Do You Need GAP Insurance?

The first time most people hear the term “GAP insurance” is when an auto dealer is asking them if they want to purchase it for their car, along with...

5 min read

Chris Gottschalk

:

Oct 5, 2023 4:45:00 AM

Chris Gottschalk

:

Oct 5, 2023 4:45:00 AM

Let’s face it, applying for an auto loan can be a nerve-wracking experience. You’re letting a complete stranger review your finances, and decide whether you can get the cash you need for purchasing a new car. Even if you are approved, you’ll be putting yourself in debt and having to pay it off for years to come.

It’s probably impossible to completely get rid of those butterflies that start fluttering in your stomach when you meet with an auto lending advisor to discuss financing. However, you can boost your confidence a lot when you know what to do when applying for an auto loan—and what NOT to do.

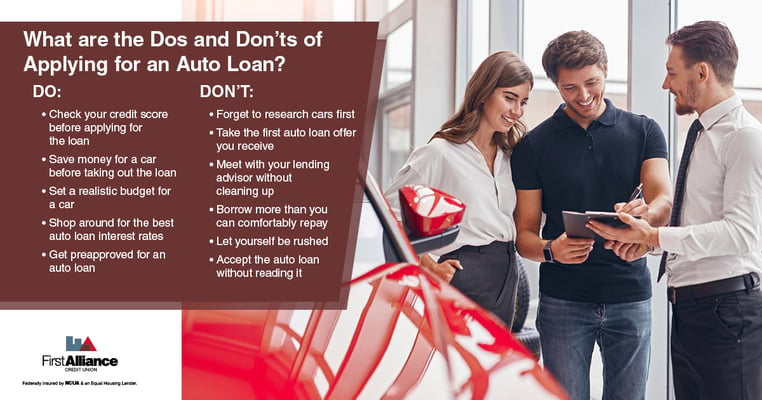

Most banks consider your credit score to be the first, best and often only factor in whether they should give you an auto loan. While credit unions like First Alliance will look at the whole of your personal finances, the fact is that a higher credit score is a huge advantage when applying for an auto loan. It improves your chances of getting your loan application approved and can even prevent you from paying higher rates of interest.

A lot of places will let you check your credit score for free. First Alliance Credit Union, for instance, offers it as a perk to members. If you want to be thorough, though, get your credit score from big three credit reporting bureaus of Equifax, Experian and TransUnion and make sure that your credit score is roughly the same with each bureau.

If you don't have a good credit score, you might want to take some steps to raise it. For instance, you can:

Even though you'll be using an auto loan in order to buy a car, you should still set aside as much money as you can beforehand. The more cash you can use for a down payment, the less you’ll have to borrow. This means you’ll have lower monthly payments and pay less in interest overall.

Before applying for a loan or even looking for a car, figure out what you can comfortably afford to pay each month. This will be substantially easier if you have a spending plan with all your monthly expenses mapped out. However, you can also use an auto loan payment calculator, like the one First Alliance Credit Union offers, to figure out what your monthly payments will be.

Different banks and credit unions offer different interest rates, so don’t accept the first loan offer you receive. Instead, talk with various lenders and try to get the best interest rate possible. Remember, the lower interest rate you get, the less money you’ll pay over the life of the loan.

Nothing can derail an auto loan application like realizing you're lacking an important piece of information you need to continue. Gather all the information you need to complete the auto loan application, and the process will be a lot smoother.

When applying for an auto loan, you will need to provide personal information such as your name, address, social security number and employment details. You'll also need to provide information about the car you intend to purchase, including its make, model and VIN number.

When you get pre approved for an auto loan, you get a huge advantage when you go shopping for a car. Preapproval gives you a much better idea of how much car you can afford, and it also helps keep you from spending more than you intended. Even better, you’ll strengthen your negotiation position, since any car salesman that sees the pre approved auto loan will know you have a definite limit on how much you can borrow.

The more you know about the type of car you want to buy, the better off you’ll be. You can start by researching the typical value of the car you’d like to buy using a site like Kelly Blue Book or Edmunds. From there, you can search for other vehicle information, including seating, gas mileage and add-ons.

If you're planning to buy a used car, you'll want to do even more research. Look for reviews of the car, especially ones that focus on reliability. You might even look for information about what parts of the car are prone to giving out first. Finally, research similar types of cars, so you can select a fitting substitution if your first choice isn't available.

You might be excited the first time a lender lets you know you’ve been approved for a loan, but don’t accept their offer just yet. Wait until you hear from other lenders, and select the best loan offer from all the ones you receive.

Since the lending advisor will be looking over your finances, you'll want to make sure they're as neat as possible. Make sure your budget is current and that you don't have any outstanding bills. If you can manage to pay off your debts, even better.

Almost every car buyer has faced the temptation of spending just a bit more to get a better model or option. The problem is that this can quickly spiral out of control and leave you with a car you can barely make loan payments on each month. Set a firm limit on what you’re willing to pay, and if a car costs more than that, either look for a new car or try to negotiate with the dealer.

Take your time when making decisions about your auto loan. Rushing into a deal without careful consideration can lead to costly mistakes. Be patient and deliberate throughout the process to help get the best auto loan and the best auto price.

Always read and understand the fine print of your loan agreement. Look out for hidden fees, penalties, or clauses that may not be in your favor. Clarify any doubts with the lender before signing.

When you’re applying for an auto loan, there are steps you can take that will make getting an auto loan easier, like reviewing your credit history and going through the preapproval process to get the best deal possible. However, there are also some things that will make the process more difficult, like not getting offers from different lenders and being rushed into a car loan.

One step you should definitely take is to get an auto loan through First Alliance Credit Union. Our lending advisors won't just guide you through the application process, they'll also look over your finances as a whole with you and make sure the the auto loan you're considering is the best solution for you.

Were you surprised by any of the dos or don’ts in this article? Let us know on Facebook!

The first time most people hear the term “GAP insurance” is when an auto dealer is asking them if they want to purchase it for their car, along with...

When the time comes to start looking for a new or used vehicle, you will also likely be looking for a auto loan, and if you're getting a vehicle loan...

We see and hear all over, "Bad Credit Loans", "Credit Repair Loans", "Bad Credit, No Problem Loans", and the list goes on and on. If you know you...