Finding the Best Personal Loan for Debt Consolidation: Your Next Steps

Managing multiple debts can feel overwhelming in today's financial landscape. However, there is a beacon of hope in the form of debt consolidation...

5 min read

Jenna Taubel

:

Feb 27, 2024 5:45:00 AM

Jenna Taubel

:

Feb 27, 2024 5:45:00 AM

When you're thinking about getting a personal loan, one of the most important choices you'll have to make is whether to go with a fixed or variable interest rate. Both loan options have their pros and cons, so it's crucial to understand them before making a decision.

Finding the best interest rate for your personal loan is important because it can make a significant difference in the overall cost of borrowing money. Lower interest rates mean lower monthly payments and potentially less interest paid over the life of the loan. This can save you money and make your loan more affordable.

When it comes to determining a good interest rate on a personal loan, you'll need to consider various factors such as the current market rates, your credit score, and the loan term. Interest rates for personal loans can range from as low as 3% to as high as 36%. Therefore, when it comes to getting a good personal loan rate, you should aim for a rate that is lower than the average rate for your credit score bracket.

To determine a good interest rate for your personal loan, it's essential to compare rates from different lenders and consider your creditworthiness. Lenders typically offer lower interest rates to borrowers with excellent credit scores, while borrowers with lower credit scores may face higher interest rates due to the perceived higher risk of lending to you based on your past credit history.

Additionally, the loan term can also influence the interest rate. Generally, shorter-term loans tend to have lower interest rates compared to longer-term loans. This is because lenders perceive shorter-term loans as less risky, as there is a shorter period for potential financial instability or changes in the borrower's circumstances.

Ultimately, the goal is to secure a personal loan with an interest rate that aligns with your financial goals and capabilities. A good interest rate is one that allows you to comfortably make your monthly payments while minimizing the overall cost of the loan.

Personal loan rates tend to be higher than rates for other types of loans due to a variety of factors. However, the main factor is that most personal loans are unsecured, meaning they don't require collateral, such as a house or car. Not having an asset attached to the loan is an increased risk for the lender should you not be able to repay the loan. Anytime there is increase risks associated with a loan it leads to higher interest rates.

Additionally, the interest rate also depends on the borrower's creditworthiness. Those with lower credit scores are typically charged higher rates due to the perceived higher risk of default. Therefore, if you are looking for a personal loan with bad credit you can expect to qualify for higher personal loan rates than someone with good credit.

You can explore more reasons why personal loan rates are higher in this article.

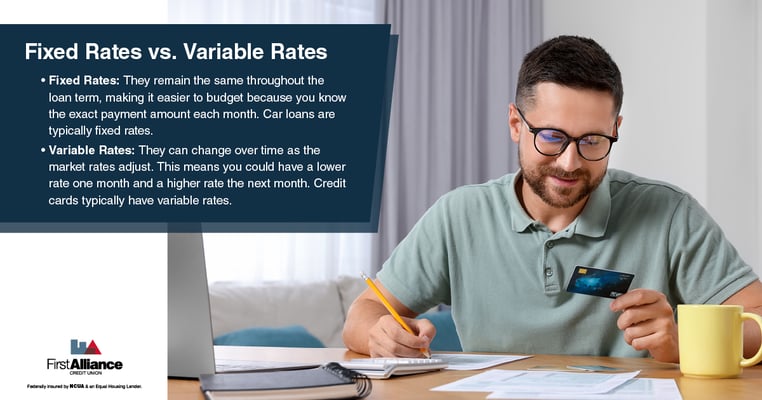

Typically, personal loans primarily offer fixed interest rates. If you come across a personal loan that offers a variable rate, it is more likely to be a line of credit. A personal loan provides a fixed interest rate along with a fixed end date or term for repayment. On the other hand, a personal line of credit usually offers a variable rate (although some may have fixed rates) and does not have a specific end date for repayment. In other words, think of a personal line of credit like a credit card, but without the physical plastic card in your wallet.

Depending upon your needs for the loan, you may want to consider the pros and cons between the a personal loan and personal line of credit. To help you make an informed decision, let's explore some of the key difference between fixed and variable interest rates.

