First Alliance Credit Union Closes Lobbies Due to COVID-19

Everything we do is done with the very best of intentions and in the interest of our members and employees. The coronavirus pandemic has affected...

2 min read

![]() First Alliance Credit Union

:

Jul 22, 2019 6:46:00 AM

First Alliance Credit Union

:

Jul 22, 2019 6:46:00 AM

Our Online Banking system comes with lots of excellent features! To ensure you know how to use these features and feel comfortable navigating the system we have put together a series of blog posts to highlight these features and offer a few tips.

A large part of your finances involves moving your money around between your accounts and paying other people. This article will share with you the best ways to transfer funds and make payments in the upgraded Online Banking system!

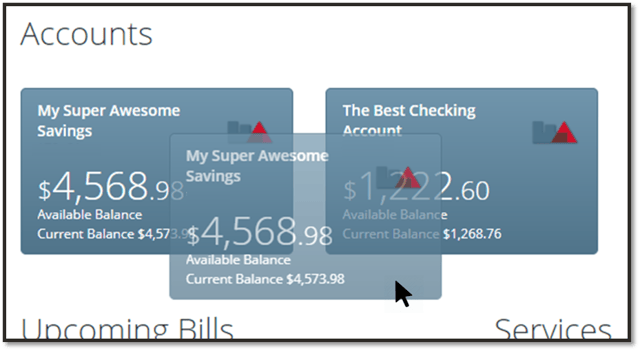

When you first logged into Online Banking after the upgrade, the Accounts screen displays in “Tile View”, where each of your accounts shows in separate tiles rather than in a list. When you are in Tile View you can initiate a funds transfer between your accounts by dragging and dropping the “from” account on to the “to” account. One word: AWESOME!

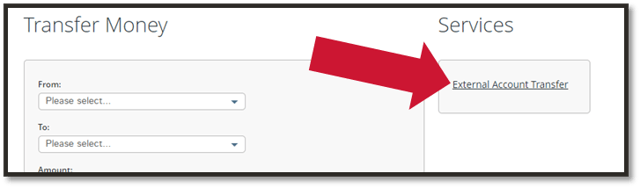

It’s no secret; we know you have accounts at other financial institutions. So to make it easier for you to manage your finances between First Alliance and your other financial institutions there is now a feature called External Account Transfer. This option can be found under the “Transfers” tab, the External Transfer link is on the right side of the screen. The first time you use this feature you will be required to verify your email address. Make sure you carefully enter the information of your other financial institution. You can set up one-time or recurring transfers to your other financial institutions.

External Transfer is a free service! However, it’s important to note that you can only make external transfers to accounts where you are the owner, for example you will not be able to transfer to your mother’s account at another financial institution. Your name has to be on the account. If you are looking for a way to pay other people keep reading!

Online bill pay is free to enroll in, this feature allows you the option to pay your bills and even friends or family members. No check writing involved!

While Bill Pay is not a new feature to Online Banking, there is a new way to view and access your upcoming bills besides through the “Pay Bills” tab at the top of the screen. On the bottom of the Accounts screen, any eBills you have set up will show up here when you have unpaid bills. You can pay those bills from the Accounts screen by clicking “Pay Now” or click “Pay Any Bill” to access all of your billers. Bonus: You can now add billers within the Mobile Banking App either manually or with Bill Capture!

If you have ever split an expense with a friend then the “Pay People” feature (a.k.a. Zelle) is one you will want to check out! Zelle eliminates the hassles of checks and cash by allowing you to send and receive money through emailing and texting. Plus, the person you are paying through Zelle does not need to be a First Alliance member. Here are a few examples of when Zelle could be used to make paying friends and family easier, instead of sending cash or check:

These options for transferring funds and making payments are just some of the cutting-edge online banking features you get when you become a member at First Alliance Credit Union. If you’re a member, download our mobile app or go into our online banking account and check out all the online banking options at your disposal.

Everything we do is done with the very best of intentions and in the interest of our members and employees. The coronavirus pandemic has affected...

In the past, we’ve discussed why and how you should switch financial institutions when you move to a different city or a different state, and with...

Peer-to-peer payments are quickly becoming the new normal. People are using them to do everything from sending birthday money to paying your buddy...