Basics of a CD Ladder Strategy

You're probably aware that a certificate of deposit, commonly called a CD, is a type of investment account. You might also be aware of the advantages...

5 min read

Chris Gottschalk

:

Feb 2, 2023 4:45:00 AM

Chris Gottschalk

:

Feb 2, 2023 4:45:00 AM

When you learn about certificates of deposit (CDs) for the first time, it’s hard not to get excited about the interest your money can earn. That excitement, though, is quickly tempered by the fact that you won’t be able to withdraw the money in the CD for anywhere from a month to five years. Isn’t there any way to get the interest rate of a CD without locking your money away?

Fortunately, there is. It's a saving strategy using certificates of deposit called CD laddering.

When you set up a CD ladder, a key benefit is that you get to keep that high interest rate, while still being able to access your money if you need it. Even better, once you know the basics of building a CD ladder, you'll be able to figure out how to make one that maximizes your money.

As previously mentioned, the biggest drawback of putting your money in a CD is that you can’t access it until the CD matures, which just means that term of the CD ends. In other words, if you put $2,000 into a 2-year CD, you won’t be able to withdraw that money without a penalty until two years have passed.

As previously mentioned, the biggest drawback of putting your money in a CD is that you can’t access it until the CD matures, which just means that term of the CD ends. In other words, if you put $2,000 into a 2-year CD, you won’t be able to withdraw that money without a penalty until two years have passed.

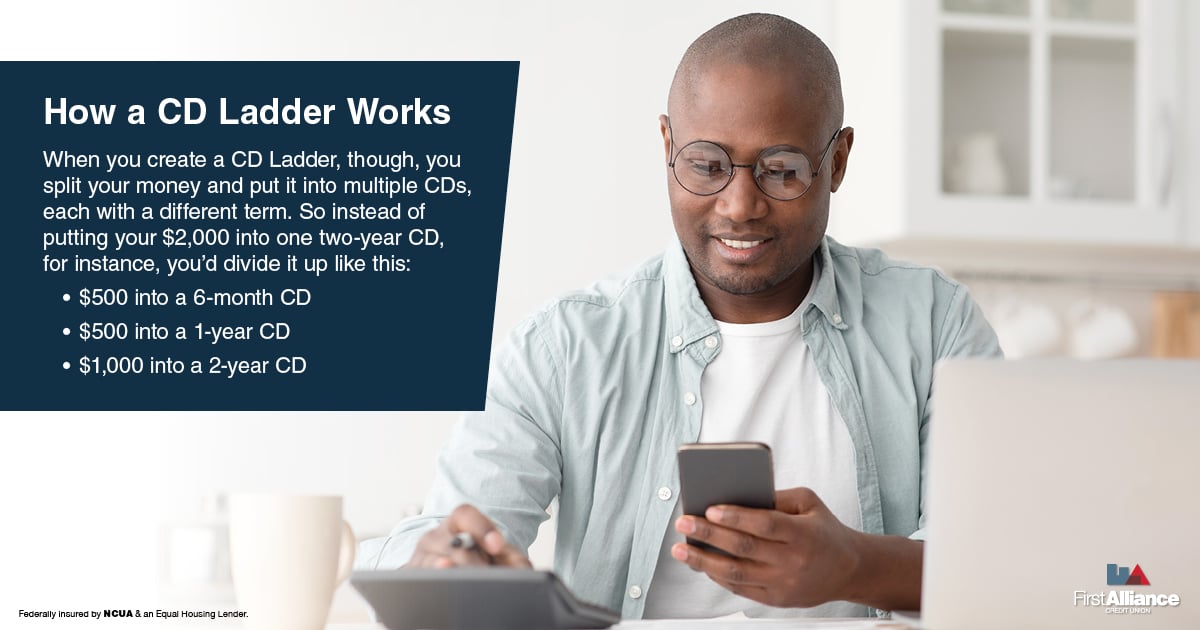

When you create a CD ladder, though, you split your money and put it into multiple CDs, each with a different term. So instead of putting your $2,000 into one two-year CD, for instance, you’d divide it up like this:

Each separate CD is a “rung” on the CD ladder. As each CD comes to term, you’ll either use the money if you need it, or create another rung by opening another CD.

Having multiple CDs with different terms also gives you some flexibility you just won’t get if you were to put the same amount of money in a long-term CD and let it wait. If interest rates happen to rise, for instance, you can take advantage of it when one of your short-term CDs matures. On the other hand, if interest rates fall, you can still take some comfort in knowing that you have some long-term CDs that are still earning the higher past interest rate.

