secure.

-

Convenient way to pay from any banking account.

-

Payments accepted from checking accounts & savings account.

-