What you Need to Know Before Talking with Your Kids About Money

Talking to kids about money can be a daunting task for many parents, but it’s an essential part of teaching your children financial literacy. When...

To the dismay of tens of thousands of users, the popular personal finance app Mint is being shut down at the end of 2023. This is a shame, since Mint has been arguably one of the best personal finance apps out on the market. It lets you track your spending, create a customized budget and even keep track of bills, among other features.

While Intuit, Mint’s owner, is recommending that Mint users migrate over to Credit Karma, which will have some of Mint’s popular features, it won't have all of them. Unfortunately, one of the features that won’t be carried over is the budgeting feature. This has led a lot of people to look elsewhere for a personal finance app that can do what Mint used to.

That’s where the My Money tool First Alliance offers its members comes in.

Of course, in order to experience everything the My Money tool has to offer, you'll need to know how to access it first. Fortunately, this is pretty easy.

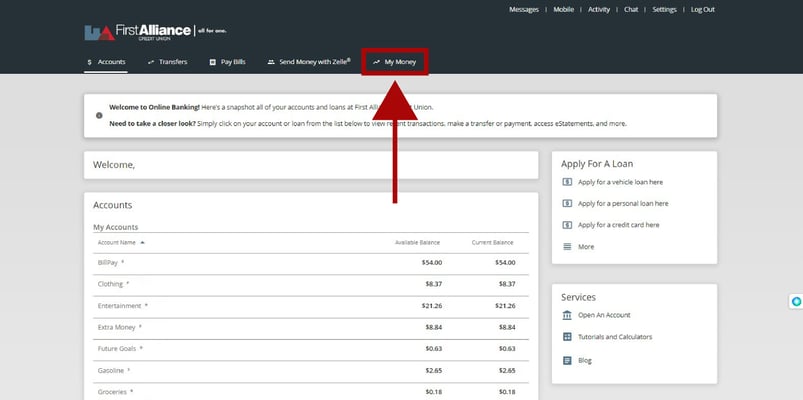

If you want to get to the My Money tool through your online banking account, all you have to do is go to the tabs just underneath the First Alliance Credit Union Logo. The My Money account is on the tab that's all the way to the right.

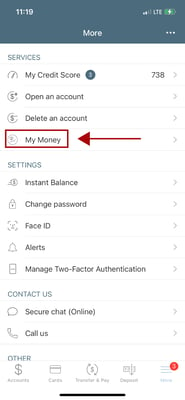

If you usually use the First Alliance Credit Union mobile app for banking, though, accessing your money is even easier. You'll find it in the Quick Links section when you sign in.

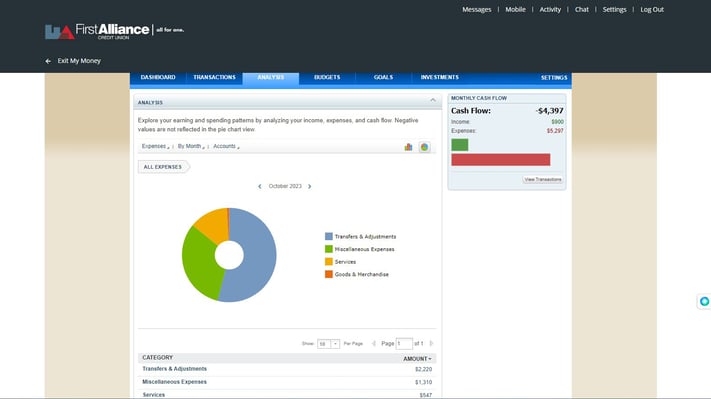

When you log into My Money, you’ll discover your First Alliance Credit Union checking accounts and savings accounts are already linked to the tool, this lets you track your spending whenever you make a debit card or credit card purchase, one of the features that made Mint so popular. Even better, you can see graphs that tell you how much you spent in the categories you set up.

Being able to track and visualize your spending is a great way to get a sense of where you’re spending your money each month. You can use this information to make sure you’re staying on budget and make changes if you need to.

