How to get Your Finances Ready for the New Year

For most people, January is a time to prepare for the year ahead. The most popular way to do that is by making New Year's resolutions, but people...

If you’re like most people, your preparations for the new year mostly involves writing up a list of New Year’s resolutions. These resolutions usually involve things like finally getting into shape or decluttering home for good, and while these are worthwhile goals, they’re usually forgotten after a couple of weeks and the new year passes by the same way the last one did.

If you really want to make 2022 your year, don’t just set some New Year’s resolutions and hope that they come true. Instead, take some steps to prepare for the next 365 days and lay the groundwork for this year being your year.

One of the best ways you can prepare for the year ahead is by setting some financial goals. Setting financial goals at the start of the year helps you to prioritize what you want to do over the next 12 months. It can also help boost your mood as you start thinking about all the great things you’ll do in the next year.

To start setting financial goals, think about all the things you’d like to do and write them down. Once you’ve written your goals down, separate them out by how long you think you’ll need to achieve them. Short-term goals should be able to be accomplished in one year, medium-term goals will take two to five years to accomplish, and any goal that will take longer than five years to accomplish is a long-term goal.

To start setting financial goals, think about all the things you’d like to do and write them down. Once you’ve written your goals down, separate them out by how long you think you’ll need to achieve them. Short-term goals should be able to be accomplished in one year, medium-term goals will take two to five years to accomplish, and any goal that will take longer than five years to accomplish is a long-term goal.

Once you’ve written up your list of goals, make them S.M.A.R.T.—Specific, Measurable, Attainable, Realistic and Time-Bound. Then select the goals that are most important to you and start working on them. If you manage to complete a goal, go to your list of S.M.A.R.T goals and select another one to take its place.

Nothing prevents a year from being your year like having to go into debt due to a financial emergency. You can make sure a financial emergency won’t derail your year by building up an emergency fund you can use to defray costs ranging from surprise auto repairs to long-term hospital stays.

You can start building an emergency fund by saving at least 10% of each paycheck. If you’re already saving 10%, try to increase that amount to 15% or even 20%. You can also use direct deposit to make the process easier by automatically diverting a certain amount of your paycheck to your savings.

While you should ideally review your budget at the end of each month, reviewing your budget at the beginning of a new year not only helps you prepare for the year ahead, it also gives you an overview of what your needs and priorities will be, especially if you’ve set some financial goals.

All you need to do to review your budget is make sure that you haven’t overspent in any categories. If you have, you’ll want to figure out why you overspent, then determine if it’s likely to happen again. If you are probably going to overspend, you should adjust your budget by increasing the amount you allot to that category and reduce the amount you spend in another, less important, category.

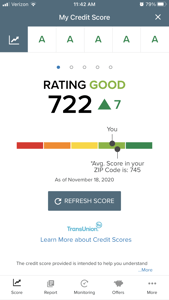

Once you’re satisfied you have your current finances well in hand, take a look at your credit score. If you’re a member of First Alliance Credit Union, you can look over your credit score when you log into our online banking platform or mobile app, but you can also get your credit score at sites like AnnualCreditReport.com, the official site of the Consumer Finance Protection Bureau, and receive a free annual credit report from each of the three major consumer reporting companies.

Once you’re satisfied you have your current finances well in hand, take a look at your credit score. If you’re a member of First Alliance Credit Union, you can look over your credit score when you log into our online banking platform or mobile app, but you can also get your credit score at sites like AnnualCreditReport.com, the official site of the Consumer Finance Protection Bureau, and receive a free annual credit report from each of the three major consumer reporting companies.

Once you get your free credit report, go through it and make sure there are no inconsistencies, especially if you believe your credit score is too low. If you need to raise your credit score, take the recommended steps and then give yourself a reminder to check your score again in three to four months.

A lot of people talk about what they’ll do to make the new year their year, but most people never progress beyond writing down their New Year’s resolutions. If you take the above four steps, though, you’ll be setting yourself up for success over the next 365 days. You’ll have your priorities in place, thought out solid plans and made sure that an emergency won’t send you into debt.

If you’d like additional help in making this year your year, become a member of First Alliance Credit Union today. You can open up a money market account to get a higher interest rate for your emergency fund, use the My Money feature of our online banking platform to help you design a budget that works for you, and even take out loans to help you achieve your financial goals.

For most people, January is a time to prepare for the year ahead. The most popular way to do that is by making New Year's resolutions, but people...

If your New Year's resolutions involve money, you're not alone. According to one report, nearly half of Americans are making finance-related...

January 1st is a time to look ahead and make a New Year's resolution or two concerning all the things you want to do during the new year. That...