Six Tips to Help Reduce Your Debt

No one likes being in debt or owing money to someone, but there is a large percentage of the population in the United States that is currently in...

2 min read

![]() First Alliance Credit Union

:

Sep 17, 2019 6:45:00 AM

First Alliance Credit Union

:

Sep 17, 2019 6:45:00 AM

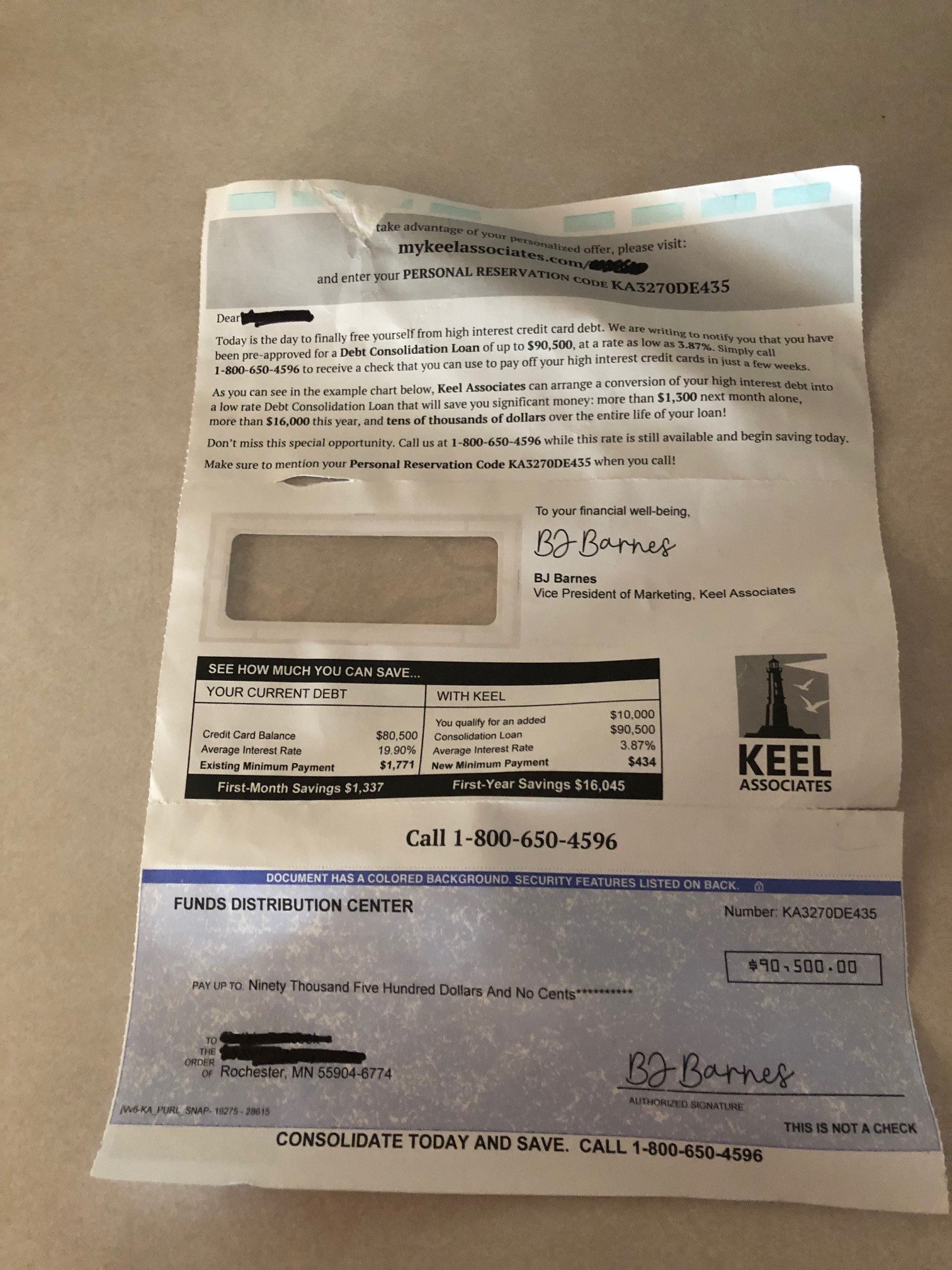

Recently, we had a member who received a debt consolidation offer in the mail. She was preapproved for a $90,500 signature loan at a rate of 3.87% to consolidate high interest credit card debt. Understandably, she was concerned that she received this mailing and more so, a preapproval for a loan she didn’t want or more importantly, need.

The member brought the offer letter to us for review, to get some insight into how this happens. She also wanted to make sure that this blog post was written, so that our other members and the community have a better understanding of the risks associated with these types of solicitations for debt consolidation.

Lenders, such as the one who sent this letter, do what is called a “soft pull” on a pool of people’s credit reports, using a number of factors, such as age, income, whether or not you have real estate, a car loan, credit cards, etc. and then formulate offers based on the information they get back. It’s important to note that your credit score is not pulled during this process.

These lenders then get a “ball park” of what they think you may owe on high interest credit cards. In our member's case, the data that was returned probably included her car loan and mortgage, which would easily get a person to a number like $90,500, and assumed a good portion of that debt was credit card debt.

As you can see in the letter, they assumed that our member had $80,500 in credit card debt and gave her an extra $10,000 on top of that for the loan if she were interested. They even went so far as to calculate what her payment may be and what the interest savings could be if she were to take out the loan.

If you have credit card debt, these types of offers may seem perfect for you. However, there are reasons to be wary of these types of offers:

Taking out a loan is a financial transaction. With any financial transaction, you want to know who you are doing business with. In this case, if she had accepted the offer, our member would be doing business with an unknown lender using only an 800 number and a promo code.

It is important that you know who your lender is. Meet with them face to face. Discuss your financial situation. When you build a strong relationship with your lender, it helps you if you need to borrow in the future, and the lender can provide you with other products or services that may help you with your finances.

3.87% is an incredibly low interest rate for an unsecured or signature loan. These loans are secured only by your signature, which is your promise to pay. There is no collateral such as a house or a car, so the risk of default on these types of loans is higher. In the market today, the interest rates for these types of loans start in the 5% to 6% range, and the rates increase based on the borrower’s credit score.

When you get these types of offers in the mail, don’t even bother to open them. Simply shred them and throw them out. Since its difficult to pin point exactly how these types of companies get your information, it’s almost impossible to opt-out of receiving them.

If you are finding yourself overwhelmed with credit card or any other type of debt, reach out to your lender or lenders right away. They are the best equipped to provide you with solutions, insight and guidance to help you eliminate that debt safely.

No one likes being in debt or owing money to someone, but there is a large percentage of the population in the United States that is currently in...

Getting into debt is easy. Getting out of debt, though, is a lot harder, and the difficulty only increases if you have multiple debts. Between...

Many people say that they would love to pay off their debts. However, they're not quite sure just how to pay off debt. Fortunately, there are several...