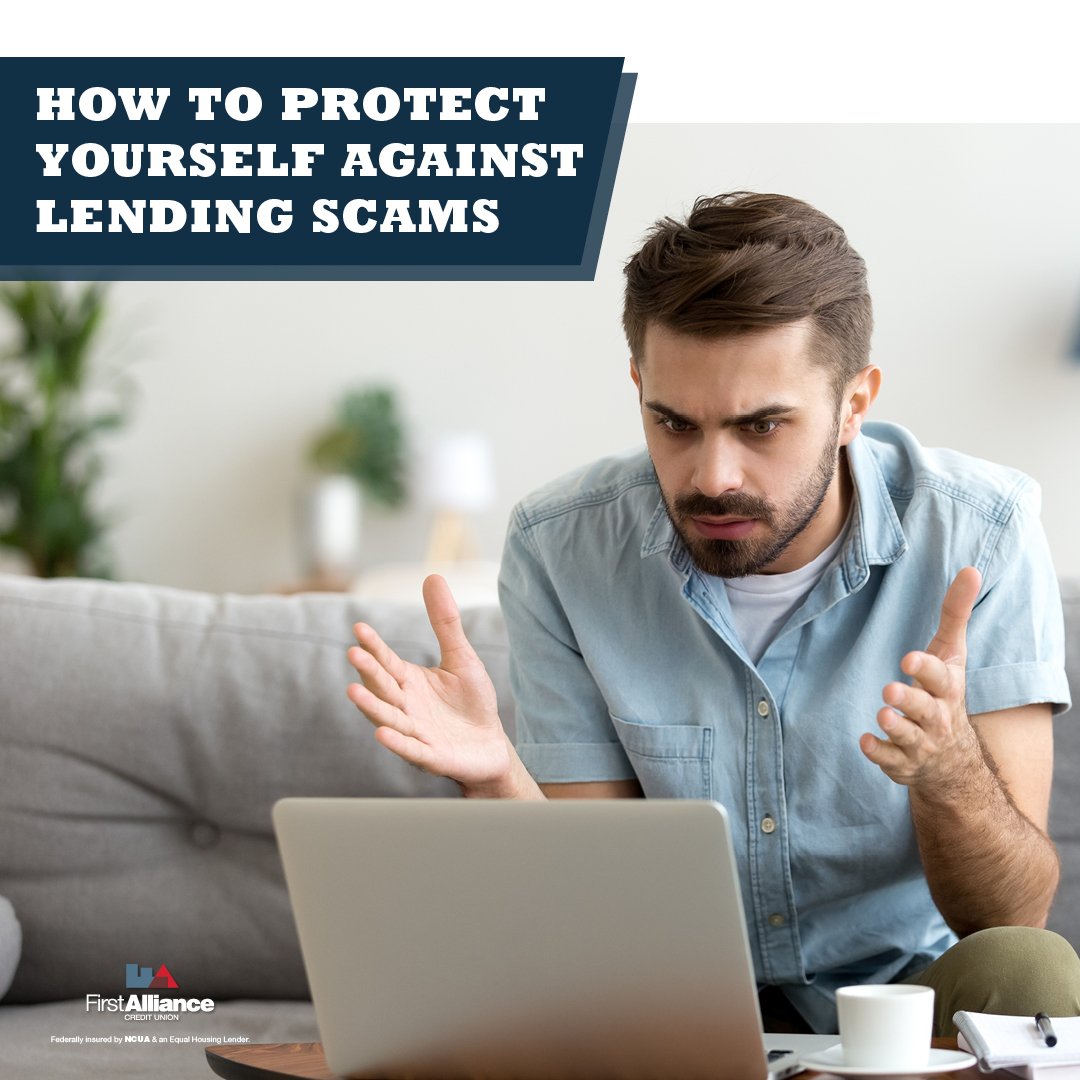

How to Protect Yourself Against Lending Scams

Out of all the different types of scams, lending scams might just be the most insidious. These types of scammers fool their victims into thinking...

5 min read

Chris Gottschalk

:

Oct 6, 2022 4:45:00 AM

Chris Gottschalk

:

Oct 6, 2022 4:45:00 AM

October is all about spooky creatures and scary stories, and we’re no different at credit unions. In fact, one favorite activity of credit union employees during the Halloween season is to sit around, lit only by the lights of the Advisor Supported Kiosks, and tell spooky stories about money.

So sit back and enjoy some of the all-time scariest stories involving money. We don’t want to scare you too badly, though, so we’ll also let you know what you can do to stop these financial horror stories from happening to you.

Ellen and David had wanted a house for years. Finally, after several walkthroughs, they found a house they loved, and after meeting with a mortgage broker, discovered that they were preapproved for even more than they needed.

It wasn’t until they were at the closing that they realized how much they would have to pay on the mortgage each month and that didn’t even include their utilities. They faced each other and realized that they would either have to buy a house they couldn’t afford or lose the money they made for the down payment!

