Your Financial Security is a Top Priority at First Alliance

With all of the recent data breaches and Facebook privacy concerns in the news the last few months, I felt it was important to highlight some of the...

3 min read

![]() First Alliance Credit Union

:

Jul 27, 2017 1:44:16 PM

First Alliance Credit Union

:

Jul 27, 2017 1:44:16 PM

Our newly upgraded Online Banking system comes with lots of excellent new features! To ensure you know how to use these features and feel comfortable navigating the updated system we have put together a series of blog posts to highlight these features and offer a few tips. We take the security of your personal information seriously, so we have put together this post to specifically discuss the new security enhancements and why they are important for your safety.

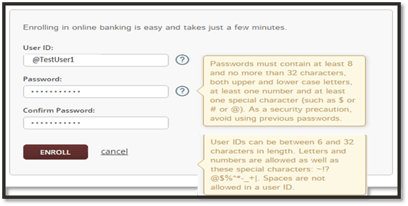

Strong security of your First Alliance Credit Union Online Banking account is an extremely important step in fraud protection, and it all starts with a strong username and password. One of the best practices for creating a secure password or username is to use numbers, symbols, and a combination of both upper and lower case letters. This is why when you are prompted to create your new password for Online Banking the requirements were a little different than before. Passwords that are at least 8 characters in length and require a combination of numbers, letters, and symbols are significantly more difficult for identity thieves to figure out, than shorter passwords or those that do not require a symbol.

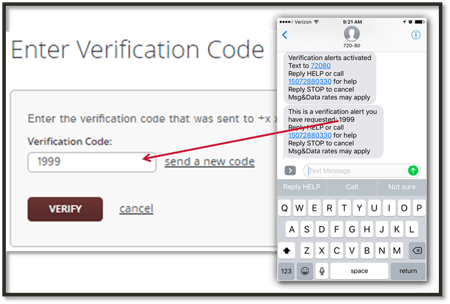

If you have logged into Online Banking since the upgrade on June 17th then you have been presented with this new security feature. Out of Band Authentication is the fancy, technical term for the process of using your phone to verify who you are while logging into Online Banking by entering a 4 digit code that is sent to you via text or phone call. You may have been prompted for this more than once since first logging in to the updated system. This is because the system is learning the specific devices and locations you use to access your Online Banking account.

Here are the most common reasons you could be prompted for phone verification:

In the future, you may also be prompted with a few sporadic checks to ensure you really are you! While this step can be a bit cumbersome at first, the more you log in the less frequently you are likely to be prompted with the phone verification step. This security enhancement is an important upgrade feature because even if someone manages to obtain your login credentials, they would still need to have access to your personal phone to access your account.

Bonus Tip 1: Using our free Mobile Banking App does not require phone verification, since you’re already using your phone to access the account!

Bonus Tip 2: If you have any additional people on your account (aka joint owners), make sure to add their phone number in Online Banking. That will allow both of you to receive the verification code by phone. Go to "Settings", "Security & Alerts", and "Identity Verification Phones" to add additional phone numbers.

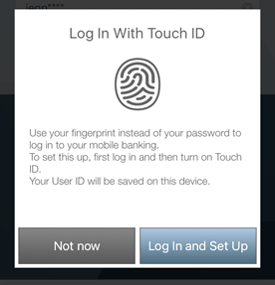

If you are a Mobile Banking App user with an iPhone then you have likely noticed that TouchIDTM is now enabled! Not only is this feature more convenient since you can skip entering your password to login, but it also is one of the very best security features out there, biometric! Not a Mobile Banking user? You should be, it’s free for both iPhone and Android devices.

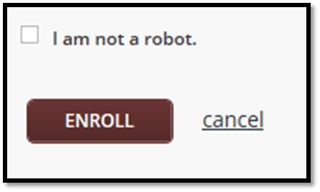

If you are a new user enrolling for the first time in Online Banking, one of the very first steps you complete is to prove you’re human, using ReCaptcha technology. This used to mean you look at a picture of letters or numbers and enter what you see into the field. Now it just involves checking a box that says "I am not a robot". While this step seems simple, it is actually a very effective tactic to stop what is known as “bot” activity from trying to gain access to your account.

As you can see we take your security very seriously, with the upgraded Online Banking experience we had opportunities to add several state-of-the-art security enhancements throughout the login and enrollment processes. We are regularly evaluating these processes to find the perfect balance between high-level security and convenience. If you have questions about these security feature enhancements please do not hesitate to contact us!

With all of the recent data breaches and Facebook privacy concerns in the news the last few months, I felt it was important to highlight some of the...

The security of your personal and financial information is our highest priority. We have many processes and procedures in place to ensure that we are...

Paying at checkout has gotten faster and easier thanks to tap-to-pay technology. If you’ve noticed people quickly tapping their card on a payment...