Using a Second Account as Overdraft Protection

Overdraft fees are a pain. In our post last week we share some tips for how to avoid overdraft fees all together. But life, and your budget, doesn’t...

In March 2020, Congress included stimulus checks as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This $2 trillion aid package is intended to help those impacted by the coronavirus pandemic including individuals, businesses, health care, education, and state and local governments.

The CARES Act outlines the funding guidelines for the Economic Impact Payments. These payments are also commonly referred to as COVID-19 relief checks, stimulus checks or recovery rebates. The payments you'll be eligible to receive are based on your 2018 or 2019 adjusted gross income (AGI) from your tax filings and are actually a refundable tax credit for your 2020 tax return filing.

If you filed taxes as an individual and your income did not exceed $75,000, you'll be eligible for $1,200. If your AGI is from $75,000 up to $99,000, the payment amount is reduced by $5 for every $100 above the $75,000 threshold.

Those who file jointly with a combined income of less than $150,000 are eligible to receive a payment of $2,400. If your combined AGI is from $150,000 up to $198,000, your payment amount will be reduced by $5 for every $100 above the $150,000 threshold.

Eligible families will receive an additional $500 for each child under the age of 17. There is no cap to the number of children you can receive that additional benefit for, they simply need to have been claimed as a qualified dependent on your recent tax return filing.

You can use this calculator to help estimate your stimulus payment.

Calculator courtesy of Tax Foundation.

No action is needed by most people at this time. The distribution of the economic impact payments (aka stimulus checks) will be automatic, with no action required for most people. Social Security recipients, senior citizens, and railroad retirees who are also eligible, do not need to do anything to receive their stimulus payments.

However, some taxpayers who typically do not file returns may need to submit a simple tax return to receive the economic impact payment according the the IRS.

If you have not yet filed your 2019 tax returns you are encouraged to do so before April 15th, to ensure you receive an accurate stimulus check in a timeline manner. While tax filing deadlines have been extended, it will be beneficial to file your returns as soon as possible to ensure you receive the most accurate stimulus payment possible.

First Alliance Credit Union members have access to free and discounted use of TurboTax for filing their taxes.

The first wave of stimulus checks will be dispersed around mid-April for those who have direct deposit available through past tax return filings with the IRS. The first wave of payments could take about three weeks to process, but most eligible people can expect to receive their directly deposited payments before April 15th.

The IRS then will begin putting the first wave of paper checks in the mail in May. However, the paper checks will take more time to produce and process compared to those being directly deposited, some people may not receive a mailed check until September. Paper checks will be arriving over the coming months based on your income level at the time of your 2018 or 2019 filing as follows:

The government is working on developing a web-based portal for individuals to provide their banking information to the IRS online, but that has not yet been implemented. It will be live here when it becomes available.

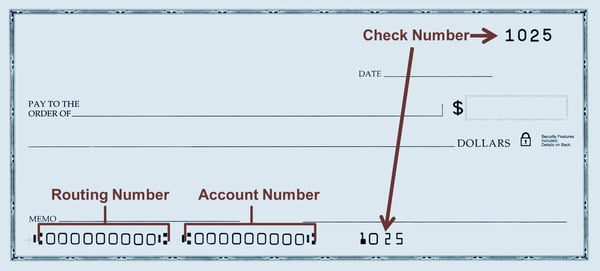

If you've never used direct deposit before you will need your account number and the routing number from your banking institution which you can find at the bottom of a check, or your can contact your financial institution directly. First Alliance Credit Union's routing number is 291975481.

It is recommended that you keep your stimulus check in your banking account and do not withdraw it as cash. Your money will be safer in a banking account than kept as cash. Additionally, using cash increases your chances of contracting COVID-19 as cash in handled by multiple people before it come to you. The best and safest options for accessing your stimulus funds once they have been deposited into your account are through your cashless options such as:

If you do not have access to a banking account or these important digital banking tools contact the team at First Alliance Credit Union. Once you've open your account, you'll be able to have your stimulus check directly deposited and access to all these important tools to access your finances quickly and easily.

Overdraft fees are a pain. In our post last week we share some tips for how to avoid overdraft fees all together. But life, and your budget, doesn’t...

There are a few important things to know for those who are eligible to receive an advance on your child tax credit from the federal government as...

When the Federal government passed the CARES Act in March 2020, the one aspect that arguably affected the most people directly was the economic...