Unfortunately, this financial horror story can happen to anyone who doesn’t start the homebuying process by thinking about how much house they can afford. However, you can easily figure out how much you can safely manage to spend on a house payment by using a free mortgage calculator like the one First Alliance Credit Union offers. This useful tool will let you figure out what your monthly payments will be based on the amount you want to borrow, among other factors.

Lola needed money to pay her monthly bills, and her account was drained since her son had to go to the doctor. If only she could just get a quick loan. That’s when the neon Pay Day sign caught her eye…

It all seemed so innocent at first, she would get the loan for two weeks at most, then pay back the money, plus interest, using a post-dated check. When her next paycheck came, however, she realized that the interest the Pay Day lender had charged would be more than her paycheck could cover! The only thing she could do was accept the Pay Day lender’s offer of another loan, even more expensive than the first.

Calling Payday lenders bloodsuckers is an insult to vampires everywhere. They prey on the most vulnerable members of society, offering them quick and easy loans. The problem is that the interest rates they charge on their loans are usually well over 100%. Worse, when a lot of people attempt to pay back their loan, they realize they won’t have enough money to last until their next paycheck, and they need to take out another, more expensive Pay Day loan.

The best way to free yourself from a Pay Day lender is to avoid them. If you’re having financial difficulties, talk with someone at your bank or credit union about your situation and see if they have any small loans available. First Alliance, for instance, offers a No Hassle loan that lets you borrow $1,000 for 12 months, with same-day approval.

Other types of loans that you might want to investigate include:

Even if you have taken out a Pay Day loan, an unsecured personal loan can still help you get free from their clutches. All you have to do is get a loan big enough to cover the amount you owe.

Zeke was a good guy. He had a stable job, lived within his means and was responsible with his money. Then he got into a bad car accident and was in the hospital for months. When he finally got out, he discovered that he had thousands of dollars in medical expenses, all of his bills were late, and to make matters worse, his employer had put him on unpaid leave while he was recovering!

Press play for Kristina’s quick tips building an emergency fund.

This might just be one of the scariest financial horror stories, because a medical emergency could strike someone at any time. Health insurance will help defray some of the costs, but you’ll still need to have some way to pay your day-to-day living expenses, especially if you live alone.

The only real way to avoid this scenario is to build up your emergency fund, and the best strategy for that is to regularly save 10% of each paycheck if you can manage it. Eventually, you’ll have around $3,000 in your account, which is enough to get you through most emergencies.

For the worst financial emergencies, though, you should keep putting money in your savings account until you have at least three months of salary saved up. This will help keep your head above water until you can either find a new job or are able to return to your old one.

Dave was new to investing, and when he heard how people who had invested in cryptocurrency had become millionaires overnight, he took his savings and maxed out his credit card to buy some cryptocurrency that was supposed to take off. Two months later, though, when he looked at his digital wallet, he saw that his crypto was now a small fraction of its original value! Even worse, according to talk online, the cryptocurrency was unlikely to gain any of its original value!

This financial horror story seems new, but it's unfortunately a tale as old as time. Plenty of people have been taken in by the promise of a "sure thing," only to find out much too late that the rosy optimism of the investment was either wishful thinking, willful fraud or a mix of both.

The best way to avoid this situation is, first and foremost, not to invest money that you can't afford to lose. For instance, you might decide to put some of your savings in a new investment opportunity, but only if your other funds are in more stable investments. You should also never rack up credit card debt to fund your investments, even if you're convinced it will pay off--the risk simply isn't worth it, and even if your investments do pay off your profits will be eaten up by the interest the credit card companies charge.

Outside of not risking money you can't afford to lose, you need to do your own homework when considering any investment. Read up on any potential investments yourself, and don't just rely on one source for your information. You might even want to consult a financial planner to make sure you're investing your money wisely.

In order to avoid becoming the victim of financial horror stories, it's crucial to educate yourself about personal finance. Create a budget, save for emergencies, and be wary of scams. Regularly monitor your accounts, protect your personal information, and remember to ask for help if you need it.

Everyone likes a good spooky tale, but financial horror stories always make people’s blood run cold. Fortunately, you don’t have to follow any superstitious ritual or carry a talisman to protect you against them. All you need to do is make sure you have enough money in your savings account to deal with unexpected emergencies and make sure you know what you’re getting into when you apply for a loan or a mortgage.

You can also put your financial fears to bed when you become a member of First Alliance Credit Union. You can easily build up your savings by using Direct Deposit to automatically put part of your paycheck in a savings account, and watch over it using our online banking platform or mobile app. You can also talk with our lending advisors about applying for a loan with a very reasonable interest rate, and get their advice on what type of loan will work best for you.

Out of all the different types of scams, lending scams might just be the most insidious. These types of scammers fool their victims into thinking...

In the world of superheroes, Tony Stark, aka Iron Man, stands out from the rest. Instead of being super strong or firing energy bolts at people,...

When you decide to move to a new place, you have to figure out the answer to a lot of questions, such as how you’ll move all your belongings and when...