Identifying Good vs Bad Loans: Protect Your Financial Future

When it comes to borrowing money, not all loans are created equal. Distinguishing between a good loan and a bad loan can significantly impact your...

Out of all the different types of scams, lending scams might just be the most insidious. These types of scammers fool their victims into thinking they’re a legitimate financial institution, and then charge the victims exorbitant fees, steal their personal information or both. This would be devastating to anyone, but it’s especially painful to people who have gone through the stress of filling out a loan application and who could really use that loan to finally reach their goals.

The good news is, like other types of scammers, most lending scammers use the same tactics on their victims. When you know the signs of a lending scam, you’ll be able to avoid these scammers and protect yourself from fraud.

Lending scams are schemes designed to trick individuals into paying money upfront for a loan, usually a personal loan, that never materializes or comes with predatory terms. A scammer often poses as a legitimate lender, and they usually target people who have had financial troubles who might have trouble getting loans from other credit unions or banks.

Once you apply for a loan on a scammer’s site, they will ask for personal information and request payment in return for processing the loan. Scammers will usually request that the upfront fee be paid by:

Lending scams can lead to financial loss, identity theft, and a damaged credit score. It's crucial to be aware of the common types of lending scams and how scammers operate and how to distinguish between a scammer and a legitimate lender.

a) Personal loan scams: Personal loan scams offer loans with attractive terms, such as low interest rates, guaranteed approval, or no credit check. However, scammers use these offers to deceive individuals into paying upfront fees or providing personal information, only to disappear once the money or information is obtained.

b) Payday loan scams: Payday loan scams target individuals who are in a financial bind and need quick cash. Scammers offer high-interest payday loans with hidden fees, aggressive debt collection practices, and loan terms that trap borrowers in a cycle of debt.

c) Credit card scams: Scammers posing as credit card companies offer loans, often with upfront fees, promising approval, regardless of credit history. However, legitimate credit card companies do not offer loans, and scammers disappear after receiving the upfront fee, without providing any loan.

Lending scams specifically target individuals who have bad credit, are facing financial difficulties, or are in desperate need of money. These scammers often prey on vulnerable populations such as the elderly, low-income individuals, and those with limited financial literacy.

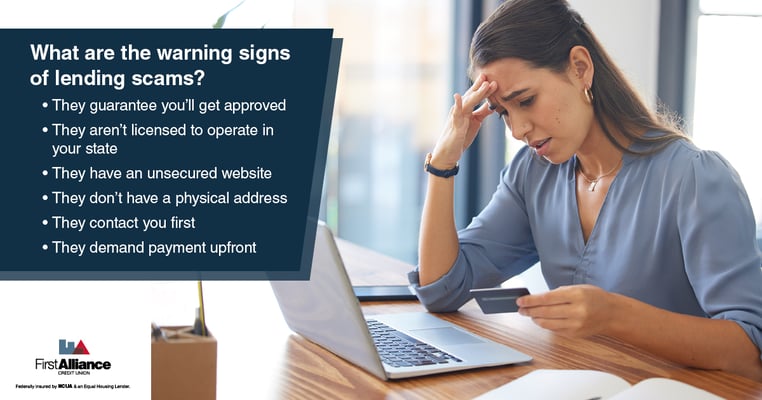

Fortunately, lending scammers aren’t known for their innovation. They use similar tricks to try to fool you into applying for a loan with them. Here are some red flags that will help you recognize a predatory lender:

Lending scams often promise guaranteed approval, but while this is attractive, it’s not a promise a legitimate lender can make. No legitimate lender can guarantee loan approval without considering factors like your credit score and financial history. Any lender that guarantees approval for a loan, regardless of credit score or financial history, is trying to scam you.

A big red flag of scammers is that their business isn’t registered and licensed to operate in your state. Verify the lending company’s name, address and phone number, and check with your state’s consumer protection agency to ensure the lender’s legitimacy.

Legitimate lenders have secure websites, where you can safely enter personal information without the risk of identity theft. If a lender's website is unsecured, lacks a physical address, or does not provide clear information on loan terms and fees, it's best to avoid dealing with them. Look for physical location information and check if the address matches on Google Maps, as scammers often use vacant lots or non-existent offices as a front.

