Loan Payment Options at First Alliance Credit Union

We know everyone manages their money a little differently. Some people prefer a more self-service style with online banking, while others like coming...

4 min read

Jenna Taubel

:

May 8, 2018 6:50:00 AM

Jenna Taubel

:

May 8, 2018 6:50:00 AM

With all of the recent data breaches and Facebook privacy concerns in the news the last few months, I felt it was important to highlight some of the financial security products and services that First Alliance Credit Union offers to you, most of them for free. Your financial security is our top priority; it is important that you know we integrate a lot of security checks and technology on the “back-end” of everything we do every single day. However, there are also additional products and services you can use to take control over your financial security. Here is a list of our favorite financial security products and service available to you right now.

My Cards is a state-of-the-art feature within our free mobile app that helps you manage your finances, while protecting you from fraud, by controlling how, when, and where your First Alliance Credit Union debit cards and credit cards are used. All for free!

The My Cards feature allows you to turn your debit card or credit card “on” and “off” to prevent unauthorized usage of your cards. The app also sends you real-time notifications anytime a new transaction is process. You will know immediately if an unauthorized charge has occurred, so you can immediately turn your card "off" to prevent further fraudulent charges. Additionally, transaction controls allow your debit or credit card to only work in specific location or geographic areas you choose to add an additional layer of protection. If you're card is used outside of your preferred location or merchant settings, the transaction will automatically decline.

First Alliance Credit Union partners with LegalShield to offer you comprehensive identity theft protection plans at a discounted price. When you enroll in either an individual or family protection plan, LegalShield will monitor your identity from every angle, from your Social Security Number to your social media accounts, and more. If any change in your status occurs, you will receive an email update immediately. If you didn’t make those changes, they will work with you to resolve the situation quickly, before too much damage can be done. Your identity will be diligently monitored for signs of criminal activity and will give you all you need to keep your identity safe from thieves and fraud, giving you the upper hand.

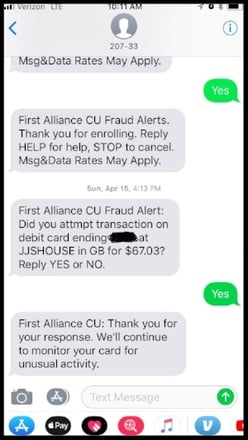

Earlier this year, we added the option to receive a text message from our Fraud Department instead of a phone call, if fraud is detected on your debit card. We added this service because we realized our members would receive a call from our Fraud Center’s 800-number, assume it was a solicitation and let it go to voicemail. This resulted in legitimate transactions being denied and members becoming frustrated. Sending these fraud alert notifications via text message has helped alleviate this issue, as we can now share the information with you faster than ever before. When you receive a notification, all you have to do is reply “yes” or “no” to let us know whether or not the transaction was legitimate. We strongly encourage all of our members to take advantage of this free notification service. If you opted out before and want to opt-in, just give us a call and we can re-send the opt-in text message.

Earlier this year, we added the option to receive a text message from our Fraud Department instead of a phone call, if fraud is detected on your debit card. We added this service because we realized our members would receive a call from our Fraud Center’s 800-number, assume it was a solicitation and let it go to voicemail. This resulted in legitimate transactions being denied and members becoming frustrated. Sending these fraud alert notifications via text message has helped alleviate this issue, as we can now share the information with you faster than ever before. When you receive a notification, all you have to do is reply “yes” or “no” to let us know whether or not the transaction was legitimate. We strongly encourage all of our members to take advantage of this free notification service. If you opted out before and want to opt-in, just give us a call and we can re-send the opt-in text message.

You can keep tabs on your credit score inside our mobile banking app. It is important to regularly monitor your credit score and credit report so you can identify fraud before it gets out of control. If you notice your credit score change significantly or begin seeing accounts or credit lines that are not yours, it is a red flag that someone has stolen your identity. If you see this occurring, you need to file a dispute to have it removed from your credit report immediately, which you can do quickly and easily from inside our mobile banking app. Plus, our mobile banking app also uses bio-metric technology as another layer of protection, so you can use your fingerprint to login to your account instead of a password.

While EMV chip cards are not a new technology, but there are surprisingly a large number of financial institutions in the US that still do not offer this level of security for their credit and debit cards. EMV chip cards add another layer of protection to your point-of-sale transactions. Your personal information is encrypted and a unique code is generated for each transaction with EMV cards. Whereas a traditional magnetic strip card holds your information statically, making it more susceptible to fraud. For example, if a hacker obtained transaction information from a specific point of sale purchase, they would not be able to duplicate your card information and use it to make fraudulent purchases. This is because each transaction code can only be used once with EMV cards, whereas the information from a magnetic stripe card can be replicated.

Keeping on the debit card safety topic, we also instant issue our debit cards. This means your debit card is created inside our branch and handed to you at the same time you open your account. This eliminates having to mail your debit card to you, which has the potential to be intercepted and fall into the wrong hands. This also helps if you ever need to cancel your debit card due to fraud, because you don’t have to wait the seven to ten days that you normally would when your card is mailed to you. Instant issue debit cards are not only convenient; they are the more secure option.

As you can see First Alliance Credit Union takes your personal financial security very seriously. On top of taking every precaution possible to keep your personal financial information safe on the “back-end” of the credit union’s daily processes, we also offer the latest technologies and services to help protect you from the ramifications of fraud and identity theft. If you ever have questions or concerns about how you can better protect your financial and personal information, do not hesitate to contact us. That’s what we are here for. Your financial security is our top priority, every day.

We know everyone manages their money a little differently. Some people prefer a more self-service style with online banking, while others like coming...

Mobile Wallets are convenient way to securely make purchases at stores, as well as online and through some apps. First Alliance Credit Union’s debit...

The penny was first authorized in 1792, but as of November 12th, 2025 the United States has officially minted its final penny.