How to Use a HELOC for Second Home Purchases

For many young adults, the idea of buying a second home or investing in property is a good idea but might seem out of reach. However, a Home Equity...

8 min read

Jenna Taubel

:

Dec 4, 2025 5:29:59 AM

Jenna Taubel

:

Dec 4, 2025 5:29:59 AM

Property taxes across Minnesota are rising, and for many homeowners, the increases could be significant. According to reporting from the Star Tribune, cities and counties across the state are proposing large levy increases as they manage higher expenses, wage growth, inflation, and cost shifts from state and federal programs. In some communities, homeowners could see double-digit increases, adding hundreds of dollars to next year’s housing costs.

For households already navigating rising prices on groceries, insurance, and everyday expenses, these tax hikes can add real pressure to the monthly budget. But with some preparation, you can stay ahead financially and avoid unpleasant surprises.

This quick guide breaks down how MN property taxes are determined, how to appeal an increase, and what to do if you can’t pay your property taxes on time.

Think of property taxes as a fee you pay to support your local community. These taxes help fund things like:

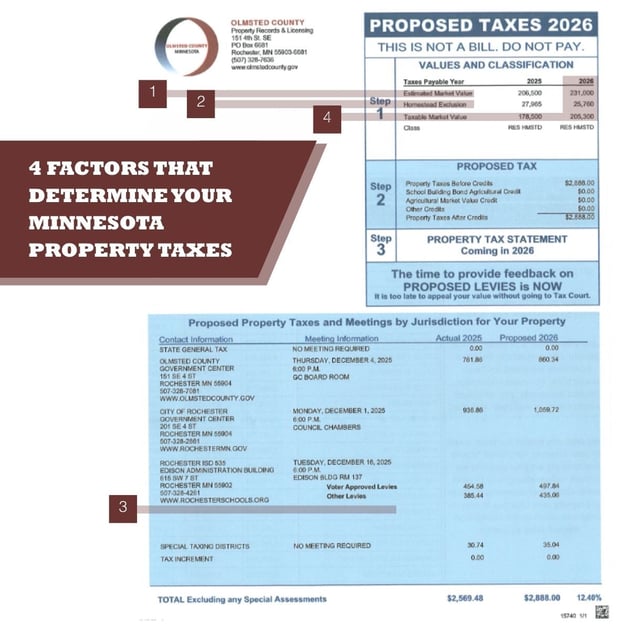

Every fall, you’ll receive a Truth-in-Taxation Notice from your county. This important document gives you a heads up about what your property tax bill could look like in the coming year.

It outlines your final estimated tax amount based on:

These notices are meant to keep you informed before any tax increases are officially set. Public hearings are then held in December, giving community members the chance to ask questions or share concerns before budgets are finalized and the tax rates are locked in for the year ahead. This timeline gives you the opportunity to plan ahead, ask questions, or participate in the decision-making process if you have feedback on your local government’s spending priorities.

How much you pay in property taxes depends on four main factors that come together to determine your final bill. These factors include both personal details, like your home’s value and how it’s classified, as well as broader community influences, such as local government budgets and how many properties there are to share the tax burden.

By understanding what affects your property tax amount, you can make more informed decisions, whether you’re budgeting for the year ahead, considering an appeal, or planning for a new home purchase.

Each year, your county assessor estimates what your home would sell for on the market. This number is called your Estimated Market Value, and it is used to calculate your property taxes. If home values rise in your area, your EMV may go up, and that can increase your property taxes, even if your home hasn’t had any improvement made to it. Many Minnesota communities are experiencing rising home values, which is shifting more of the tax burden onto homeowners.

For property taxes purposes, Minnesota puts homes into four different categories called classifications, such as:

First-time buyers almost always fall under the homestead classification, which typically comes with several key advantages. As an owner-occupied property, homestead status often means you’ll be taxed at a lower rate than non-homestead (rental or second home) properties.

In addition, Minnesota offers specific homestead credits and exclusions, which can help reduce your overall property tax bill, sometimes by hundreds of dollars each year.

Cities, counties, and school districts each set a yearly budget, known as a tax levy. This levy determines how much money they need to collect through property taxes to fund services.

Right now, many Minnesota communities are increasing their levies. For example:

Tax levies play a significant role in driving up property taxes each year. These increases are then divided among all property owners, directly impacting how much you owe.

As government budgets grow to cover things like infrastructure improvements, rising labor costs, or added community programs, the amount collected through property taxes can climb sharply. In years when levies are raised more than usual, homeowners often see some of the steepest property tax increases, even if their personal property value hasn’t changed much.

The tax base is the total value of all taxable property in an area, this includes homes, businesses, and other real estate. When new homes or businesses aren’t being built, or if property values for commercial spaces decline, there are fewer properties contributing to the overall tax pot. As a result, the responsibility for funding local services shifts, and existing homeowners may find themselves shouldering a larger portion of those costs.

This means your property tax share can go up, even if your own home’s value hasn’t changed much, simply because the overall pool of contributors has gotten smaller or less valuable.