Fixed interest rates offer stability and predictability throughout the loan term, making them a popular choice for many borrowers. With a fixed interest rate, your monthly payments remain the same, allowing you to budget more effectively. This can be particularly beneficial if you prefer to have a consistent payment amount and want to avoid any potential fluctuations in your monthly budget.

One advantage of fixed interest rates is that they provide peace of mind, as you know exactly how much you will be paying each month. This can help you plan your finances more effectively and make sure that your loan payments fit comfortably within your budget. Whether you are using the personal loan for debt consolidation, home renovations, or unexpected expenses, having a fixed interest rate can provide stability and certainty.

Another benefit of fixed interest rates is that they offer protection against potential interest rate increases in the future. If market rates rise, your fixed interest rate remains unchanged, ensuring that your monthly payments do not increase. This can be especially valuable if you are concerned about potential financial instability or changes in interest rates.

Variable interest rates can be an enticing option for borrowers looking for flexibility in their personal loan. Unlike fixed interest rates, which remain unchanged throughout the loan term, variable interest rates can fluctuate over time. While this may seem risky, variable rates have their own advantages and can benefit certain types of borrowers.

One of the main advantages of variable interest rates is the potential for lower initial rates compared to fixed rates. This can result in lower monthly payments at the beginning of the loan term, making it more affordable for borrowers with tight budgets. Additionally, if interest rates decrease over time, borrowers with variable rates can benefit from lower monthly payments and potentially save money on interest.

However, it's important to note that variable interest rates come with a level of uncertainty. Since they can change throughout the loan term, borrowers should be prepared for potential increases in their monthly payments. This can be a disadvantage for individuals with fixed budgets, as they may find it challenging to adjust their finances to accommodate higher payments.

It's also important to consider the current market conditions when opting for a variable interest rate. If interest rates are expected to rise significantly in the near future, borrowers should be cautious about choosing a variable rate. On the other hand, if interest rates are projected to remain relatively stable or decrease, a variable rate may be a more attractive option.

Ultimately, the decision between a fixed and variable interest rate depends on your individual circumstances and risk tolerance. If you need to prioritize stability and predictability you'll likely find comfort in a fixed interest rate, however if you're willing and able to take on some levels of uncertainty for potentially lower initial rates may opt for a variable rate personal line of credit.

When considering a variable interest rate, it's essential to review the terms and conditions of the loan carefully. Understand how often the rate can change, what factors influence the rate adjustments, and any caps or limits on rate increases. This will help you make an informed decision and ensure that you are comfortable with the potential changes in your monthly payments.

Remember, whether you choose a fixed or variable rate, it's essential to compare offers from different lenders and consider your creditworthiness. This will help you secure the best possible interest rate for your personal loan and ensure that it aligns with your financial goals and capabilities.

A personal loan offers great flexibility and can be utilized for a wide range of purposes. It can be used to consolidate debt, finance home renovations, cover unexpected expenses like medical bills, or fund significant life events such as weddings or travel. Additionally, it can also be used for educational expenses or to make big-ticket purchases. In essence, a personal loan provides a convenient and versatile solution for individuals in need of funds, without the limitations often associated with other types of loans.

Whether you go with a fixed rate personal loan or variable rate personal line of credit, it will have a significant impact on your financial journey. You'll need to consider the advantages and disadvantages of each option, taking into account your current financial situation and future goals.

If you're ready to take the next step, reach out to a trusted financial advisor at First Alliance Credit Union for a discussion about your options. We offer personalized guidance and assist you in securing a loan that aligns with your financial aspirations. Remember, making the right choice today can lead to a more stable and prosperous financial future. We are here to help!

Managing multiple debts can feel overwhelming in today's financial landscape. However, there is a beacon of hope in the form of debt consolidation...

When the Federal Reserve, aka the Fed, announces they’re raising interest rates, the news always focuses on whether the higher interest rates will...

Buying a car is an exciting experience, but the road to financing can be a bit bumpy if you're not careful. Getting an auto loan isn’t just about...