What’s in the First Alliance Credit Union Switch Kit?

If you’ve ever heard of the First Alliance Credit Union switch kit, you might be aware that it’s a free download that can help you switch financial...

2 min read

Chris Gottschalk

:

Feb 17, 2022 4:45:00 AM

Chris Gottschalk

:

Feb 17, 2022 4:45:00 AM

If you’re thinking about switching to a new bank or credit union, you might have come across some financial institutions offering something called a “Switch Kit” to make the process easier.

While this may sound appealing, let’s face it—a lot of companies offer products to make some task or another easier, and most of them don’t exactly live up to the hype. So how exactly does a bank account switch kit make switching banks easier?

One of the biggest reasons switching to a new bank or credit union can be so intimidating isn’t just because there’s several steps you need to take—it’s also because missing one of those steps can create a lot of problems. If you forget to transfer one of your automatic payments to your new account, you’ll get hit with late fees and lower your credit score. Forget to transfer your direct deposit, on the other hand, and you might end up having to rely on your credit card or emergency fund for a month or so as you work with your employer, your old financial institution and your new financial institution to get your direct deposit transferred to your new checking account.

One of the biggest reasons switching to a new bank or credit union can be so intimidating isn’t just because there’s several steps you need to take—it’s also because missing one of those steps can create a lot of problems. If you forget to transfer one of your automatic payments to your new account, you’ll get hit with late fees and lower your credit score. Forget to transfer your direct deposit, on the other hand, and you might end up having to rely on your credit card or emergency fund for a month or so as you work with your employer, your old financial institution and your new financial institution to get your direct deposit transferred to your new checking account.

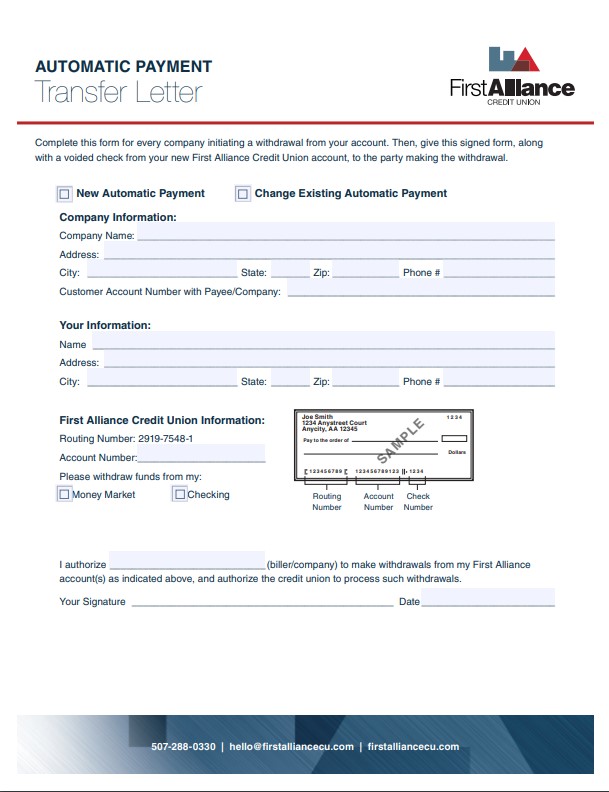

When you use a switch kit, though, you usually get forms and checklists that will help you organize the process and make it easier for you to keep track of everything you need to do. For instance, the First Alliance switch kit contains a checklist with all the steps you’ll need to take, as well as a place to list all your automatic payments and deposits. This not only reduces the possibility that you’ll overlook something, it also takes away a lot of the stress associated with switching financial institutions.

Of course, knowing what automatic payments and deposits you need to transfer is only half the battle. You also actually need to contact the companies to transfer your payments and deposits. Sometimes, that can be even more stressful than trying to make sure you haven’t overlooked a payment.

Switch kits usually have form letters you can use that let you fill in all the information companies require when changing automatic payments. They also have form letters you can send to reroute your direct deposits to your new checking account.

Once you have your new checking and savings account established and your automatic payments and deposits transferred, you’re finally ready to close your old account. In order to do that, though, you’ll need to verify your identity with your previous financial institution. While the best way to do this is in person, it’s not always possible, and if you want your old financial institution to send the money in your old account to your new one, the process can get even more complicated.

Once you have your new checking and savings account established and your automatic payments and deposits transferred, you’re finally ready to close your old account. In order to do that, though, you’ll need to verify your identity with your previous financial institution. While the best way to do this is in person, it’s not always possible, and if you want your old financial institution to send the money in your old account to your new one, the process can get even more complicated.

This is why many switch kits have a standard closure request form letter. Like the payment transfer letters, it simplifies the process of closing your account by showing you what information you need to include. All you have to do is fill in the blanks.

When you use a switch kit, you make the process of switching to a new bank or credit union a lot easier. A switch kit helps simplify the process of getting your payments and deposits transferred and helps you keep the whole process organized to lower the odds that you’ll overlook something.

If you’d like to switch to a new financial institution, such as becoming a member of First Alliance Credit Union, download our free switch kit and see for yourself what it can do.

If you’ve ever heard of the First Alliance Credit Union switch kit, you might be aware that it’s a free download that can help you switch financial...

If you search the Internet for advice on how to switch to a new bank or credit union, odds are you’ll get a lot of articles that do their best to...

Out of all the steps you need to take to switch financial institutions, switching your direct deposit to your new bank or credit union is perhaps the...