6 Steps to Take if You Can’t Pay Your Rent

Nothing is as scary as not being able to pay your rent. For many people, the space they’re renting is their home, and while having to move would be...

It's tax filing season, and we know it can be overwhelming. But don't worry, we're here to help! Take a moment to discover seven often overlooked deductions that can actually lower your tax bill. While many people are familiar with deductions like mortgage interest and charitable contributions, there are some lesser-known categories that can really save you some money.

Before you submit your tax refund this year, take a moment to delve into these valuable deductions that can help you maximize your savings. Whether you're tackling your taxes on your own or getting help from a tax professional, it's important to carefully examine each deduction to determine if you qualify.

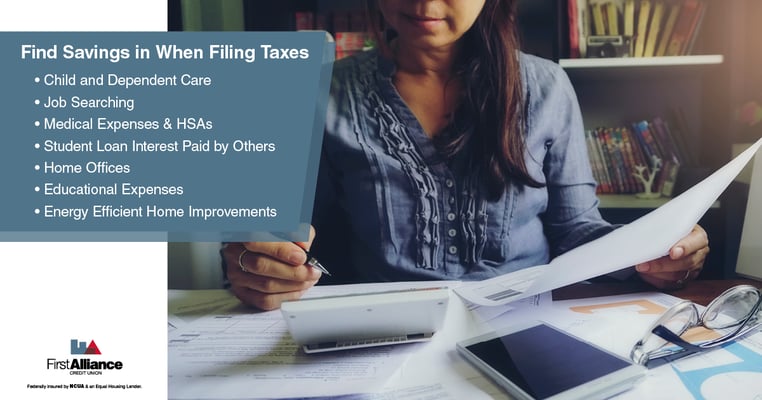

If you had to pay for childcare while working or job hunting, you may be eligible for this deduction. Typically, your child must be 12 years old or younger and considered your dependent. This credit also applies if you're paying someone to care for a spouse or dependent (regardless of their age) who is unable to take care of themselves. In most cases, you'll need to obtain the care provider's social security number or taxpayer identification number and include it on your tax return.

Were you on the hunt for a new job last year? Well, here's some good news for you! You may be able to deduct related expenses on your taxes. That's right, costs like resume preparation, travel expenses for job interviews, and even fees paid to employment agencies can potentially lower your tax bill. Of course, there are some limitations and criteria to meet, but taking advantage of this deduction can definitely help alleviate some of the financial stress that comes with unemployment.

In addition to the expected healthcare costs, you may also be able to deduct travel expenses for appointments, home improvements that are medically necessary, and even certain alternative treatments. Contributions made to your HSA can also be eligible for tax deductions. Not only do the funds in your account grow tax-free when used for qualified healthcare expenses, but your contributions can also help reduce your overall tax liability.

In certain situations, parents or other individuals may contribute to the repayment of a student loan. If the individual is not claimed as a dependent on someone else's tax return and is legally responsible for repaying the loan, they can still take advantage of the tax deduction for the interest paid by others. This provides a valuable opportunity for families or benefactors who assist with educational expenses to help ease the burden of student loan interest.

The IRS allows taxpayers to take advantage of a valuable deduction by claiming a portion of their home-related expenses. This includes mortgage interest, property taxes, utilities, and even a percentage of rent. The deduction is calculated based on the percentage of the home used for business, providing a practical and beneficial way for self-employed individuals and remote workers to recoup some of the expenses they incur while conducting business from the comfort of their homes.

Whether you're enhancing your skills for your current job or investing in a new career path, some educational deductions can maximize your tax savings and help ease the financial strain. The Lifetime Learning Credit and the American Opportunity Credit are two valuable options. These credits cover qualified education expenses, including tuition, fees, and course materials.

If you've made the smart choice to invest in energy-efficient upgrades for your home, such as solar panels, energy-efficient windows, or a new HVAC system, you could be eligible for valuable tax credits. These credits, including the Residential Renewable Energy Tax Credit and the Non-Business Energy Property Tax Credit, have the potential to provide significant savings. Not only will these upgrades benefit the environment, but they can also give your tax refund a welcome boost.

Start Filing with TurboTax Now

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit. Note that GreenPath Financial Wellness and First Alliance Credit Union do not provide legal or tax advice, this information is intended for general guidelines only. Please consult a tax professional.

Nothing is as scary as not being able to pay your rent. For many people, the space they’re renting is their home, and while having to move would be...

If you are dealing with credit card or other debt, you're not alone. The average American household carries about $6,600 in credit card debt.

Seeking housing assistance can be a complex, confusing process. Whether dealing with a job loss, reduced hours at work or other unanticipated...