Financial Moves to Make When Life Gets Expensive

If you’ve been feeling like your paycheck doesn’t quite cover what it used to, you’re probably right. Thanks to inflation, you’re paying a little...

5 min read

Chris Gottschalk

:

Oct 19, 2023 4:45:00 AM

Chris Gottschalk

:

Oct 19, 2023 4:45:00 AM

When you get your paycheck, how do you feel? Are you happy for the new funds and excited about how you’ll allocate them? Or do you feel anxious, like you’re only getting temporary relief from a never-ending string of bills and expenses and that you just can’t make ends meet?

If that last question had you nodding your head in recognition, you’re not alone. According to a 2023 Capitol One Survey, 77% of the respondents felt anxious about their financial situation. Additionally, 58% said that their finances controlled their lives.

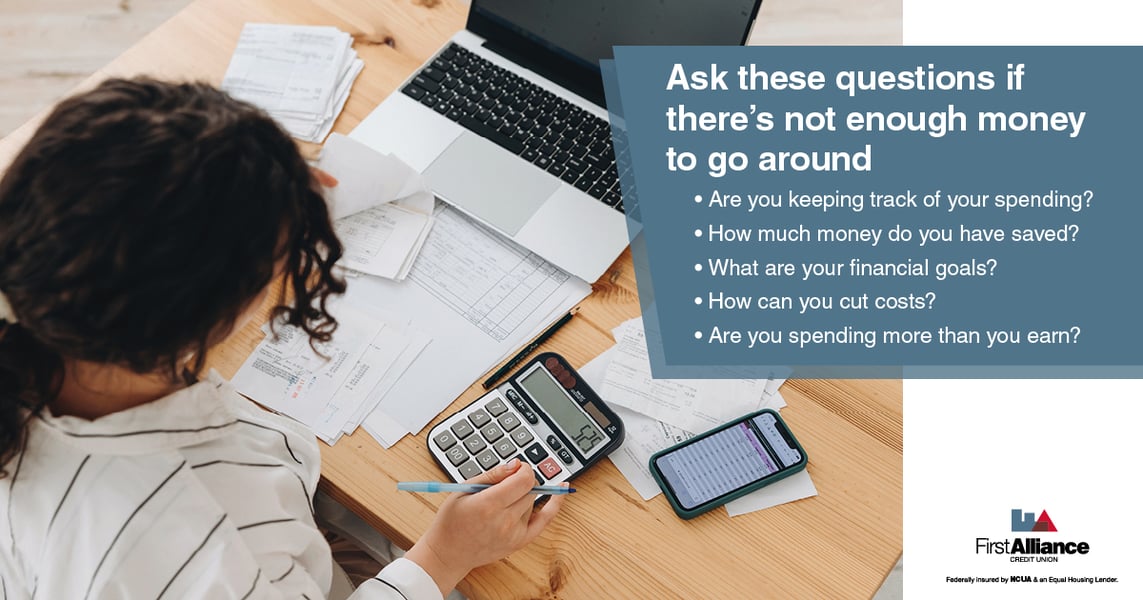

There’s no getting around the fact that feeling like there's not enough money to go around can be a constant source of stress. However, if you do feel like you don’t have enough money, there are five questions you can ask that might help you take control of your money and feel better about your finances.

One of the biggest reasons people feel like they don’t have enough money is that they’re not sure where their money goes each month. They’re pretty sure they have enough to pay off their monthly bills, but they have no idea how much they have left over for things like gasoline, groceries or what they’d do if they had an emergency.

When you track your spending, though, you start to understand where your money is going. Even better, you can identify areas where you’re spending more than you’d like and adjust your spending to focus on the things most important to you. In other words, it gives you control over your finances.

Tracking your spending can also help you plan and reach financial goals. You can figure out how much money to set aside for financial goals, such as an emergency fund or paying off high-interest debt.

