How To Go Christmas Shopping Without Going Bankrupt

As you may have heard from Alvin and the Chipmunks, Christmas, Christmas, time is here. Time for toys and time for cheer. The only problem is that in...

3 min read

![]() First Alliance Credit Union

:

Nov 6, 2019 7:36:00 AM

First Alliance Credit Union

:

Nov 6, 2019 7:36:00 AM

Using your credit card to do your holiday shopping has a lot of advantages. However, there is one big advantage--it's easy to overspend. Most people realize they've overspent when they get their first credit card statement and realize they've spent more than they expected.

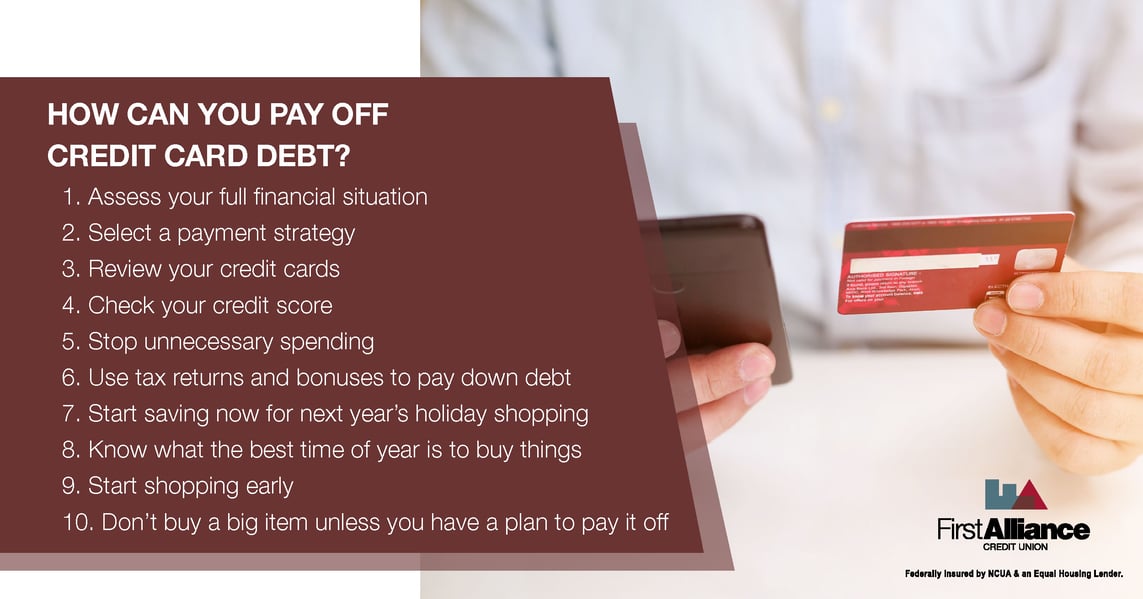

To help you recover from your holiday credit card debt, we have put together 10 tops that will make paying off your credit card balance easier.

Review and assess your total financial situation, including your monthly budget and your short and long-term financial goals. Make a list of all of your debts, payment due dates, minimum payment amounts, interest rates and the time frame in which you would like to pay down your debt.

Consider paying down the credit cards with the highest interest rates first. If that seems too difficult, try paying down your smallest balance first so you can see your progress right away. If you can, pay more than minimum payments, and pay them on time. Automatic bill payment, or electronic payment can help ensure that your payments are made on time.

Make sure you’re being wise about what credit cards you’re using and why. Consider eliminating credit cards with annual fees and incorporating more rewards cards into your wallet. Take advantage of the points you can accumulate with a rewards card and put them towards some of your holiday purchases.

Check your credit report so you understand where you stand and how your credit may have been impacted by your holiday spending. During times of high activity on your credit accounts, it is also especially important to make sure that your credit report is accurate. Then, after you have had time to achieve your goals and pay down your debt, get another score to see how where you fall in the range of risk has changed once you have paid down your debt.

Now that you have a plan, and you are focused on paying down your debt from the holidays, stay focused and avoid spending extra cash on items that you don't need. Cutting out unnecessary spending like eating out, or that pair of shoes that you want, but really don't need, can make a big difference in your monthly budget. In fact, simple lifestyle changes, like making coffee at home, instead of buying it each day, and bringing your lunch instead of buying lunch, can help you save thousands of dollars over the course of a year.

Holiday bonuses and tax returns are two larger lump sums of money that can be used to pay down credit card debt. Make sure you are taking full advantage of extra income by putting it toward credit card debt or using it to save for next year’s holiday expenses. If you have a rewards credit card, use any money you get back to put towards your balance.

Make a holiday shopping budget and set aside money specifically dedicated to it. If you put away $50 each month, before you know it, you’ll have $500 to put toward next year's gifts. A Holiday Club Account is a perfect way to start saving for next year.

Write down all of the people you need to buy for and start listing ideas for potential gifts. Have an idea of what you want to buy well in advance of the holidays and keep an eye out for those gifts over the course of the year.

By shopping early, you will absorb the cost of holiday gifts throughout the year rather than all at once. Your bills will be easier to pay off and you will keep your credit card balances low, yet they will remain active throughout the year - all of which are good ways to strengthen your credit score.

Even if that big screen TV or computer you’ve always wanted is finally on sale, don’t take it home without knowing whether or not it fits into your budget or without having a plan to pay it off. Determine how you can make adjustments and sacrifices in other parts of your budget to help pay for it. Make sure you know how long it will take to pay it off and what funds you will use to pay for any large expenses.

It's understandable why so many people go into debt during the holidays, but you don't have to max out your credit card every time December rolls around. All you need to do is plan ahead and make sure you're managing your money effectively.

If you need some more help, set up an appointment with a First Alliance Credit Union Money Navigator today. They'll help you set up a personalized payment plan and get you feeling more confident about your finances.

As you may have heard from Alvin and the Chipmunks, Christmas, Christmas, time is here. Time for toys and time for cheer. The only problem is that in...

The 2020 holiday season is going to be different than any other holiday season they’ve experienced. In addition to the usual holiday concerns of ...

.jpg)

These days, a lot of people’s feel more dread about the winter holidays than enthusiasm. That’s because the winter holidays are expensive, and thanks...