5 Easy Steps To Financial Literacy For Beginners

Did you know that, according to one report, almost half of Americans make a New Year’s Resolution related to finance? If you’re one of those people,...

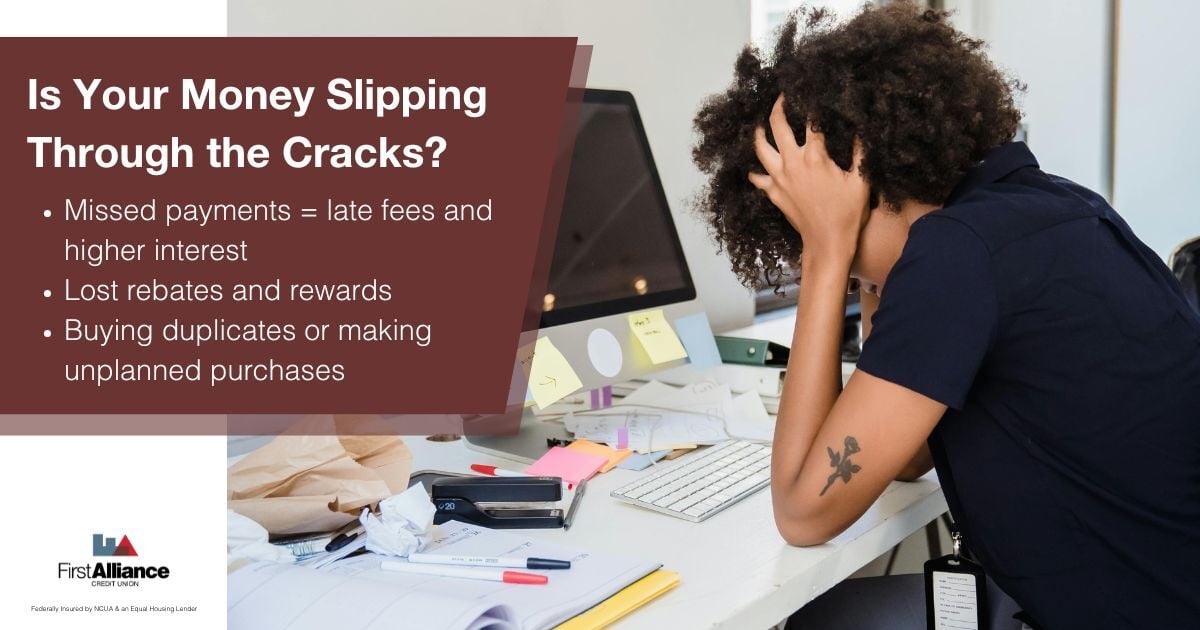

Managing your money goes beyond keeping tidy records or color-coding spreadsheets. When your finances become disorganized, the real impact shows up in missed payments, unnecessary fees, and added stress you don’t need in your life.

The good news? Getting financially organized is simpler than it seems. With options like automatic payments, customizable alerts, and user-friendly budgeting tools, you have easy ways to take control of your finances and gain lasting peace of mind.

Here are 11 of the most common ways disorganization can quietly drain your wallet, along with simple, actionable tips to help you get back on track, minimize money leaks, and build lasting financial confidence. Whether it’s overlooked payments, forgotten rewards, or habits that add up over time, recognizing these patterns, and knowing how to address them, can make a meaningful difference for your finances.

How it costs you: Missing a payment can trigger late fees right away, bump up your interest rates, and even lower your credit score, making loans and credit cards more expensive in the future. These consequences add stress and take money out of your pocket over time.

Quick fix: Set all your regular bills, like utilities, phone, and loans, to auto-pay so nothing slips through the cracks, and you avoid costly late fees. If auto-pay isn’t an option or if you prefer a hands-on approach, dedicate a short time each week for a “bill check-in.” Review all upcoming due dates, confirm payments, and make sure your accounts are funded to cover what’s coming up. This easy routine helps prevent missed payments, lowers stress, and keeps your credit in good standing.