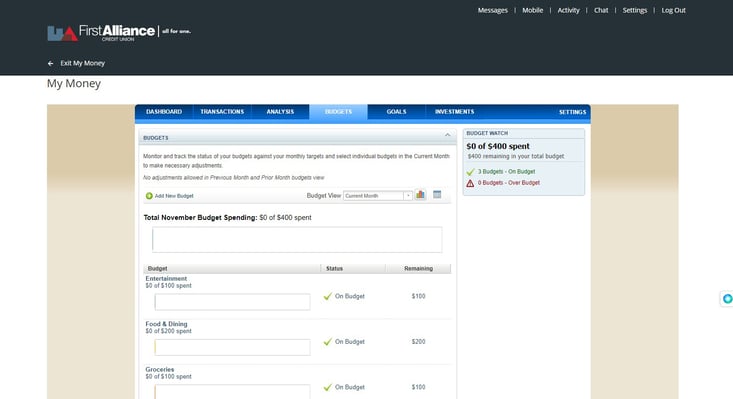

Not only can you track your spending with My Money, you can use it for the one feature that most Mint owners are going to miss—creating a budget. You can select from several types of budget categories, set how much you want to spend on that category each month, and edit it as you see fit.

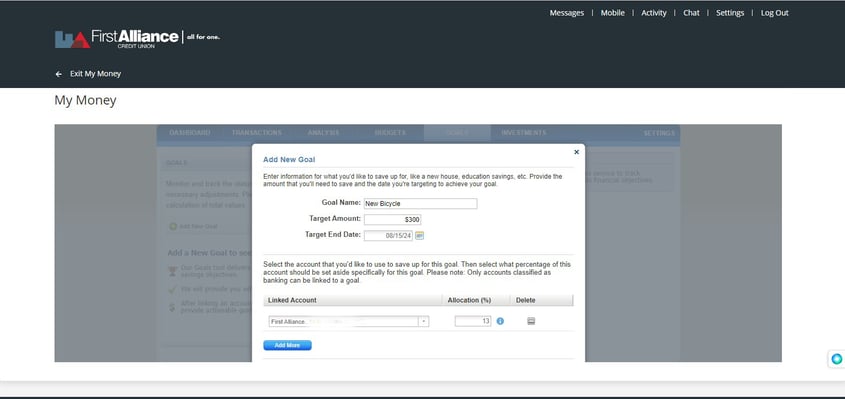

The My Money tool also has a tab that lets you set financial goals. You can give your goal a name, set your savings target and even give yourself a goal date. If you’re familiar with the SMART goal framework which makes your goals:

You’ll notice that creating a financial goal in My Money will give you the Specific and Time-Bound aspects of your goal. All that remains is making sure your goal is measurable, attainable and realistic.

As an added bonus, you can also link an account you’d like to use to save up for this goal and even select what percentage of your account should be set aside specifically for your goal.

