How Long Should You Keep Financial Records?

Ever feel like you’re drowning in paperwork? If you do, you’re not alone. Every month, the average American gets bombarded with a flurry of bills,...

6 min read

![]() First Alliance Credit Union

:

Jul 30, 2019 7:57:45 AM

First Alliance Credit Union

:

Jul 30, 2019 7:57:45 AM

My Money is your free Personal Finance Management tool available exclusively inside your First Alliance Credit Union online banking account. It is a robust, feature-packed tool that helps you stay on top of all your financial accounts, budget and goals.

Using this powerful tool is easy. By categorizing your online banking transactions, you can begin learning where your money goes and looking for places you might be able to save. Keep scrolling to review some of the most common questions we receive about our My Money tool!

If you haven't watched the tutorial video yet, we encourage you to do so now! It will answer most questions for you about the new My Money tool, such as how to navigate it and how to use all the amazing features available. You can watch it below!

Nope! This is a free feature available to all of our Online Banking users!

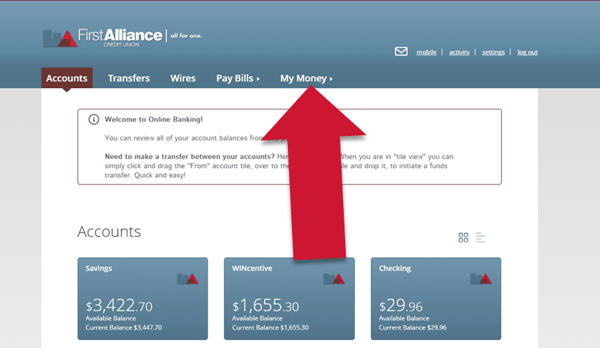

All you will need is an active First Alliance Credit Union online banking account. No extra software is necessary. Once logged in you will have immediate access to the My Money tool by clicking on the My Money tab in the main navigation bar. No additional login credentials are required. You can access your My Money tool from almost any PC that has Internet access as most browsers and Internet Services Providers will support the My Money tool without issue.

It’s easy to begin using the My Money tool in your First Alliance Credit Union online banking account.

You should only be prompted to complete this brief enrollment process the first time you access your My Money tool. Once you’ve successfully completed the enrollment process the next time you click the My Money tab you will be shown your personalized dashboard.

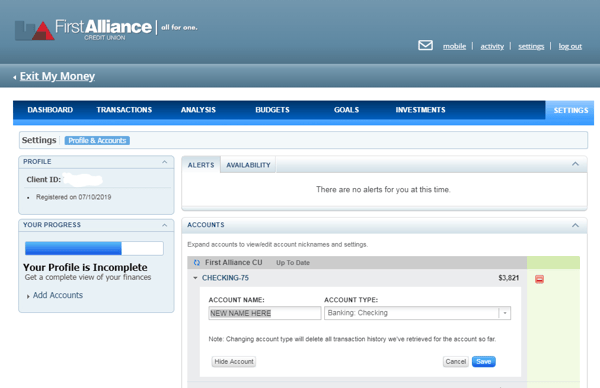

If you have set up account nicknames for your accounts in Online Banking, those names may not map over into the My Money tool. To reset your account nicknames navigate to the account list under Settings inside the My Money tab. Click the arrow next to the account you would like to rename. Type in the new name for the account and click save.

If you have linked accounts with your spouse or your children within your First Alliance Credit Union online banking account these accounts will be initially included in your My Money accounts listing. Unfortunately, when the linked accounts are pulled into the My Money tool any naming conventions you had set up will not be mapped over. The best way to differentiate between the linked accounts is by taking a look at the account balances for the account to help you differentiate them. Then you can manually remove the accounts you do not wish to see in your My Money tool going forward. If you need help with this process please do not hesitate to reach out to us at 507-288-0330 or hello@firstalliancecu.com.

