Is Saving Money Good For Your Brain?

We all know we need to save more money, but did you know that saving money actually has positive psychological effects? For instance, having money...

Sometimes we all just want to be able to wave a magic wand and make our wallets fuller and lives easier. Unfortunately, magic isn't real so that’s never going to happen. Sigh. Instead, here are some quick tips on saving money that are easy to follow and totally do-able!

Instead of going on a shopping spree with your friends, have a clothing swap where you shop in each other’s closets. One woman’s trash is another woman’s come-up. Or in the event you don’t wear the same size, or like the same styles, try shopping at a second-hand store, like Plato’s Closet or Good Will, your dollars will go farther because the costs are fractions of what you will pay at the mall.

Spending less can be like making more. Get rid of the $200 a month cable bill and it's like giving yourself an after-tax raise of $2,400 a year. Now just make sure you use your “raise” wisely by investing more in retirement, starting an emergency savings fund, or using it to pay down other debts. Don’t just use it spend more somewhere else.

Buying gift cards on sites like Raise.com, where the gift cards are discounted anywhere from 1% to 25% below face value, means that you’ll save money before you even go to the store. They have discounted gift cards for a wide variety of businesses, like Wal-Mart, Uber, Home Depot, and lots more. Next time you know you need to do some shopping, check for a discounted gift card first.

As a general rule of thumb, when trying to figure out how much house you can afford, your monthly payment should be below 28% of your total monthly income to be considered affordable. For example, if your monthly income is $2,000, then your house payment shouldn’t be more than $560 a month (not including any payments you escrow). Following this simple rule will help ensure you aren’t house broke.

If you’re consistently overspending, go on a “Cash Only Diet”, this will break you out of your overspending rut really fast. It’s psychologically harder to spend physical money than it is to swipe a card. Try it for a week or two and you will be surprised how much you save just by using cash to pay for your everyday purchases. It will make you think twice about buying that doughnut when you go in to the gas station to pay for your gas, I guarantee it!

Set aside one minute each day to review your accounts. This 60-second act will help set your spending tone for the rest of the day! Mobile banking apps make this very easy to do anytime of the day, from anywhere. If you don’t think you will remember to do it, set yourself a daily reminder on your phone, then every day during your morning constitution you’re checking your accounts and not Facebook.

If you need a visual to get motivated, try crafting a financial goals vision board, it can help remind you of your financial goals so you can stay on track. It doesn’t have to be large or have tons of stuff on it to be effective. If you’re goal is to save up enough money to go to Hawaii next year, your vision board might have a picture of Hawaii, along with the cost of the trip, and maybe a picture of you having fun from your last vacation, to remind you of what you’re working towards. Keep it in a place you will see it every day, like your fridge or even on the dash of your car. Even just a sticky note with the word Hawaii on it might be enough to keep you motivated.

Create a positive phrase for yourself to act as rule of thumb for how you save and spend. Every time you're about to make a purchase repeat your mantra to help you decide if it is really a need or a want. Here’s a few that might work for you, or make up your own.

Whatever phrase will keep you saving, instead of spending is fine. It could even be a poem or song lyric, as long as it makes you think about reaching your financial goals.

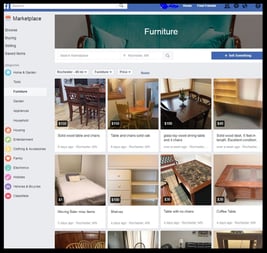

Go through your belongings, like seasonal décor, clothes, furniture, or tools and sell the items you don’t want or need any more on sites like Craigslist or Facebook. Use your earnings to open up a new savings account or to add to your emergency fund. This is not only a great way to de-clutter your home, but it is a great way to earn some extra money without too much effort.

Find out if your credit union offers a prize-linked savings account, like WINcentive Savings. These accounts offer you chances to win money just for saving money. Every increase in your savings account month to month enters you into a prize drawing for chances to win money monthly, quarterly, and annually. This can be a great way to start building a habit of saving money. Even if you don’t win one of the cash prizes, you will be a winner just for saving money.

The best thing about these savings tips is that you don’t have to follow all of them. Even if you only select one tip and save a few dollars at a time, you’ll be surprised at how much you have after a couple months.

Once you have some money saved up, make sure you have a safe place to store it. Become a First Alliance Credit Union member today and put your money in a savings account.

We all know we need to save more money, but did you know that saving money actually has positive psychological effects? For instance, having money...

Saving money can feel simply overwhelming, especially when you're juggling entry-level jobs, student loans, and maybe even living with roommates. But...

The number one tip you hear again and again from financial experts is start an emergency fund. This typically means having money in a savings account...