3 Ways a Switch Kit Makes Switching Banks Easier

If you’re thinking about switching to a new bank or credit union, you might have come across some financial institutions offering something called a...

One of the biggest questions people have when switching to a new bank or credit union is how long does switching bank accounts take. It’s understandable—these days, most people get their paycheck direct deposited into their accounts, not to mention make automatic digital payments from their accounts. The longer switching to a new bank account takes, the longer you’ll be without a paycheck and the more likely you are to be late in paying all the bills that were connected to your old account.

Unfortunately, there’s no simple answer to this question. It all depends on your employer and the companies that you pay. However, some steps are faster than others, and when you have an idea about how long each step can take you’ll be able to use this information to make your switch go a lot easier.

Let’s start with the good news. Opening an account doesn’t take much time at all. In fact, in many cases, you can open an account the same day you fill out your application, provided you have enough money for the initial deposit.

On the other end of the spectrum, transferring your direct deposit to another financial institution can take some time. While many companies will be able to transfer your direct deposit to a new account starting with your next paycheck, other companies might take longer. When transferring direct deposits, always check with your HR department to find out how long the process will take.

Finally, transferring electronic bill payments completely depends on the company. While some companies might be able to transfer your payments immediately, others might need an additional pay cycle to process the information. Again, you’ll need to check with each company to figure out when the transfer will take place.

While all these conflicting timelines might seem designed to give you the biggest headache in history, once you know the timelines for each process you can use that information to make switching financial institutions easier.

The simplest way to use this information is by submitting your direct deposit, finding out when the transfer will take place and then contacting all of the companies to which you make automatic payments. You can have them transfer their billing to your new account and also have them change the date your bill is due to after your direct deposit transfer request is processed.

On the other hand, if companies can’t or won’t change the due date of your bill, you’re still at an advantage. Just make sure their next bill will go to your new account and leave enough money in your old account to pay everyone off. It will be a little more work, but you’ll still be able to pay all your bills on time and on the next billing cycle you’ll have everything transferred to your new account.

Switching banks can take anywhere from a day to several weeks, depending on how quickly you can transfer direct deposits and automatic bill payments. Here’s a breakdown of the steps to make it easier:

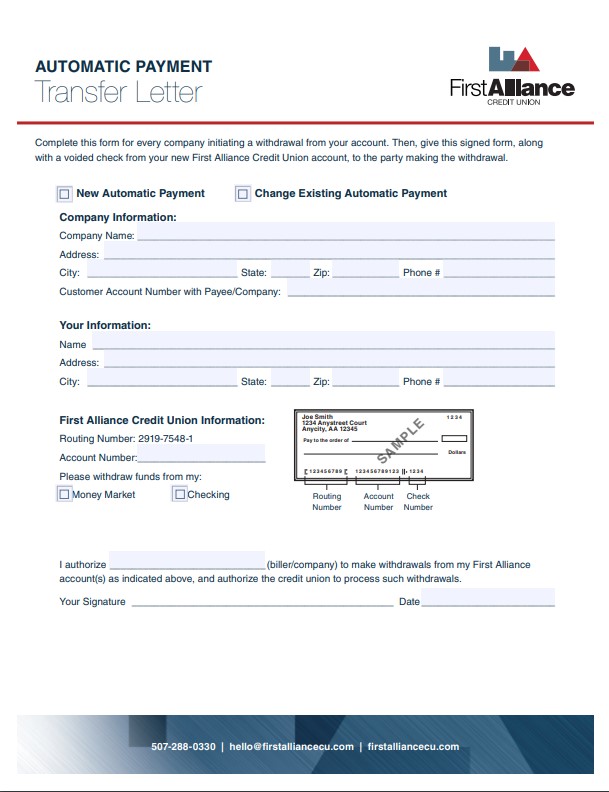

You can also make switching to a new bank or credit union easier when you use First Alliance Credit Union’s free downloadable switch kit. Not only does it let you write down all your automatic payments and direct deposits along with their due dates, it also provides you with form letters that will make direct deposit and automatic payment transfers much easier.

If you’re thinking about switching to a new bank or credit union, you might have come across some financial institutions offering something called a...

If you’ve ever heard of the First Alliance Credit Union switch kit, you might be aware that it’s a free download that can help you switch financial...

Out of all the steps you need to take to switch financial institutions, switching your direct deposit to your new bank or credit union is perhaps the...