Your final property tax bill is made up of taxes collected by several different districts that overlap where you live, such as:

This is why two homes with the same value in different neighborhoods can have very different tax bills. If one neighborhood falls under districts with higher levies or limited tax bases, homeowners there will end up paying more than those in an area with lower budgets or a broader pool of taxable properties.

So, even when two properties are worth the same amount, the specific mix of districts, local budgets, and available tax base can lead to significant differences in what each homeowner pays.

If you notice that the value or property details listed on your valuation or tax notice don’t seem accurate, you’re not stuck, you have the right to question and challenge what’s there. Don’t feel intimidated; this is a normal part of the process, and many homeowners go through it each year to make sure they’re being taxed fairly.

While the process may seem daunting, it’s a straightforward, step-by-step approach that many Minnesota homeowners follow each year. Here’s a practical overview of how to initiate and navigate an appeal:

When you get your notice, be sure to review the following:

Carefully checking these details ensures you’re being taxed fairly and gives you time to act if you find a mistake.

Look at homes in your neighborhood with similar size, age, and condition. Pay attention to recent sales of properties that match yours as closely as possible, this is often called looking at “comparable sales” or “comps.”

If you find that your home’s estimated market value is significantly higher than other comparable homes in the area, that could indicate a mistake in your assessment. Make note of any differences, such as updates or renovations, that might account for variations in value. Documenting these details will help you build a solid case if you need to challenge your valuation.

Start with an informal conversation. Reach out to your county assessor’s office, this is often just a phone call or email to talk with a real person about your questions or concerns.

Assessments aren’t set in stone, assessors are usually open to reviewing it, if you have solid evidence, like:

Many times, they can walk you through their reasoning or correct mistakes right away, saving you extra steps. Remember, the goal is simply to make sure your assessment is accurate and fair.

These appeal meetings are called Local Board of Appeal and Equalization or County Board of Appeal and Equalization. At these sessions, you’ll have the opportunity to present any documents, data, or other evidence you’ve gathered and clearly explain why you think your home’s estimated market value or property classification is inaccurate.

Both boards are specifically there to listen to homeowners' concerns, review the evidence, and make adjustments if warranted, helping ensure assessments remain fair and up-to-date. Remember to bring all supporting materials with you and be prepared to walk through your case in a straightforward, factual manner.

Most first-time buyers won’t ever need to file a tax court appeal, as earlier steps in the process typically resolve any issues. However, it’s reassuring to know this option is available if you feel your concerns haven’t been addressed through other channels.

If all previous steps fail to result in a fair outcome, you can formally file a petition with the Minnesota Tax Court. This is a more involved process that may require additional documentation and possibly professional legal or tax assistance, but it exists as a final resource to help ensure your property is assessed accurately and you’re only paying your fair share.

Life happens, especially when you’re adjusting to the costs of first-time homeownership. If you’re worried about paying your tax bill, know that you’re not alone and there are steps you can take to protect your investment and your peace of mind.

The important thing is to act early and connect with available resources and solutions, rather than waiting until the situation becomes overwhelming. There are two main options to help you manage these costs and keep your financial plan on track.

Some counties offer short-term payment plans for property taxes, but you typically need to reach out as soon as possible to explore this option. By contacting your county early, you may be able to set up a payment arrangement that divides your tax bill into smaller, more manageable installments, helping you avoid late fees and additional penalties. Availability and terms can vary, so acting quickly increases your chance of qualifying for assistance before any missed tax payments affect your account.

If your property tax bill increased more than your current budget can handle, using the right financial tool can make a big difference in managing your property tax obligations, helping you stay organized and avoid costly penalties, especially in your first year of homeownership.

While borrowing money to pay for property taxes isn't ideal for ever situation, there are two valuable options to consider as a new homeowner:

With flexible terms, competitive rates, and a simple application process, a personal loan can offer peace of mind when paying for property taxes, because:

The ability to finance larger home improvement projects or cover seasonal expenses, with the security and convenience of borrowing against the value you’ve built in your home, makes a Home Equity Line of Credit (HELOC) a smart option for helping to cover property taxes. Other benefits include:

One important thing to keep in mind when using a HELOC to cover property taxes is that you need to have enough equity built up in your home to borrow against. For many new homeowners, especially in the first few years, there might not be sufficient equity available unless a larger down payment was made when the home was purchased.

Property taxes can feel confusing at first, especially with many Minnesota communities proposing their largest levy increases in years. But with the right information and a plan, you can stay ahead, protect your budget, and build long-term financial confidence.

And you don’t have to figure it out alone. First Alliance Credit Union is here to help you every step of the way, whether you need:

Our Member Advisors are committed to helping first-time homeowners feel supported, informed, and confident as they build their financial future.

For many young adults, the idea of buying a second home or investing in property is a good idea but might seem out of reach. However, a Home Equity...

Navigating the adulting world can be a financial maze, especially when it comes to housing. It's like trying to win a video game where the odds are...

Even if you didn’t owe money this past tax season it’s more important than ever to plan for next tax season now. The idea of tax planning isn’t...