Long-time readers of this blog won’t be surprised to learn that the best way to track your spending is by creating a spending plan, or as it’s better known, a budget. While it’s not hard to create a budget on your own, there are several budgeting tools and apps out there that can make the process easier. At First Alliance Credit Union, for instance, you can download our budget worksheet to help you figure out budget categories and give you suggestions on how to modify the categories to fit your own needs.

Once you’ve created a budget, though, you have to stick with it in order for it to be effective. Fortunately, this isn’t hard.

The toughest part of sticking with a budget is getting in the habit of checking your finances a few times each week to stay on top of how much you’ve spent, and how much money you have left in each of your budget categories. Once you’re aware of this information, you’ll be able to make decisions about what you’re able to buy, and what you’ll want to put off until later.

If you feel like there's not enough money, the thought of putting some money in a savings account might feel like a bad joke. How is saving money going to help if you feel like you don’t have enough money in the first place?

Admittedly, getting into the habit of saving money can be difficult if you feel like money is tight in the first place. However, having some money in savings can dramatically lower the stress you feel about money. When you know you have some money set aside if an emergency hits, for example, you’ll feel more secure about your finances.

Having extra cash in your savings can also help you feel like you have enough money in other ways, too, including:

The best way to start saving is to try to set some of your paycheck aside each month. A good target to shoot for is 10%, but if you feel like you can’t manage that look through your budget and save as much money as you comfortably can. The key is to save regularly.

When you set clear financial goals, you’re not just saving up to get cool stuff. You’re creating a path for your financial success. More importantly, you’re shifting your mindset from merely surviving to succeeding.

One of the best way to help yourself set financial goals is to make them SMART. In other words, make sure your goals are:

When you have this information, you’ll be able to create a roadmap to reach your goal that you’ll be able to follow.

If this question caused you to roll your eyes, we understand. However, it is true we can spend a lot of money on little expenses that add up over time. If you can find those little costs and eliminate them, you might be surprised at how much money you free up in the long run.

Let’s face it—almost everything has gotten more expensive in the past few years, and prices probably won’t go back down. If you’re feeling like there’s not enough money to go around, the problem might be that prices have climbed faster than your income.

If you’re struggling to make ends meet each month, the first thing you need to do is make sure you have control of your finances. Once you know where your money is going each month, look for these signs you might not have enough income:

If you’re not making enough money to sustain your lifestyle, you need to figure out how to increase your income. This can be a lot easier said than done, but it is possible.

One way to increase your income is to ask for a raise at work. This can be hard for a lot of people, but if you don’t ask, you won’t get anything.

When you ask for a raise, make sure you’re prepared beforehand. Document all your accomplishments in the past year or so, as well as any awards you’ve won. Numbers and statistics can make a huge impression, so be sure to include specifics that showcase how your contributions have led to the company doing better.

If your boss turns down your request, don’t give up. Ask what it would take to get a raise, or even a bonus at the end of the year.

You might also want to consider looking into a part-time job, or perhaps even freelancing. There are a lot of job boards online, such as:

You’ll find people on these sites looking for help for anything from mowing their lawn to editing their novel.

If you’re constantly feeling like there’s not enough money to go around, the good news is that asking yourself a few simple questions might help. By tracking how much you spend each month, saving money regularly and reducing unnecessary costs, you’ll be able to get control over your finances and give yourself some peace of mind. However, if your income really can’t keep up with your expenses, you’ll want to look for ways to bring in more money.

You can also get help controlling your finances and making sure your money covers your needs by becoming a member of First Alliance Credit Union. You can get help creating a budget and building up your savings by using the guides in our resource center, and keep track of your the money in your bank accounts with our online banking platform and mobile app. You can even get a quick “No Hassle” loan to help with any unexpected expenses.

If you’ve been feeling like your paycheck doesn’t quite cover what it used to, you’re probably right. Thanks to inflation, you’re paying a little...

When you become an adult, you stop being worried about things like ghosts, devils and monsters lurking in the dark. That’s mostly because those...

If you’ve never thought much about money or your finances before, it can be hard to know where to start. To help you gain control over your own...