First Alliance Credit Union Creating an Innovative Branch Design

In March 2019, First Alliance Credit Union announced their plans to build new full service branch off West Circle Drive NW in Rochester. Today, at...

4 min read

Chris Gottschalk

:

Jun 15, 2023 4:30:00 AM

Chris Gottschalk

:

Jun 15, 2023 4:30:00 AM

You probably won’t be surprised to learn that the First Alliance Credit Union of today is very different than when it was created 90 years ago. In fact, if you were to take one of First Alliance’s original members and put them in front of a current branch, they probably wouldn’t recognize it as the small organization they entrusted with their money.

However, that founding member would be able to tell that the core of the credit union they used, the commitment to its members and the southeaster Minnesota community hasn’t changed at all.

“For the last 90 years, our mission at First Alliance Credit Union has been to provide the highest quality products and services to our members,” Lisett Comai-Legrand, Director of Retail Member Experience, said. “We have a rich history, not just in Rochester, but in all the communities we serve.”

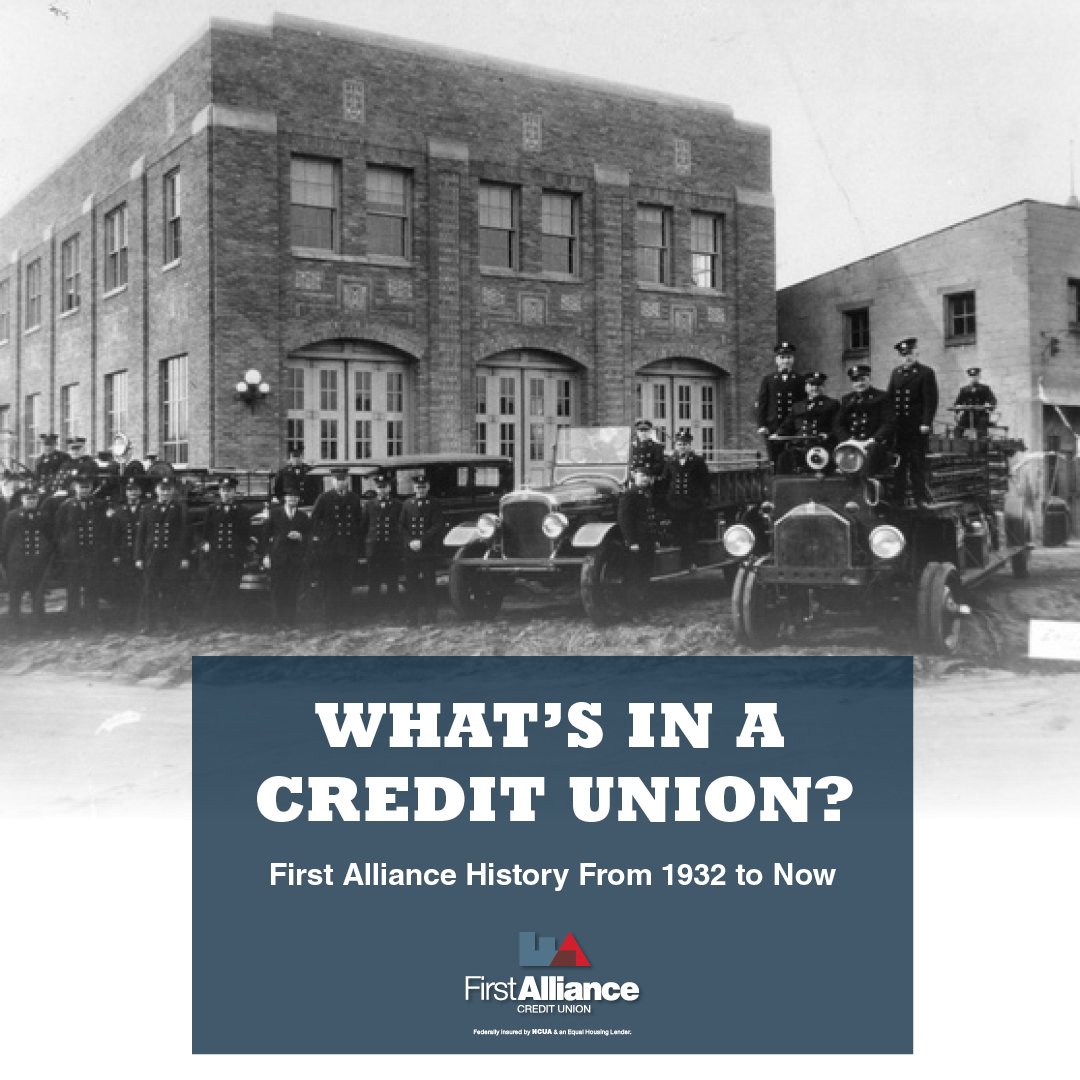

The credit union that would become First Alliance was created in 1932, during the depths of the Great Depression. In that year, seven firefighters joined forces with a new Rochester school teacher and formed the first credit union to exist in Rochester. Since it was an alliance of people employed by the city of Rochester, naturally they called it the Municipal Employees Credit Union, and it specifically served Rochester city employees.