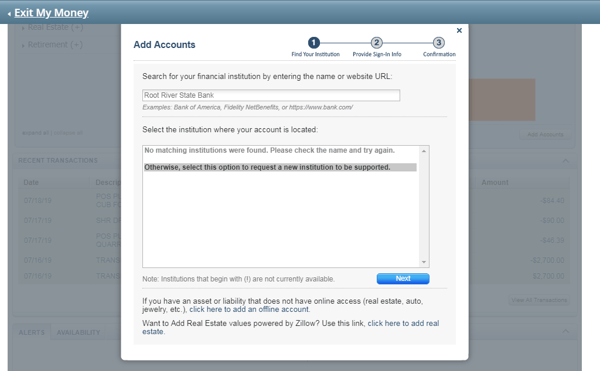

My Money is able to access online accounts from over 18,000 data sources, however if the institution you are trying to connect to doesn’t seem to be available, you can request the account to be added. Note: This will take time to process and is not immediate. You can add unavailable and/or non-liquid accounts as offline accounts in the meantime.

The My Money tool is not currently available inside the First Alliance Credit Union mobile app. However, our Online Banking platform does optimize well to most mobile devices, especially tablet screens. Mobile app functionality for My Money is under development and we are hoping to have the integration available in early 2020, we will release more details as this function becomes available for our free Mobile Banking app.

Extremely! First Alliance Credit Union uses the latest Internet security available, including secure communications (SSL), firewalls, 256 bit encryption, and operating systems that have been designed to provide maximum security. Your security is our top priority at First Alliance Credit Union.

By default, the My Money tool will include all your First Alliance Credit Union accounts, as well as loans and credit cards. Using the feature called "account aggregation," you can also pull in any other financial accounts for which you have online account access. For example, you can bring in data from:

Keep reading to learn more about the Account Aggregation feature in the My Money tool.

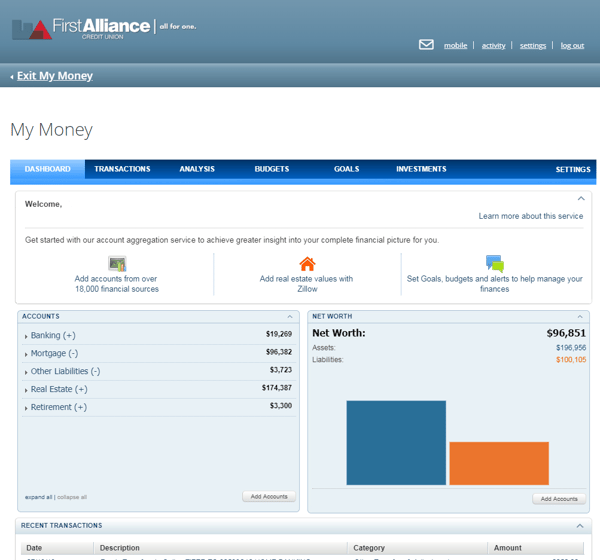

Account Aggregation is the powerful feature inside the My Money tool that allows you to organize all of your financial information in one place. With Account Aggregation, you can include all of your accounts, regardless of where they are held, giving you an integrated view of your entire financial picture.

Account Aggregation accepts account data from over 18,000 data sources so you can enroll all of your accounts, regardless of where they are held, and view your entire financial life right from your First Alliance Credit Union Online Banking account. You can add many types of accounts, including online investment, retirement, banking, insurance, mortgage, loan, and credit card accounts, as well as non-liquid assets such as real estate, automobiles, and jewelry. Non-liquid assets can even be added as offline accounts if you want.

The Account Aggregation feature inside the My Money tool can help you simplify your financial life. It can give you a clear, consolidated, up-to-date picture of your personal finances to help you make informed, timely decisions. Account Aggregation also lets you track all of your online investment, retirement, banking, insurance, mortgage, loan, and credit card accounts from a secure, convenient dashboard accessed through your First Alliance Credit Union online banking. There is no longer a need to visit multiple sites to get your most current financial information.

Aggregation allows you to consolidate all of your financial resources into a single, holistic view. To gain this singular view, we encourage you to pull in all of your financial accounts into My Money. Account Aggregation can retrieve your account information from more than 18,000 data sources, so you can include assets together with liabilities and even non-liquid assets.

Account Aggregation uses the login credentials you provide for accessing your other financial institutions' websites to retrieve your transactions and balances. It pulls in the data from your existing online financial accounts.

