4 CD Investment Strategies You Must Know

At first glance, you wouldn’t think that putting your money in a certificate of deposit, otherwise known as a CD, requires a lot of strategy. True,...

So you’ve put aside money regularly for a couple years, and now you have a substantial amount of money in your savings account. You have so much money that you’d like to invest it, preferably in a risk-free account that offers you a better interest rate than a traditional savings account. After reading about the advantages and disadvantages of a certificate of deposit (CD), you realize this is a fantastic option.

There’s only one question—how do you go about opening a CD account? While it is slightly different than opening up a checking or savings account, it is still easy to do, and once you’ve opened your first CD you’ll have no trouble opening one again.

The first step in opening a CD is to figure out what kind of CD you want to open. In other words, how long do you want your money to be in the CD?

There’s no one-size-fits-all answer to this question. However, since CDs with a longer term have better interest rates, you'll want to think about how long you're comfortable keeping a portion of your money locked away versus the interest rate you want to get.

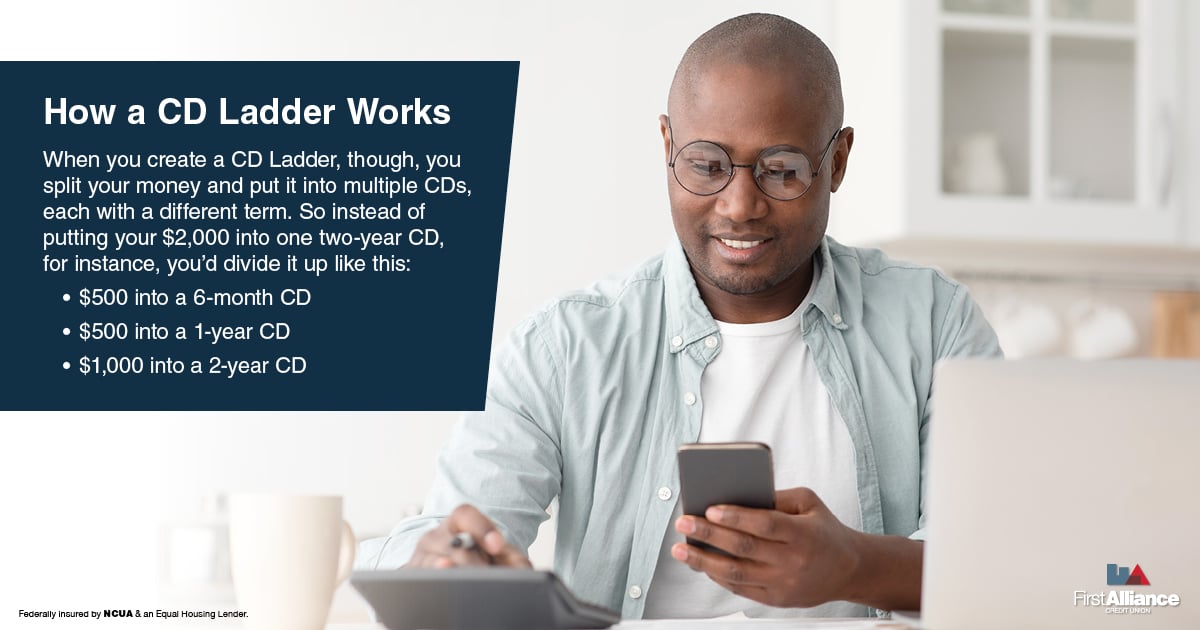

It's worth mentioning that you can open multiple CDs that have different terms, so you can regularly have some money available while the rest of it is getting the higher interest rate. This is known as a CD ladder strategy, and they can be as simple--or as complex--as you need.

Once you know how long you’re comfortable keeping your money in a CD, you’ll have to think about how much money you want to put in the CD account. Your first step should be contacting the credit union or bank you’re planning to open the CD with and ask about their minimum deposit requirements. At First Alliance, for instance, the minimum deposit for a CD is $500.

Again, there’s no one right answer for this, but a good rule of thumb is to put away money you know you won’t need during the term of the CD. For instance, if you have $20,000 you’re saving up for a down payment on a house next year, you might want to put it all into a CD to make sure it doesn’t get spent on other things. On the other hand, if you’ve saved up that money as part of your emergency fund, you’ll want to reserve enough money in an account that is easily accessible, to get you through most financial emergencies, usually $4,000.

With most credit unions and banks, your next step will be filling out a request form to open the CD account. In the case of First Alliance Credit Union, the form will consist of your name, contact information, the CD term you’d like and how much money you want to deposit in the CD. There’s also an additional space where you can share information such as where the funds are coming from, your goals for this account and any other questions you might have about the account.

Once you're done, a member advisor will contact you and answer any questions you might have and make sure all the information on the form is correct. Once this is done, the member advisor will open the CD account. If you’re not already a member, you’ll also need to make sure you fulfill the membership requirements.

Opening a Certificate of Deposit isn’t hard. Once you know the term of the CD you want and how much money to put into the CD, all you have to do is visit your credit union’s website and fill out a form to open the certificate of deposit account.

If you want to find out how easy opening a CD account can be, visit the First Alliance Credit Union website and see for yourself. You only need $500 to get started ($505 if you’re not already a member), and once you open the CD you can track how much interest it earns by viewing it on our online banking platform or our mobile app.

At first glance, you wouldn’t think that putting your money in a certificate of deposit, otherwise known as a CD, requires a lot of strategy. True,...

When you learn about certificates of deposit (CDs) for the first time, it’s hard not to get excited about the interest your money can earn. That...

A lot of articles about certificates of deposit, otherwise known as CDs, assume that you already have a few thousand dollars saved. However, what if...