4 Unexpected Benefits of a Checking Account

Checking accounts have a lot of obvious benefits. They’re a safe place to keep your money that lets you pay your creditors and provides a paper trail...

3 min read

Chris Gottschalk

:

Aug 17, 2021 5:45:00 AM

Chris Gottschalk

:

Aug 17, 2021 5:45:00 AM

Opening up a checking account at a new financial institution can be kind of exciting, because you get to explore all the features your new financial institution offers and setting up your account so it works best for you. If you’re opening a new checking account because your old one was shut down due to having a negative balance, however, you might be a bit more apprehensive.

How do you avoid making the same mistakes that led to your previous financial institution closing your old checking account? The good news is that managing a checking account isn’t hard. All you need to do is build up a few good money management habits.

Your first step to maintaining a healthy checking account should be to check your balance daily. While this piece of advice is an essential step, it can also leave people rolling their eyes in annoyance. It’s nice to know how much money is in your account, but isn’t checking it every day a bit much?

Your first step to maintaining a healthy checking account should be to check your balance daily. While this piece of advice is an essential step, it can also leave people rolling their eyes in annoyance. It’s nice to know how much money is in your account, but isn’t checking it every day a bit much?

The truth is that monitoring your checking account every day is easy. It only takes one or two minutes a day to log in to your account via online banking or a mobile app, and you get some fantastic benefits in return.

The most obvious benefit of monitoring your checking account daily is that it can stop you from overspending. When you know how much you have left in your account until payday, you also know how much you can spend without overdrawing your account.

Checking your account daily will also help you get into the budgeting mindset. When you see how much money you have, you automatically start thinking about how you can best use that money to take care of your needs and wants, which is what budgeting is all about. Once you’ve gotten used to the budgeting mindset, you can take the next step and create your own budget, which is a key step toward financial success.

Debit cards are a lot more convenient than having to carry cash with you whenever you want to make a purchase. However, when you use them you’re also spending money without having to see it come out of your account. This can make overspending a lot easier.

While monitoring your checking account daily can help you make sure you’re not spending more money than you have, get out of the habit of using debit cards and into the habit of using cash. It will admittedly be more of a hassle than using a debit card, but it will also help you understand how much you’re spending and what you’ll have left in a way you simply can’t get when you use a debit card. Getting cash from an ATM before making a purchase is also a great way to cut down on impulse buying.

If you absolutely need to use your debit card, though, take a minute before you pay and login to your account to make sure you have enough money in your checking account to cover the purchase. The First Alliance Credit Union mobile banking app makes this task even easier with its Instant Balance feature.

If you absolutely need to use your debit card, though, take a minute before you pay and login to your account to make sure you have enough money in your checking account to cover the purchase. The First Alliance Credit Union mobile banking app makes this task even easier with its Instant Balance feature.

Outside of overdraft charges, one of the biggest stumbling blocks people encounter when trying to manage a checking account is the fees, especially monthly or maintenance fees. These fees may not be as severe as overdraft penalties but they’re also more consistent. Even if the fee is just $5 a month, if you’re not careful it can lead to you overdrawing your checking account, especially if you’re on a tight budget.

Before you open a new checking account, make sure you know what fees you’ll be paying and how often you’ll have to pay them. If you do have to pay a monthly fee, make sure you know what dates you’ll have to pay it.

Of course, the best way to deal with monthly checking account fees is to avoid them altogether. Most credit unions, for instance, don’t charge monthly or maintenance fees on their checking accounts. This can end up saving you a substantial amount of money each year.

While you might be apprehensive about managing a checking account if you’ve had problems managing a checking account in the past, don’t let that stop you from trying again. Just remember to check your account daily, use your debit card sparingly and watch out for checking account fees.

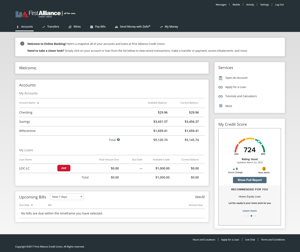

If you need help rebuilding your finances, become a member of First Alliance Credit Union today. We’ll help you get set up with a checking account and savings account, and from there you can explore the resources that we offer to help people manage their accounts more effectively. Access your account 24/7 through our online banking platform or mobile app, use our electronic bill pay service to make paying bills easier and use the My Money online banking feature to keep track of your spending and create a budget that works for you.

Checking accounts have a lot of obvious benefits. They’re a safe place to keep your money that lets you pay your creditors and provides a paper trail...

Did you know there are different types of checking accounts? If you didn’t, you’re not alone. Most people are only aware of one type of checking...

Let’s be honest—while there are some checking account fees you want to avoid at all costs, such as a monthly fee, there are a lot of fees that are...