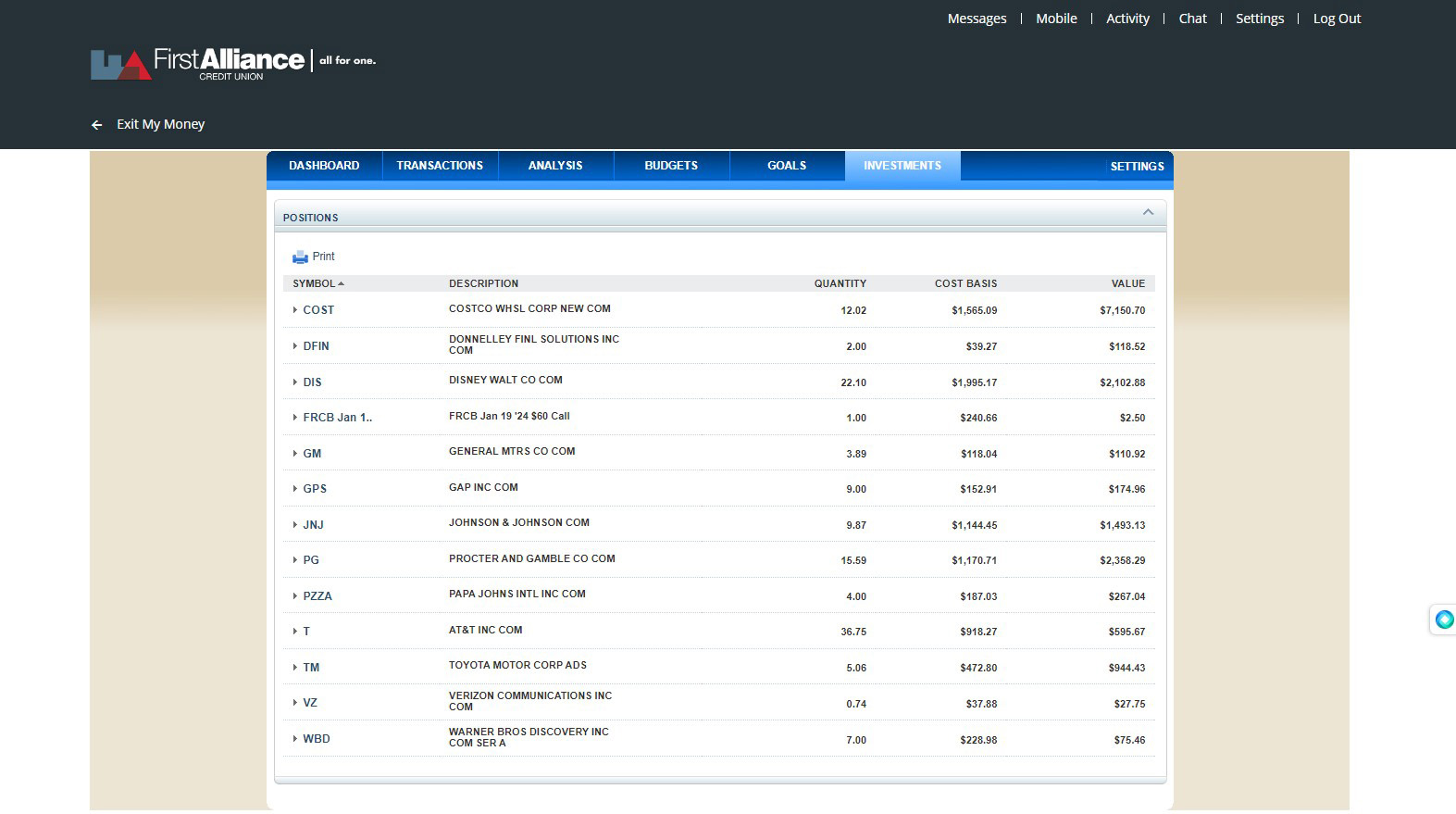

Finally, the My Money tool can monitor your investments. You can track all your investments in one place and get a “big picture” overview of how they are performing.

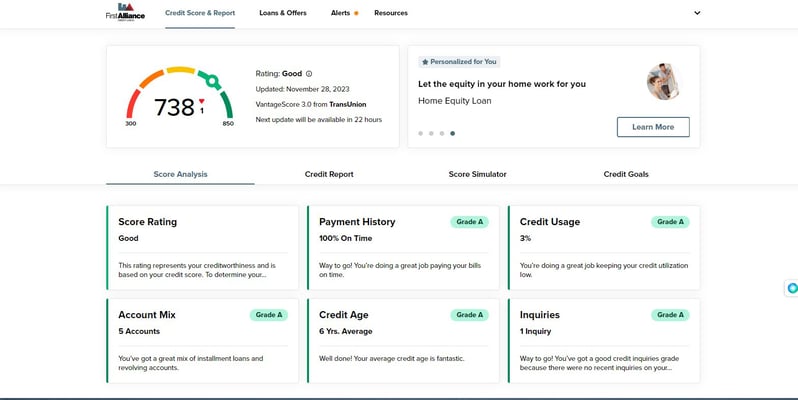

To be fair, this one is kind of a cheat, since you won’t find it on the My Money tool. However, you will find it when you log into our online banking platform or mobile app. It’s easy to access, provides the same service as Credit Karma and you’ll get alerts about how well you’re doing building (and maintaining) your credit score.

If you’re a Mint user who’s looking for a replacement and you’re a First Alliance Credit Union member, give the My Money tool a try. You’ll not only be able to track your spending and use that information to create a budget, you’ll also be able to set financial goals and track your progress. You can even check your credit score.

The best part about the My Money tool? It’s free to all First Alliance Credit Union members. Just log into your online bank account or mobile app and go to the My Money section to set it up and monitor your finances the way you would with Mint.

Talking to kids about money can be a daunting task for many parents, but it’s an essential part of teaching your children financial literacy. When...

My Money is your free Personal Finance Management tool available exclusively inside your First Alliance Credit Union online banking account. It is a...

As parents we all want to teach our kids the best habits possible to help them grow into happy and healthy adults, that includes nurturing...