How it costs you: You lose out on money you’re entitled to, whether it’s a rebate, refund, or reimbursement, because the deadline to submit slips by, or you can’t track down the receipt when you need it. This means cash that should have ended up back in your pocket simply goes unclaimed, often because paperwork or documentation is missing or buried amid the clutter.

Quick fix: Keep a “rebate folder” in your email or phone and set reminders before deadlines. Whenever you receive a rebate offer, whether it’s a digital form, a receipt from a recent purchase, or an email confirmation, save it to this folder right away. Then, use your phone’s calendar or reminder app to schedule a quick alert a week before each rebate’s expiration date. This not only helps you keep track of what’s due but also makes it easy to find the necessary paperwork when you’re ready to submit. By having all your rebate info organized in one spot and timely reminders in place, you’ll minimize the risk of missing out on money that rightfully belongs back in your pocket.

How it costs you: You may overlook better rates on loans or savings, miss out on special promotions, employer-offered financial perks, or valuable budgeting tools, all simply because these options weren’t on your radar or you didn’t have a system for tracking what’s available. When you’re not actively organized or reviewing your current financial landscape, it’s easy to stick with the status quo and miss the chance to reduce costs, boost your savings, or maximize your workplace benefits.

Quick fix: Schedule an annual financial review with your credit union or a trusted financial advisor to look for ways you might be able to save more money, reduce loan costs, or access new benefits that fit your needs. Don’t forget to ask about member-exclusive perks, special promotions, or new tools you could use. Setting aside this time just once a year ensures you’re not leaving money on the table, helps you stay proactive about your financial well-being, and keeps your financial goals moving forward.

How it costs you: Impulse shopping leads to overspending and buyer’s remorse. When you make spur-of-the-moment purchases, it’s easy to buy things you don’t truly need or can’t really afford. Those unplanned expenses can quickly derail your budget, add up over time, and leave you regretting purchases that don’t fit your financial goals. Left unchecked, impulse buys chip away at your savings and create unnecessary stress, making it harder to stay on track with your long-term plans.

Quick fix: Before making any unplanned purchase, give yourself a 48-hour waiting period. This “cooling-off” window helps you pause and reflect before spending, so you have time to ask yourself if the item is really necessary, fits your budget, or supports your bigger goals. Many impulse buys lose their appeal once you’ve stepped away for a couple of days. If, after 48 hours, you still feel confident about the purchase and it works for your finances, you can move forward without regret. This simple rule can help prevent buyer’s remorse, keep your spending in check, and strengthen your commitment to the financial plans you’ve set for yourself.

How it costs you: A forgotten or misplaced gift card is unused money, essentially, it’s like setting cash aside and never getting the chance to use it. Those unspent balances quietly fade into the background and, over time, can add up to significant dollars lost. Whether it’s a physical card tucked away in a drawer or a digital code buried in your email, letting gift cards slip through the cracks means missing out on purchases you’ve already paid for.

Quick fix: Store all your physical gift cards securely in your wallet so they’re always with you when you shop. For digital gift cards, immediately log the details, such as the card number, PIN, and expiration date, in a dedicated note on your phone or save them in a secure wallet app. This makes it easy to quickly access your gift cards whether you’re shopping in-person or online, helps you track remaining balances, and ensures you never miss out on using the full value before a card expires.

How it costs you: Disorganization with your account balances can trigger expensive overdraft charges. When you’re not consistently monitoring your checking account or keeping track of what transactions are pending, it’s all too easy to accidentally spend more than you have available. Even a single forgotten payment, debit card swipe, or automatic withdrawal can push your balance below zero, resulting in overdraft fees that quickly add up. These fees don’t just take a bite out of your finances, they can also cause embarrassment and stress, and may even affect your ability to use your account moving forward.

Quick fix: Turn on low-balance alerts in your online or mobile banking so you get notified right away if your account is getting close to zero, this gives you time to transfer funds or adjust your spending before you risk an overdraft and the fees that come with it. Pair this with a spending tracker, either built into your credit union’s online tools or through a trusted budgeting app, to keep a real-time view of your expenses. Together, these tools help you spot potential issues early and stay in control of your account balance, so you can avoid surprises and manage your money with confidence.

