What Are Money Market Accounts? A Simple Guide for Minnesota Savers

You want savings that grow and stay within reach. You also want simple and safe. A money market account fits that plan. It is a savings account built...

2 min read

![]() First Alliance Credit Union

:

Jul 27, 2017 1:43:46 PM

First Alliance Credit Union

:

Jul 27, 2017 1:43:46 PM

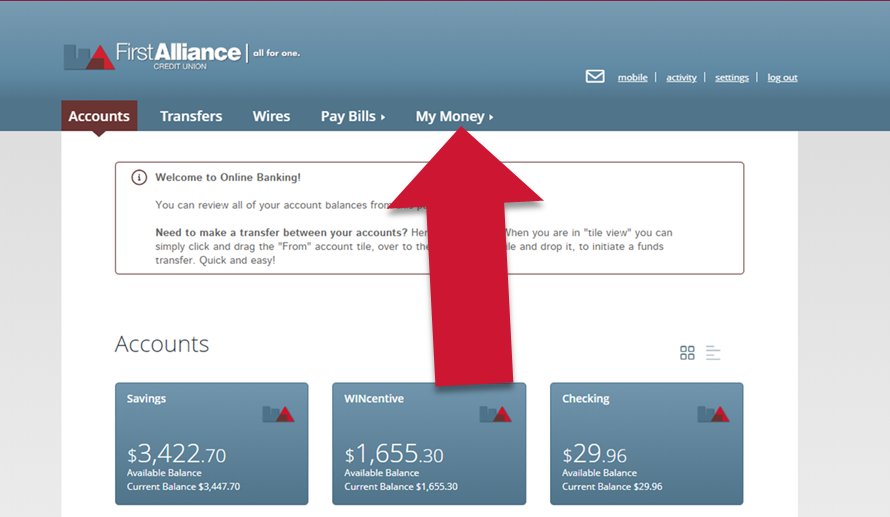

Our newly upgraded Online Banking system comes with lots of excellent new features! We know how important it is for your personal finances to feel, well, personal! Here we share a few quick tips to help you customize your new Online Banking experience!

To ensure you know how to use the newest features and feel comfortable navigating the updated system we have put together this series of blog posts to highlight them and offer a few tips.

If you haven’t nicknamed your accounts yet, your account probably shows up looking generic, like "REGULAR SHARE-01". If you have multiple savings accounts or car loans, or are connected to other member accounts (like your kids) this can quickly get confusing, plus it’s just kind of boring to look at. So have some fun with your accounts and give them a nickname! Here’s how:

Giving your accounts a nickname is a quick and easy way to personalize your Online Banking experience. Plus, you can change the name at any time!

If you have several accounts, you may not want to see all of them every time you login to Online Banking. To keep your “Accounts” view clean and organized so you can see your most important accounts you can “hide” and “unhide” accounts in real-time by follow these simple steps:

Keep in mind, when you choose to hide an account, it will no longer show up on the Accounts screen or in the list of accounts you can transfer to or from. If at any time you do need to make a transfer or want to see a hidden account again, simply repeat the steps listed above.

Setting up account alerts is a great way to personalize your Online Banking experience, while also keeping you on top of your finances! Accounts alerts can be set up to notify you of a variety of account activities such as account balances or transactions that fall above or below the limits you set. For example, if you tend to overdraw your account it may be helpful to add an account alert to notify you when you only have $50 left in your checking account. Setting up account alerts is simple, here’s how:

Bonus Tip: Account alerts can be sent to you via email or your mobile phone!

These are a few of our favorite ways to personalize your First Alliance Credit Union Online Banking experience. Hopefully, these helpful tips will make your Online Banking experience even better. If you need any help using these features do not hesitate to contact us!

You want savings that grow and stay within reach. You also want simple and safe. A money market account fits that plan. It is a savings account built...

You probably know that credit unions and banks offer checking accounts and savings accounts. What you might not know, however, is how many different...

First Alliance Credit Union is thrilled to introduce, My Money, the newest feature available in its robust and easy-to-use Online Banking platform....