Should You Get a Personal Line of Credit or a Personal Loan?

One of the most versatile loans you can get from a financial institution is a personal loan. You can use the money for anything from funding your...

3 min read

Chris Gottschalk

:

Aug 29, 2023 4:45:00 AM

Chris Gottschalk

:

Aug 29, 2023 4:45:00 AM

We’ve all needed a little extra money at some point. It might be due to an unexpected expense, or maybe you need some help to hit an important financial goal, like a home improvement project. Regardless of the reason, one of your best bets for extra cash is to take out a small personal loan.

Of course, once you’ve decided to take out a personal loan you need to choose the best personal loan lender. While you could talk to someone at a bank, you might want to visit your local credit union and talk with a lending advisor first. Banks might be more well-known for giving out loans, but credit unions have some advantages banks just can’t match.

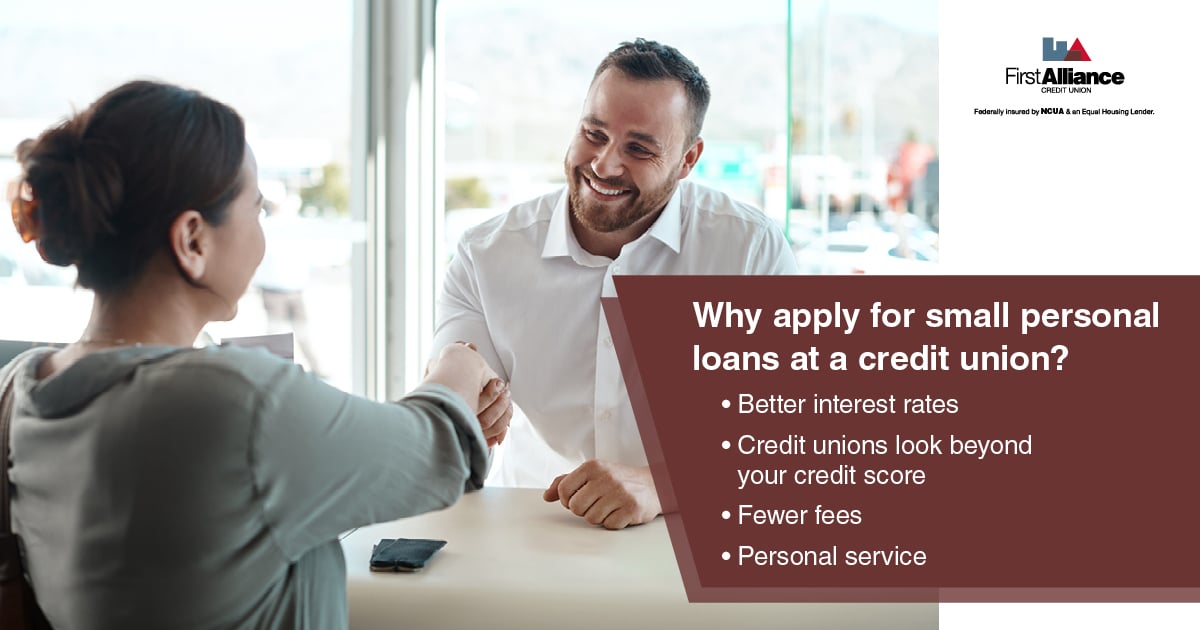

The biggest advantage of credit union personal loans is the interest rate. Since credit unions are not-for-profit entities, they’re more concerned with covering operating costs instead of turning a profit. This means that by and large, a credit union’s interest rates will be lower than the interest rate you get from a bank.

Even better, credit unions’ interest rates can only be so high. As of 2023, the National Credit Union Association board has capped interest rates at 18% through September 10, 2024. Regardless of how much the Fed raises the prime rate, you can rest assured you won't have to pay more than 18% interest.

It’s one thing to apply for a small personal loan when you have a good credit score and a record of paying all your bills on time. It’s another matter entirely to apply for a small personal loan when you’ve had money problems in the past and are trying to rebuild your finances.

While a bank might reject you outright if you’ve had money troubles, a credit union lending advisor usually takes the time to talk with you. At First Alliance Credit Union, for instance, lending advisors will take your whole financial situation into account. They’ll base their decisions on you as a person, taking into account your current financial situation, why you need the small personal loan and any plans you have to make your personal loan payment each month.

A credit union’s commitment to personal service goes beyond just getting a big-picture look at your finances. A personal lender can also help you through the entire process, from answering any questions you might have about how to apply for a personal loan to helping you figure out if a personal loan is your best option.

If it turns out a personal loan isn’t your best option, though, a lending advisor won’t just shrug their shoulders and wish you better luck the next time you apply. Instead, they’ll discuss other steps you can take, such as how to raise your credit score or how to manage your money with a budget.

You’re probably aware that when you’re repaying a personal loan, you’ll also have to pay back the interest your loan has generated. What you might not know, though, is that many banks also charge fees for their loans. These fees can include:

At First Alliance Credit Union, though, you won’t have to pay any of those fees, and while we can’t speak for every credit union, you’ll usually find that credit unions charge fewer fees than banks.

If you could use a small personal loan to help you get ahead, talk to the lending advisors at a credit union. You won’t have to pay as many fees as you would at most banks, and the lending advisor will treat you as more than just your credit score. Even better, you’ll be able to avoid the personal loan fees that many banks charge, and you’ll get a lower interest rate as well.

Want to get more information about small personal loans? Contact a First Alliance Credit Union lending advisor today. They’ll be happy to help you figure out if a personal loan is right for you, and they can also give you more information about how to maximize your chances of getting approved.

One of the most versatile loans you can get from a financial institution is a personal loan. You can use the money for anything from funding your...

Managing multiple debts can feel overwhelming in today's financial landscape. However, there is a beacon of hope in the form of debt consolidation...

If your credit score has taken a few hits, you’re not alone. Maybe you missed a few payments, maxed out a credit card, or had a loan that got away...