Why are Personal Loan Rates so High?

If you’ve ever researched loan rates, either because you’re looking to take out a loan or because that’s the sort of thing you enjoy, you might have...

In a financial emergency a Pay Day loan may seem like a lifesaver, especially if you have poor credit, have no savings, or think a traditional loan is somehow out of your reach. Pay Day loans also seem more accessible, since you can find a Pay Day lender in a storefront or pawn shop. You can even find them online.

Unfortunately, while Pay Day loans are very easy to get, they are almost impossible to pay off. Pay Day loans are full of money-gobbling pitfalls, and you should know what those pitfalls are before doing business with a Pay Day lender.

A Pay Day loan is meant to be for just a couple weeks, literally the time between each pay day. The loan approval process literally takes seconds, and that’s part of what makes Pay Day loans so attractive.

First, Pay Day lenders make sure to verify your income and whether or not you have an account at a credit union or bank. When the Pay Day loan is approved, the funds are deposited into your account. Often, the lender will require you to write a postdated check for the amount of both the loan and the interest Pay Day loans will charge.

First, Pay Day lenders make sure to verify your income and whether or not you have an account at a credit union or bank. When the Pay Day loan is approved, the funds are deposited into your account. Often, the lender will require you to write a postdated check for the amount of both the loan and the interest Pay Day loans will charge.

For example, let’s say you get a loan for $500 on November 16th. Since the loan will need to be repaid in two weeks, you will write the check for November 30th. The check will be for $575, $500 for the loan and $75 for the interest.

The lender makes you postdate the check to your next payday because it guarantees that they will be paid back on your next pay day. This system works for the lender because they don’t have to check your credit history—they already know the money will be available to them in two weeks.

The cost of Pay Day loans is what makes them literally the worst loan ever. The above example showed an interest payment of $75 on a $500 loan. If this were the cost of the loan for an entire year, the interest rate would be approximately 15%, which isn’t a bad rate if you have poor credit.

The problem is that the $75 is just the interest that was charged in a two week period. If you annualized the interest charged in two weeks, it comes out to $1,950 in total interest charges for a $500 loan! The interest charge is over 200%! That is outrageous, and it’s not even the worst part.

The real trap is that the person taking out the Pay Day loan in all likelihood cannot afford the interest payments. If a person can’t afford to pay $500 to someone without dipping into their next paycheck, being able to pay $575 to a Pay Day lender is all but impossible. This is how the vicious cycle starts.

Since the borrower can’t afford the Pay Day loan to begin with, they have to take out another Pay Day loan to pay back the first one, and then another Pay Day loan to pay back the second loan, and so on, with each loan being a little bit larger than the last. Some lenders might "helpfully" provide continuous financing by rolling over the loan every two weeks, but they still charge interest, even if the balance remains the same.

Pay Day lenders are notorious for their aggressive collections practices. They will call you continuously and may even make sure you receive a court judgment, which will negatively impact your credit.

Recently, we helped out a member who had taken out a Pay Day loan. He took out a loan with an online lender that claimed to be "better than a Pay Day lender" for $1,300. What he didn’t realize was that his interest rate was 159.65%. If he had paid that loan all the way to the end, his $1,300 loan would have cost him a total of $2,225.

If he had taken out the same $1,300 at First Alliance as an unsecured personal loan, for 12 months, with an interest rate of 8.99%, his total interest charged over the course of one year would have been $67.44. With a traditional unsecured loan,  there is also flexibility to make extra payments, which would allow the loan to be paid off faster.

there is also flexibility to make extra payments, which would allow the loan to be paid off faster.

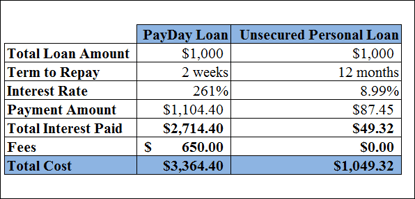

This chart breaks it down for you again, this time using a $1,000 loan that is used for one year. As you can see, between the interest rate and the fees associated with the Pay Day loan, a Pay Day loan costs $2,315.08 more than a traditional, unsecured signature loan.

The very best way to avoid Pay Day loans is to reach out to your financial institution. Tell them your story, including your financial situation. Be up front and honest about what’s happening. Even if your credit isn’t the greatest, they may be able to approve you for a small loan at a reasonable interest rate. At the very least, they can help you come up with a plan to improve your credit or start a savings account.

If you haven’t been saving, work on creating a savings plan. Make sure to set a goal. A good rule of thumb is to save at least six months of living expenses. If your budget is already tight, think about getting a second job or even selling some of your stuff that you don’t need or want. With tax season approaching, another good strategy is to put your tax refund into savings and forget about it. It will grow a little interest while still being available if you need it in an emergency. Building a savings habit will most certainly help you avoid Pay Day lenders.

If you are in the Pay Day lending cycle, First Alliance Credit Union can help you escape. Set up an appointment to talk with one of our expert member experience advisors. They will likely be able to help you with a traditional unsecured loan to help you pay off the Pay Day loan, and get your finances back on track.

If you’ve ever researched loan rates, either because you’re looking to take out a loan or because that’s the sort of thing you enjoy, you might have...

As you might be aware, federal interest rates are at an all time low. Incredibly, they're expected to get even lower in the wake of the recent stock...

We see and hear all over, "Bad Credit Loans", "Credit Repair Loans", "Bad Credit, No Problem Loans", and the list goes on and on. If you know you...