The only real downside of a CD ladder is that you won’t get the high interest rate that long-term CDs offer, at least not initially. However, many people have managed to structure their CD ladders so they regularly have long-term CDs maturing on a monthly basis.

One of the best parts about a CD ladder is how easy it is to create one. At most financial institutions, all you need to do is talk with a member experience advisor or create the CDs by filling out a form online.

One of the best parts about a CD ladder is how easy it is to create one. At most financial institutions, all you need to do is talk with a member experience advisor or create the CDs by filling out a form online.

Before you open your CDs, however, you’ll want to create a strategy that will let you get the most benefit. Some people develop very intricate strategies for creating their CD ladders, but when you’re just getting started all you really need are the answers to two basic questions.

There’s no one right answer to this question. Technically, the only requirement for creating a CD ladder is that you have more than one CD, so you could have two, three or even 10 CDs.

Having said that, most people will find that the answer to that question is largely determined by the amount of money they have available. Opening a CD typically requires a deposit of at least $500. While this isn’t as big of a deposit as you’d need for, say, a money market account, it also means that the cost of opening multiple CDs will quickly add up. It’s worth pointing out that traditional CD ladders usually contain at least 5 CDs, so you might want to make that your initial goal if you have the cash to do so.

Once you’ve settled on how much money you want to invest, it’s time to think about the intervals of the CDs in your ladder. In other words, how often do you want to be able to access your money? If you’ve never opened a CD at all, you might feel more comfortable looking for CDs with one to two-month increments. If you’re feeling more comfortable with the concept, you might want to move on to three or even six month waits between CDs maturing.

Once you’ve answered these questions, the only thing left to do is open the CDs.

There’s nothing wrong with a basic CD ladder, but once you know how to ladder CDs—and have saved up a few thousand dollars—you can start to play around with how much you invest in CDs and their terms to create a CD ladder that maximizes your return on investment.

When creating an advanced strategy, the biggest factor to consider is the passage of time. If you have a six-month CD and a one-year CD you open at the same time, when the six-month CD matures the one-year CD will mature six months after that. This may sound obvious, but once you’re aware of this you can start to mix and match CDs with different terms.

When creating an advanced strategy, the biggest factor to consider is the passage of time. If you have a six-month CD and a one-year CD you open at the same time, when the six-month CD matures the one-year CD will mature six months after that. This may sound obvious, but once you’re aware of this you can start to mix and match CDs with different terms.

For instance, let’s say you have $10,000 and want to build a CD ladder with several long-term CDs, where at least one will mature each month. You could simply create five $2,000 CDs with a one-year loan for five consecutive months, but that would mean you have to wait for an entire year for the first CD to mature. Instead, you could build a CD ladder with:

After one month, when the first CD matures, you would have:

From there, you could reinvest the $2,000 from the one-month CD into another one-year CD. Then, when the now two-month CD matures, your ladder would look like:

From there, you could create another rung on your CD ladder with a one or two month term to maximize the availability of your money, open a six-month CD to fit between the CDs that will mature in three and eight months, or even play the long game by investing in another one-year CD that would mature two months after the ten-month CD does.

As you might imagine, this type of planning can get kind of complicated. However, it can also be fun and exciting, especially when you hit on just the right combination of CDs. If you feel overwhelmed, though, you’ll be happy to know you don’t have to plan your CD ladder alone. Several CD ladder calculators and CD ladder spreadsheets are available to help you plan your strategy, and you can always talk with a member experience advisor about the best CD ladder strategy for you.

When you create a CD ladder, you’re taking advantage of a CDs features to maximize the return on your investment without sacrificing access to your money. You’ll need to plan out your strategy beforehand and think about how many CDs you want to open and how frequently you’ll want your money to be available, and you craft extremely intricate plans to get the most from your CD ladder.

If you’d like to create a CD ladder, become a First Alliance Credit Union member today and take advantage of the tools we offer. In addition to being able to open CDs, you’ll also be able to use our free downloadable SMART goal packet to save up enough to fund your first CD ladder strategy. You’ll also be able to use our online banking platform and mobile app to keep track of when your CDs mature.

You're probably aware that a certificate of deposit, commonly called a CD, is a type of investment account. You might also be aware of the advantages...

If you're like many young people just starting to save, you’ve probably heard of a certificate of deposit (CD). It sounds like a smart idea for...

%20-%20Feature.jpg)

Meet Jaden: Jaden just started his first full-time job and has saved up $1,500. He’s super excited to watch his money grow, but he’s also a bit...