How to Make Saving Money a Priority

Savings can help you achieve any financial goal. Whether it's a comfortable retirement, a down payment for a house or a new car, you can get there by...

1 min read

![]() First Alliance Credit Union

:

May 14, 2019 6:55:00 AM

First Alliance Credit Union

:

May 14, 2019 6:55:00 AM

Setting a savings goal can be difficult, especially when you're not sure where to start. Often, we end up setting our goals too high and they're impossibly hard to reach. I'm a huge fan of starting small and working your way up.

I found this 52 week savings plan on the web a few years ago, and my husband and I have been doing it every since. It may seem silly but it can really pay off. That's why I call it a seriously simple way to save. We've used the savings for to pay for our annual golf membership, buy a new refrigerator and most importantly, pay off some debt.

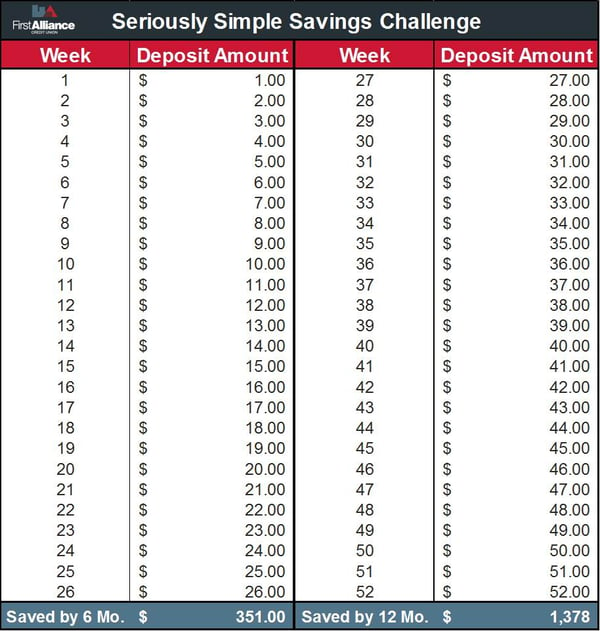

Essentially, you will make a deposit every week in the year, starting with week one. You don't have to start in January. You can start at anytime. In this example, let's assume that you start in January. So, in the first week of January, you will deposit $1.00, during the second week, $2.00, the third week $3.00 and so on, until you reach week 52 and save $52.

Take a look at the chart below. At the end of the year, you end up with $1,388! Remember, if you put the money into an interest bearing savings account, you will also earn interest on top of it.

Honestly, it's kind of difficult to figure out how to do this as an automatic transfer, so it's important to remember to make a transfer each week. You may need to set a reminder on your phone so you don't forget.

Plus, if you have another person in your household like I do, you both can make deposits, and double the money you save. After 52 weeks you'd have $2,776!

For me, the best way to get this going was to open a separate savings account from my other savings account. Primarily, because it was fun to watch the money grow and see my progress, and it made it way easier to not want to touch the money until the end of the 52nd week.

Savings can help you achieve any financial goal. Whether it's a comfortable retirement, a down payment for a house or a new car, you can get there by...

Everyone can benefit from setting financial goals, but the people who get the biggest advantage might just be teenagers. When teenagers learn to set...

On the surface, setting personal financial goals seems easy. All you have to do is think about what goals you’d like to work toward to get the future...