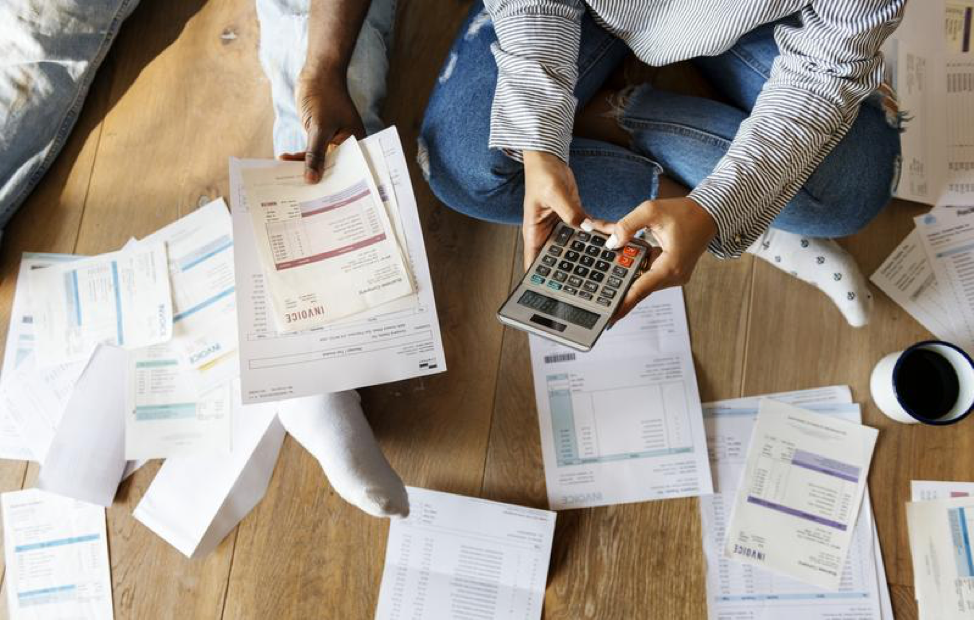

How to Reduce Financial Stress in 4 Steps

Financial stress in Olmsted County is skyrocketing, according to a recent report put out by the Olmsted County Community Health Improvement Plan. One...

People always make resolutions to manage their personal finances better. Whether that means saving more, or setting up a personal budget, the suggestions can get overwhelming. In order to cut through all of the clutter, Bill Druliner, GreenPath Midwest Regional Manager, shares his top five personal plans for financial success to consider.

One fundamental fact that gets lost in all the discussion of personal finances is this: To become financially secure, you must spend more that you make. Different systems work well for different folks, but here are a few ideas:

You don't necessarily need to pay for a credit monitoring service to be able to understand your credit report. You can obtain each credit bureau report one time per year for free by visiting www.annualcreditreport.com. If you're having trouble understanding how to improve your credit, a free credit review with a non-profit agency, such as GreenPath, can help.

You don't necessarily need to pay for a credit monitoring service to be able to understand your credit report. You can obtain each credit bureau report one time per year for free by visiting www.annualcreditreport.com. If you're having trouble understanding how to improve your credit, a free credit review with a non-profit agency, such as GreenPath, can help.

Once you've got a workable budget, automate the process of saving. Setting up direct-deposit into savings makes it much more likely you'll save. Plus, paying yourself first helps the money to be "out of sight and out of mind," so that you'll be able to stick more closely to the spending plan you've set for yourself.

It's important to reach a point where you have a balance between short-term savings and long-term (retirement) savings. It should be a priority to try to adjust your budget, so that you can take advantage of any employer-sponsored retirement plan that is offered at your job-especially of the employer offers a contribution match.

One of the first steps in decreasing your debt load is to stop adding to it in the first place. Begin to get out of the habit of using credit cards for purchases.

One of the first steps in decreasing your debt load is to stop adding to it in the first place. Begin to get out of the habit of using credit cards for purchases.

If you have debts, look for ways to try to reduce your overall interest costs. This could include balance transfers, consolidation loans, and/or a Debt Management Plan with a reputable agency such as GreenPath.

"Strive to reach a point where you never carry a balance on your credit card," said Druliner. "The money that you have been spending on interest is money that could be going toward building savings and financial security."

There is a wealth of information available about personal finances! Many community organizations, non-profits, and community banks and credit unions have free courses available to learn about money management.

You can also get a boost on the path to financial success when you become a member of First Alliance Credit Union today. We have guides to help you do everything from pad out your savings account to raise your credit score in our resource center, and the My Money tool in our online banking platform will help you create a budget that works for you. We've also partnered with companies like Green Path Financial Wellness, which offers free, unlimited financial education tools and one-on-one financial counseling.

Financial stress in Olmsted County is skyrocketing, according to a recent report put out by the Olmsted County Community Health Improvement Plan. One...

Practical money management skills learned at an early age can have a lasting impact on the rest of your child’s life. In fact, this is one of the...

When we talk about teaching financial literacy to children, it sometimes seems as though teenagers are left out of the equation. That’s unfortunate,...