Why First Alliance Members will Love the My Cards Upgrade

If you’re a First Alliance Credit Union member, you might be aware of the My Cards feature. You might also know how it will let you know about all...

3 min read

Chris Gottschalk

:

Mar 8, 2022 4:45:00 AM

Chris Gottschalk

:

Mar 8, 2022 4:45:00 AM

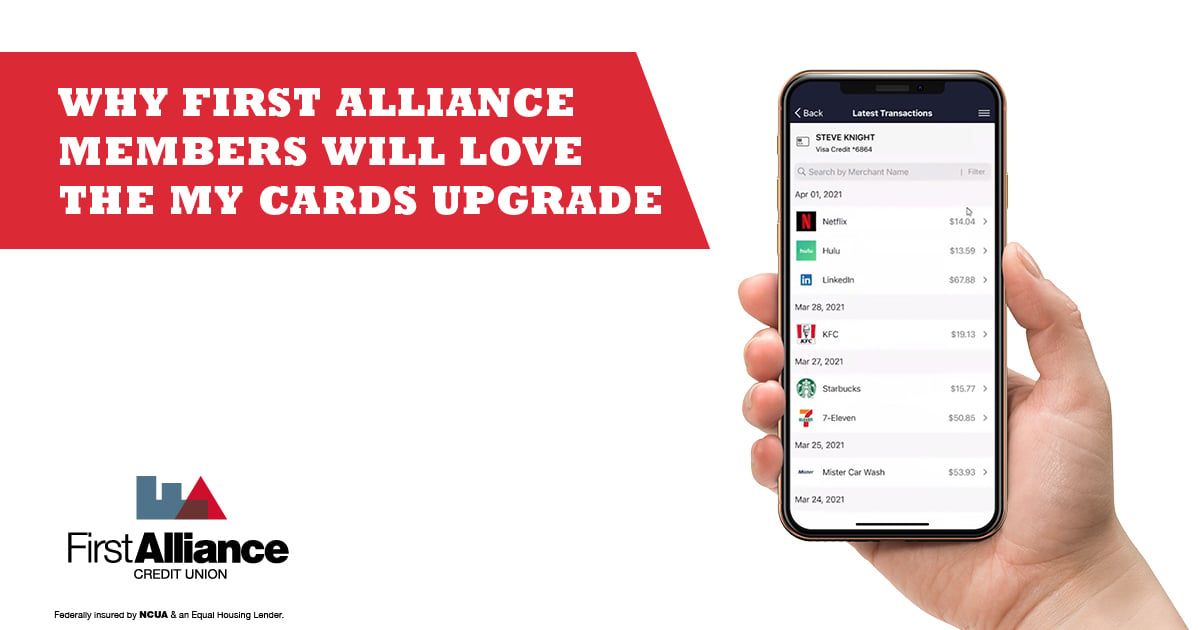

If you’ve ever used our mobile app, you might be aware of the My Cards feature that lets you control when, where or even if your debit and credit cards can be used.

This feature has the obvious advantage of alerting you if your debit or credit cards are used without your permission, not to mention letting you shut down a card that has been compromised almost immediately. However, there are also ways you can use the My Cards feature to give you some benefits you might not have considered.

My Cards lets you put a spending limit on a debit or credit card. While this has the obvious benefit of limiting the damage anyone who steals your card’s information can do, it can also be a powerful tool to stop you from overspending.

For instance, let’s say that you tend to overspend when shopping for clothes. You’ve budgeted $100 a month for clothes-related purchases, but you know that the next time you walk into Macy’s, you’re going to be tempted to spend at least twice that. All that you need to do to prevent yourself from overspending is set a limit of $100 on your card of choice before going into Macy’s, and you literally will not be able to spend more than you were planning.

For instance, let’s say that you tend to overspend when shopping for clothes. You’ve budgeted $100 a month for clothes-related purchases, but you know that the next time you walk into Macy’s, you’re going to be tempted to spend at least twice that. All that you need to do to prevent yourself from overspending is set a limit of $100 on your card of choice before going into Macy’s, and you literally will not be able to spend more than you were planning.

Even if you’re tempted to spend more, say because there’s a really good sale going on for some items you’ve wanted for awhile and you want to disable the spending limit or hit up one of our Advisor Supported Kiosks for some cash, you’ll have to consciously think about whether you’re really okay with spending more than you budgeted. This means you’ll either decide not to overspend, or that you’ll decide you’re okay with spending less in another budget category, like eating out, to balance your purchase. Either way, you’ll still keep control of your finances.

Parents face a lot of challenges when teaching their children about finances in the 21st century. One of the biggest challenges is how to teach their children to set limits on their spending in an age where most transactions involve putting a card in a reader rather than handing over actual cash. This can be especially be a problem when entrusting teenagers with their first debit or credit card.

One of the best solutions for this is to set a limit on your child’s debit or credit card and let them know that they only have that much to spend per transaction. This will make them aware that there are limits on their spending. Of course, they will be able to get around that limitation by making multiple purchases, but they’ll have to consciously think about doing it and decide whether they’re making the right choice.

There’s no denying that debit and credit cards make going on vacation more convenient, but many people are aware that identity thieves tend to look at vacationers as prime targets. This can lead to a lot of worrying about whether you’re doing everything you can to keep your information safe while on vacation.

If you use My Cards, though, you can set limits on where you can use your cards. You can make sure that no one can use your card outside of a defined geographical area or even at particular types of stores. Once you’re back from vacation, you can even make sure your card can’t be used outside the town you call home.

If you use My Cards, though, you can set limits on where you can use your cards. You can make sure that no one can use your card outside of a defined geographical area or even at particular types of stores. Once you’re back from vacation, you can even make sure your card can’t be used outside the town you call home.

All of this takes a few minutes to set up, but the end result is that you can go on your vacation without having to consider whether an identity thief is getting hold of your information. It’s one less thing you have to worry about, and that means you can enjoy your vacation that much more.

The My Cards feature of the First Alliance Credit Union mobile app is a very useful tool that puts limits on who can use your card where and for how much. However, it can also provide other benefits.

If you’d like to take advantage of My Cards, all you have to do is become a member of First Alliance Credit Union and download our mobile app. From there, you’ll not only be able to use the My Cards feature, you’ll also be able to transfer money between your accounts, schedule bill payments and even check your credit score.

If you’re a First Alliance Credit Union member, you might be aware of the My Cards feature. You might also know how it will let you know about all...

Buying a used car can be a smart way to get reliable transportation. If you’re a recent graduate in your second year at your job, you're likely...

You’re probably aware that many financial institutions have moved towards the model of self-help. Credit union online banking is no exception. When...