Monthly Child Tax Credit Payments Have Started

There are a few important things to know for those who are eligible to receive an advance on your child tax credit from the federal government as...

3 min read

Jenna Taubel

:

Jul 23, 2019 5:39:00 AM

Jenna Taubel

:

Jul 23, 2019 5:39:00 AM

We know everyone manages their money a little differently. Some people prefer a more self-service style with online banking, while others like coming into one of our branches for help. We like to be able to accommodate our member’s preferences and therefore we offer several easy options for making payments on your First Alliance Credit Union loans.

The fastest way to make your First Alliance Credit Union loan payment is from within your online banking account. For this option, simply login to your First Alliance Credit Union online banking account, either on your computer or through your First Alliance Credit Union Mobile Banking app.

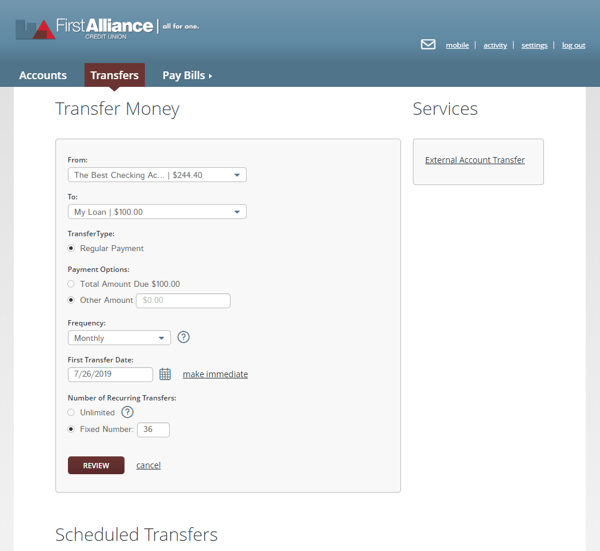

Once logged in, select the Transfers tab. Then in the “From” field choose which of your First Alliance Credit Union accounts you want to use funds from to make your payment. Then in the “To” field select your loan. You will also need to specify how much you money you want to transfer for your payment. We recommend making the minimum payment each time; however you can choose to make partial payments or larger payments as well, if that works better with your budgeting needs.

From the transfer screen you can also select to make your loan payment transfer a recurring transaction. If you set up a recurring transaction, your loan payment will automatically be paid each month on the date you select and for the amount you specified. This is a convenient option for many of our members, as you no longer need to remember to make your payment each month, it’s done for you automatically and can stopped at anytime.

Check out our tutorial video in our online resource center for more details about using online and mobile banking.

.jpg?width=1200&height=630&name=Loan%20Payment%20Options%20at%20first%20Alliance%20Credit%20Union%20-%20an%20Advisor%20talking%20to%20a%20customer%20(1).jpg) If you prefer to make your First Alliance loan payment online, we are thrilled to offer MessagePay. This secure and convenient option allows you to make payments from anywhere. Here’s how it works:

If you prefer to make your First Alliance loan payment online, we are thrilled to offer MessagePay. This secure and convenient option allows you to make payments from anywhere. Here’s how it works:

Steps to Use MessagePay:

Member Benefits:

With MessagePay, managing your loan payments is easier and more secure than ever. Enjoy the convenience of making payments anytime, anywhere, while ensuring your financial information remains protected.

If you don’t have all your banking accounts at First Alliance Credit Union yet, that’s okay. We still make it easy for you to make your payments on your First Alliance Credit Union loans. There are two options for making your monthly loan payment from an account at another financial institution.

If you don’t have all your banking accounts at First Alliance Credit Union yet, that’s okay. We still make it easy for you to make your payments on your First Alliance Credit Union loans. There are two options for making your monthly loan payment from an account at another financial institution.

You can have First Alliance Credit Union request the funds transfer from the other financial institution account to your First Alliance Credit Union loan. In order for us to set up this transaction for you, you will need to provide us your account number and the routing number from the other bank or credit union.

You can also have your other financial institution initiate the loan payment from your other account. To complete this you will need to visit your other bank or credit union and provide them with your First Alliance Credit Union account number and loan number, along with the First Alliance Credit Union routing number: 291975481.

When setting up a monthly loan payment transfer from another financial institution we recommend setting these up as a recurring transfer that occurs each month. This will be the most convenient option for managing your loan payment, as you will not need to visit a branch each month to initiate the transfer between your different banking accounts.

If you prefer to make your First Alliance loan payment in-person at one of our branches we are happy to help you. When you visit a branch you'll use the Advisor Supported Kiosks in the lobby and drive -up to complete your loan payment. You can complete this one of two ways:

If you prefer to make your First Alliance loan payment in-person at one of our branches we are happy to help you. When you visit a branch you'll use the Advisor Supported Kiosks in the lobby and drive -up to complete your loan payment. You can complete this one of two ways:

Make a loan payment with cash or write a check

Make a transfer from a First Alliance account to your First Alliance loan

If you are choosing to pay on your First Alliance loan by initiating an ACH transfer from an account at another financial institution a helpful Member Experience Advisor in the branch can assist you in setting that up. You will need to know your account number and routing number from the other financial institution.

The loan payment options we have shared here are the most common ways our members choose to manage their loans. We have occasionally had members ask to make their loan payment with a debit card or cash advance off a credit card, we don’t currently accept loan payments via a debit card or credit card cash advance. If you have a situation that may require a different payment plan than the main options presented here, please reach out to us so we can work with you to create a payment solution that is best for you and your specific financial situation.

Additionally, if you ever feel that you are struggling to pay your First Alliance Credit Union loan payments on time, please do not hesitate to contact us right away. Our Member Solutions team is here to help you work out better payment options at any time. You’re personal financial success is important to us and we are here to offer you support and guidance, without judgement.

There are a few important things to know for those who are eligible to receive an advance on your child tax credit from the federal government as...

Everyone says they could use some extra money, but thanks to the COVID-19 pandemic even a couple hundred dollars can help someone make rent or afford...

Often people think that the the only way to open an account at First Alliance Credit Union is to come into a physical branch location. However, a few...