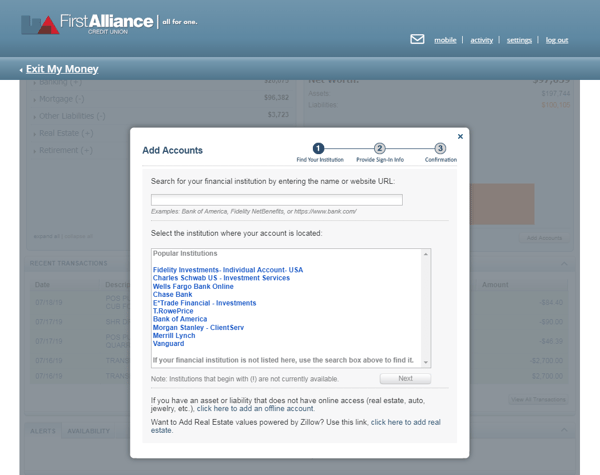

It’s easy! Simply click the “Add Accounts” button from the Dashboard tab, search for your other financial institutions, and follow the prompts and next steps. If your online account from another institution requires two-factor authentication, you will be prompted with those login steps as well. Once you’ve completed the login process for each of your external accounts in the My Money tool, your real-time data will be available each time you login to your First Alliance Credit Union Online Banking account.

Account Aggregation uses industry-leading policies, practices, and technologies to protect the privacy and security of your personal information against unauthorized access or disclosure and inappropriate alteration or misuse. Data storage and transmission are protected using one of the strongest encryption methods available (128-bit SSL).

Most alerts can be fixed by clicking the "Resolve" button next to the alert on your Dashboard. This process will allow the system to take corrective steps to fix the alert based on your input. For alerts that you cannot fix through this process, please contact us at 507-288-0330 or hello@firstalliancecu.com.

You can disable email alerts so that you do not receive emails when an account harvesting failure alert is outstanding. This can be done by setting the alert frequency to "Never" on the Profile screen. You cannot disable the Alerts completely, however, as they are used to troubleshoot issues with your aggregation services.

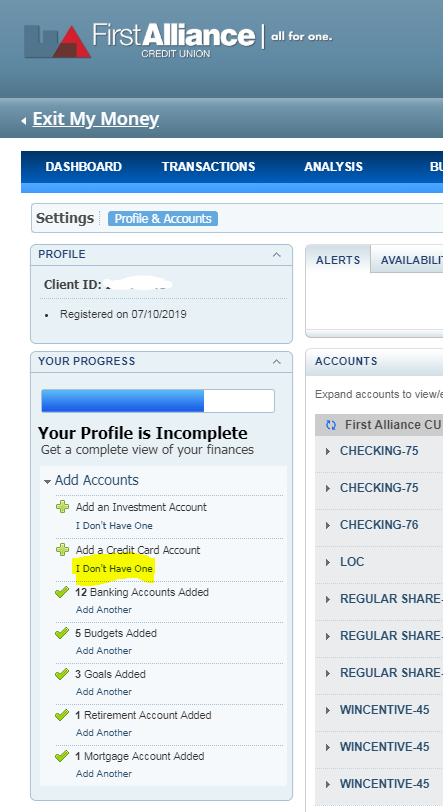

Once you have added the accounts, if your profile still shows as incomplete, please click on the profile bar which will open a list of all the possible account types that can be added. The account types that have been added will have a check mark next to them. For those account types that have a plus sign next to them, you can choose to click on "I don't have one." This will grey out that account type and move the progress bar further. Once all the accounts have either been added or it's been indicated that you do not have the account, the bar and the profile will be complete.

If you have additional questions or need assistance with the new My Money tool in your First Alliance Credit Union online banking account, call us at 507-288-0330. We are here to help you take control of your finances.

Ever feel like you’re drowning in paperwork? If you do, you’re not alone. Every month, the average American gets bombarded with a flurry of bills,...

We are once again receiving reports from members that they are receiving strange text messages about fraud on their account followed by a phone call...

We know everyone manages their money a little differently. Some people prefer a more self-service style with online banking, while others like coming...