One common tactic scammers use is to reach out to potential victims through an unsolicited text message or a robocall. This is not a tactic legitimate lenders use. If you get this kind of offer, don’t share any personal information with the sender, and never work with a lender you didn’t contact yourself.

The biggest red flag that a lender isn’t legitimate? They’ll ask you for payment before they approve you for a loan. This might be explained away as a processing fee or something similar, but the concept will always be the same: give them money first and then you’ll get your loan. Never send money, gift card information or bank account information to a lender before receiving a loan, since scammers tend to disappear once they’ve got their hands on your money.

Now that we've discussed the red flags of a lending scam, let's explore the steps you can take to protect yourself from falling victim to loan scammers.

Before applying for a loan, research the lender's company name, address, and phone number to check if they are legitimate. Look for a physical location on the lender’s website and check if the address matches on Google Maps. Contact your state's consumer protection agency to check if the lender is licensed to operate in your state, and request a list of states where the lender is authorized to offer loans, as scammers may operate outside of legal boundaries.

Another way to protect yourself against potential lending scams is to get a list of all fees beforehand. Make sure you ask any prospective lender for a list of lending fees, including:

Once you get a list of fees, look them over and compare them to fees different lenders offer to make sure you’re getting a fair deal. Make sure you fully understand all the potential fees you might have to pay. Be cautious of lenders who are not transparent about their fee structure or provide vague information.

If you come across text messages, emails, or phone calls that seem suspicious, immediately block their contact information. Scammers often utilize multiple channels of communication to pressure you into falling for their schemes, so it’s best to sever all contact with them. Additionally, make sure to report any scam messages or calls to your phone carrier, email provider, or even the FTC.

Scammers like to close the deal by putting pressure on their marks. This forces them to act quickly before they have time to consider the advantages and disadvantages of their decision.

Don’t give into the high-pressure sales tactics. Ask for some time to look over the information. If the lender is legitimate, they’ll understand why you want to review all the information of the loan and be too happy to give you the time you need.

If a lender instead pushes you to sign documents, provide personal information or make upfront payments to keep the loan offer open, just walk away. Speaking of which…

Knowing when to walk away is your most valuable tool when protecting yourself from lending scams. If something seems wrong with the loan, whether they’re demanding upfront payment or refusing to provide information on their fees, just tell them no.

Having said that, scammers don’t like letting potential marks get away. Expect to get a ton of high-pressure tactics that range from warning you the offer is only good if you sign right now to threats about how refusing will impact your credit score.

If a lender says any of those things, though, it’s a sign they’re not operating in good faith. You can walk away confident that you’re avoiding a trap.

Unfortunately, scam artists can be convincing, and you may fall victim to a lending scam despite your best efforts. If you've been scammed, it's important to take immediate action to minimize the financial and personal consequences.

If you've fallen victim to a lending scam, take action immediately. Report the scam to the Federal Trade Commission (FTC). Reach out to your local law enforcement agency and provide them with any relevant information. Contact your state's consumer protection agency for guidance. Consider filing a complaint with the Better Business Bureau (BBB). Seek legal advice if you've suffered financial losses or identity theft.

If you're trying to get a loan, you'll need to keep an eye out for lending scams. Make sure you know that any lender you're dealing with is legitimate by doing some research and seeing if they're an Equal Housing Lender and Equal Opportunity Lender, and be wary of any lender that guarantees you'll be able to get a loan regardless of your credit score. Above all, don't be afraid to walk away if you're not happy.

You can also protect yourself from lending scams when you apply for a personal loan at First Alliance Credit Union. Not only will you get a competitive rate, you'll also get a lending advisor who will look beyond your credit score. They'll help you through the process of applying for a personal loan and make sure you get the guidance you need to achieve your financial goals.

When it comes to borrowing money, not all loans are created equal. Distinguishing between a good loan and a bad loan can significantly impact your...

It can be awkward when a friend asks you for a loan, especially when you’re not sure if you should do it. Even when you want to help, there are times...

In some ways, the Internet has been a real help for anyone looking for love. Several dating sites and mobile apps give you hundreds, even thousands...