How it costs you: When you can’t remember what you already own, groceries, household goods, clothing, you buy duplicates. Not only does this mean you’re spending money on items you didn’t actually need, but those extras also add to clutter and make it even harder to keep track of what you have. Over time, these unnecessary purchases can quietly chip away at your budget and disrupt your efforts to save, especially if you find yourself tossing out unused food or storing multiples of the same product.

Quick fix: Keep a running inventory on your phone of household essentials, think pantry staples, cleaning supplies, toiletries, and common groceries, and make it a habit to update the list after every shopping trip or when you use the last of something. This way, before heading to the store, you can quickly check what you actually need, helping you avoid accidentally buying duplicates and saving you both money and time. Plus, with an up-to-date list always on hand, you can confidently shop sales and stock up smartly, keeping your home organized and your budget on track.

How it costs you: Last-minute errands waste gas, time, and often lead to impulse buys. When you’re constantly running out for forgotten items or making unplanned trips, you end up spending more on fuel, putting unnecessary miles on your car, and increasing your chances of grabbing things you didn’t intend to buy, just because you’re already at the store. These unexpected runs also chip away at your free time, creating extra stress and making it harder to stick to your budget or meal plan.

Quick fix: Plan a weekly shopping list and stick to a predictable routine for errands. By setting aside a consistent day each week to review what you need, from groceries to household essentials, you’ll not only avoid forgotten items but also minimize costly last-minute trips that eat up your time and budget. Creating a habit around planning and shopping allows you to make the most of sales, use coupons efficiently, and take advantage of member discounts at your favorite stores.

How it costs you: Without organized tax documents, you may miss out on deductions or credits you qualify for. When receipts or important paperwork are scattered or misplaced, it becomes much more difficult to prove your eligibility for valuable tax breaks. This can mean leaving money on the table at tax time, paying more than necessary, or even facing questions from the IRS if you can’t provide proper documentation. By not having your tax records in order, you may overlook expenses that could reduce your taxable income, ultimately costing you extra money that could have stayed in your pocket.

Quick fix: Keep a single, year-round tax folder, whether digital or physical, where you immediately drop all tax-related receipts, statements, and paperwork as you receive them. This simple habit makes tax time much less stressful, because everything you need will already be organized, easily accessible, and in one place. When you sit down to do your taxes, you won’t have to search through piles of documents or wonder if you’ve missed something. Plus, staying organized ensures you can take advantage of every deduction or credit you’re eligible for, helping you keep more money in your pocket and making it easier to answer any questions from your tax preparer or the IRS.

How it costs you: Library fines, subscription renewals, or service fees can pile up when you lose track. Forgetting a due date for library books, missing a subscription renewal reminder, or overlooking service payments may seem minor at first, but these lapses can quietly add up to unexpected expenses over time. Whether it’s a couple of dollars here or a late charge there, these overlooked fees slowly erode your budget and create needless financial stress.

Quick fix: Create a subscriptions list and review it monthly to cancel or update what you no longer need. Track all your active subscriptions in one place, streaming services, apps, gym memberships, magazines, or any recurring charges. Set a monthly calendar reminder to go through your list, checking for price increases, free trials ending, or services you no longer use. By keeping tabs on your subscriptions, you’ll catch forgotten expenses before they add up and make sure you’re only paying for what brings you value. This simple routine helps you avoid surprise charges and keeps your spending aligned with your financial goals.

Financial disorganization doesn’t happen overnight and neither does getting organized. But small, consistent habits can save you real money and reduce your stress in a big way. Start with just one or two of the tips above, and build from there. Your wallet, and your peace of mind, will thank you.

Did you know that, according to one report, almost half of Americans make a New Year’s Resolution related to finance? If you’re one of those people,...

It’s taken time, but you’ve finally done it. You’ve created a monthly budget that you’re sticking to, and you’re regularly adding money to your...

We all know what financial instability is like—living paycheck to paycheck, trying to figure out which bills can and can’t be taken care of this...