How to Find Local Shopping Events in Rochester

While holiday shopping is usually associated with Black Friday mobs and big box stores broadcasting their deals on every media channel imaginable,...

3 min read

Chris Gottschalk

:

Dec 11, 2022 4:45:00 AM

Chris Gottschalk

:

Dec 11, 2022 4:45:00 AM

You probably won’t be surprised to learn that most people use credit cards to fund their holiday shopping. If you’ve read any financial articles on holiday shopping, you also won’t be surprised to learn that a lot of financial experts advise against doing this.

In fairness, these financial experts raise some good points. It’s easy to lose track of your spending and get into credit card debt. Also, if you carry a credit card balance, you'll probably pay back more than you spent, thanks to the typically high interest rates.

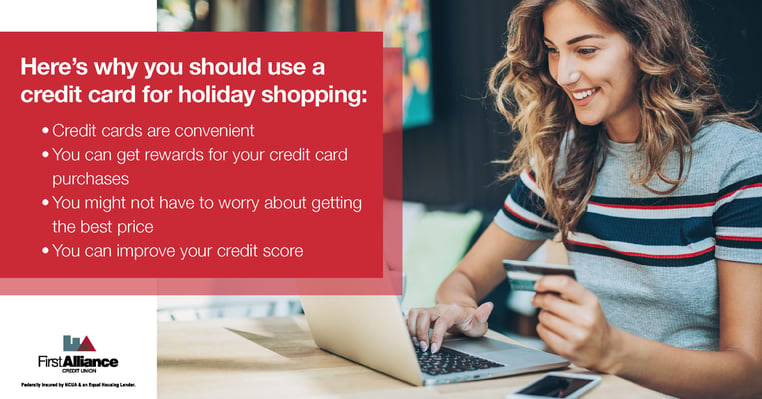

That being said, there are some good reasons why you should pay for your holiday purchases with your credit card instead of cash.

From convenience to earning rewards, there are a lot of benefits to using a credit card for your holiday shopping.

Let’s get the most obvious reason out of the way first. Paying for a purchase with a credit card is more convenient than using a debit card or cash. Instead of worrying about how much money you have in your checking account or whether you brought enough cash with you, all you have to do is charge your purchase against the sizeable limit of most credit cards.

The problem, of course, is that it's not hard to abuse this convenience and buy more than you can afford. While you’re using your credit card, be conscientious of the purchases you’re making, and don’t let yourself be tempted into an expensive impulse buy.

If you have a rewards credit card, you can take advantage of it by charging your holiday purchases to it. This will let you get at least some of the money you spent on gifts back in the form of:

Additionally, credit card companies might offer an additional incentive to open a rewards card around the holiday shopping season. They might give you additional points for a balance transfer to your new card, for instance, or give you a certain amount of points as a welcome offer. Some credit card issuers might even waive interest charges for all the purchases you make in the first month or two, which is ideal for holiday spending.

Before you make any purchases, though, you should make sure you know how your rewards credit card works. Read up on what purchases are eligible for the rewards, how long you’ll have to cash in your rewards points and what you’ll be getting back with each purchase. Above all, make sure that the other credit card features, like the interest rate and annual fees, don't cancel out the benefits of the card.

If you want to get the most out of a rewards credit card, familiarize yourself with the rewards structure. Once you've done that, make purchases from the retailers you know will get you the most points. Above all, use your credit card responsibly so your debt won't outweigh your rewards.

Some credit cards come with a price protection feature. This feature tracks the prices of items for a certain amount of time, usually 60 days. If the price falls on the item, you are eligible to get a refund on the difference in price. This can be very advantageous during the holidays, when prices on some items can fall drastically after December 25.

Believe it or not, using your credit card for holiday shopping can result in a nice gift for yourself. If you charge your holiday gifts to a credit card and pay it off, you’re building up your credit history and showing the credit rating bureaus that you’re an active borrower who can reliably pay back the amount you owe. That can potentially lead to them raising your credit score.

It’s worth pointing out you can also raise your credit score when you get a new credit card, thus increasing your credit limit. However, you shouldn’t apply for a new credit card solely for that reason. At the very least, you should ask yourself some questions before you apply.

Using a credit card to do your holiday shopping offers several benefits, from being convenient to potentially getting money back for your purchases. You might even be able to get a refund if your credit card offers price protection. Additionally, credit reporting bureaus will take note of your credit utilization in their credit reports, which can lead to getting a good credit score.

If you'd like to take advantage of using a credit card for your holiday shopping, sign up for one at First Alliance Credit Union. Our uChoose rewards card has a straightforward rewards program that gives you points on every purchase you make, as well as special offers for bonus points from select companies. You can then redeem those points for travel rewards and cash rewards, as well as gift cards to various retailers.

First Alliance doesn't just offer rewards credit cards, though. We also have platinum credit cards, classic credit cards and even personal lines of credit. Our member advisors can also offer guidance on the responsible use of a credit card and show you how to use our online banking platform and mobile app to help you avoid late payments and monitor your credit card use.

While holiday shopping is usually associated with Black Friday mobs and big box stores broadcasting their deals on every media channel imaginable,...

The holiday season is magical, but it can also feel like a full-on financial workout. Between hunting for deals, hosting gatherings, and traveling to...

As you may have heard from Alvin and the Chipmunks, Christmas, Christmas, time is here. Time for toys and time for cheer. The only problem is that in...