Since most of the credit union founders were firefighters, the first Municipal Employees Credit Union “branch” was in the original firehouse in downtown Rochester. The firefighters and other volunteers served as the credit union’s staff until the early 1960s.

In 1986, the Municipal Employees Credit Union moved out of the downtown Rochester firehouse into its first separate branch in southeast Rochester in 1986. Members have come to know this branch as the 16th Street branch. It’s still a vital part of First Alliance Credit Union!

In 1986, the Municipal Employees Credit Union moved out of the downtown Rochester firehouse into its first separate branch in southeast Rochester in 1986. Members have come to know this branch as the 16th Street branch. It’s still a vital part of First Alliance Credit Union!

Municipal Employees wasn’t just growing in terms of space, though. It was also starting to serve a wider group of people beyond city employees, and the credit union’s name was no longer reflected its growing and diverse member base. It’s leaders again looked to the foundation of the credit union, and given that it was the first one in Rochester and was the result of an alliance of a group group of employee bases, it became First Alliance Credit Union in 1996.

The next year, First Alliance opened a second branch just off 37th Street in northeast Rochester. By 2004, the credit union had expanded its charter to provide services in five southeast Minnesota counties—Olmsted, Dodge, Winona, Wabasha and Goodhue—and in 2006, it built its third branch in Byron to support its growing membership.

In addition to building new branches, First Alliance Credit Union also merged with other, smaller credit unions in the southeastern Minnesota area to serve their members. The first merger took place in 2012, when First Alliance Credit Union merged with the Rochester Dairy Employees Credit Union. It served 500 members that worked for the local Kemps plant.

More recently, in 2021, First Alliance merged with the AE Goetze Credit Union, a small financial institution in Lake City MN, which provided a First Alliance branch in scenic Lake City.

“In both cases, we were able to use the merger to present members of the smaller credit unions with more products and services than were previously available,” Comai-Legrand noted. “In the AE Goetze merger, we were also able to open a First Alliance branch in Lake City, giving our members another physical location they could access.”

In 2016, First Alliance refreshed its brand, and updated almost every aspect of its look in the process. Among the changes were a new logo, new formalized brand colors and even updated the mission and vision statements for the credit union. What didn’t change, though, was the commitment to their members.

In fact, First Alliance doubled down on its member commitment by adopting the “all for one” motto and formalizing its story lending model into a program called “no judgement, just guidance.” This program teaches First Alliance loan advisors to explore why an applicant needs a loan and look at their entire financial picture instead of just their credit score. This doesn’t guarantee that everyone who applies for a loan will get one, but it does ensure that everyone gets a chance to have their story heard.

“We believe that helping the members in our communities means begin open-minded,” Andrea Allen, Director of Lending at First Alliance Credit Union, said. “By taking the time to hear someone’s story and where they wish to go in the future, we can provide meaningful solutions and help them reach their goals.”

In 2020, First Alliance opened another branch on Commerce Drive NW by Costco. This branch not only housed First Alliance Credit Union, but four other businesses as well—Moka, Great Harvest Bread Company, Bloom Acai Café and Near North Title Group. This gave the First Alliance branch a one-stop shop feel, where people could come in and not only do their banking, but also grab a bite to eat, get some coffee or just take a second to breathe before getting back to their day.

The Commerce Drive branch also featured another new paradigm for First Alliance—Advisor Supported Kiosks. This technology gave First Alliance members more control over their finances and also makes banking more convenient and efficient. However, member advisors were still readily available to help members with important financial moves like opening accounts or applying for loans.

As it turned out, the kiosks would play a bigger role than anyone suspected, thanks to the global COVID-19 pandemic. Throughout 2020 and 2021, First Alliance took advantage of the extended lobby closures due to the pandemic to remodeled its existing branches to feature Advisor Supported Kiosks. It was a chance for members at every branch to experience the advantages the Kiosks offered.

As it turned out, the kiosks would play a bigger role than anyone suspected, thanks to the global COVID-19 pandemic. Throughout 2020 and 2021, First Alliance took advantage of the extended lobby closures due to the pandemic to remodeled its existing branches to feature Advisor Supported Kiosks. It was a chance for members at every branch to experience the advantages the Kiosks offered.

During this time, First Alliance Credit Union also opened a new branch in Stewartville, which also serves as the credit union’s administrative space.

Today, First Alliance Credit Union continues to be committed to their mission, vision and above all making sure that “all for one” is at the center of their core values. When people support each other, everyone gets the chance to experience financial success.

If you’d like to be part of the First Alliance Credit Union story, become a member today. You only need five dollars to join, and once you’re a member, you’ll get access to all our fantastic products and services, from fantastic rates on savings accounts and loans to our robust online banking platform and mobile app.

In March 2019, First Alliance Credit Union announced their plans to build new full service branch off West Circle Drive NW in Rochester. Today, at...

First Alliance Credit Union announced Monday, March 11th, 2019 that they have purchased land in the fast growing area just off of West Circle Drive...

Rochester, MN — First Alliance Credit Union is thrilled to announce a major expansion of its field of membership, the credit union is now serving 14...