How to Form an LLC in Minnesota in 4 Steps

If you’re starting up a small business, you may have heard of the benefits of forming a Limited Liability Company, also known as an LLC. You may know...

3 min read

![]() First Alliance Credit Union

:

Jan 16, 2024 5:00:00 AM

First Alliance Credit Union

:

Jan 16, 2024 5:00:00 AM

If you’re a business owner, you should know that starting January 1, 2024, you may be required to file a new report with the U.S. Department of Treasury’s Financial Crimes Enforcement Network, also known as FinCEN. The new report is called a Beneficial Ownership Information (BOI) report, and it provides FinCEN information about the owners of your business.

Congress created the beneficial ownership requirements as part of the Corporate Transparency Act. They enacted this law to prevent money laundering, financing terrorism and tax fraud. In this act, Congress states that one way people hide their involvement in these crimes is by concealing their ownership in corporations, LLCs or similar entities in the United States.

As a result, Congress has decided that businesses will be required to disclose all of their beneficial owners. FinCEN will share this information with the appropriate government agencies, financial institutions (like First Alliance) and financial regulations. This information will help the Federal Government uncover entities created for illicit purposes.

Most financial institutions already require this information for your business to do things such as opening a new business account or applying for a business loan.

A beneficial owner is someone who owns or controls at least 25% of the company’s ownership interests.

According to the FinCEN website, every LLC, corporation or other entity created by the filing of a document with a Secretary of State or a similar office under the law of state or Indian tribe is required to file a Beneficial Ownership Information report unless it qualifies for an exemption. This requirement mostly applies to companies created in the United States. However, some entities created in foreign states and registered to do business in this country must also file a BOI report.

Any company created on or after January 1, 2024, must also report the company applicants as well as the beneficiary owners. A company applicant is the person who directly files the document that creates, or first registers, the reporting company, and the person who is primarily responsible for directly or controlling the filing of said document if more than one person was involved in filing it.

According to FinCEN, 23 types of entities are exempt from the new requirements concerning beneficial ownership reporting. Most of these exemptions are due to the fact that the entities in question already must report similar information to the federal government due to other regulations.

Large operating companies are also exempt from the BOI requirement. In order to meet the criteria for a large operating company, a business must:

Inactive entities are also exempt from the BOI requirement.

A BOI report will require the following information for every beneficial owner:

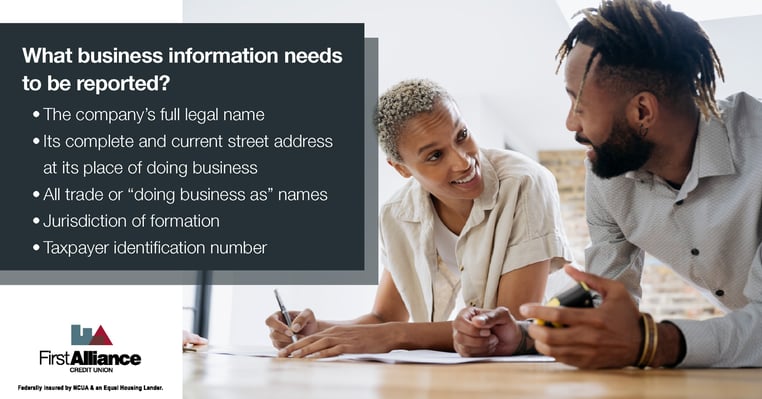

The report will also require information about the company, including:

You can file a Beneficial Ownership Information report electronically on the FinCEN website.

If a company was created before January 1, 2024 and is not exempt, it must file an initial Beneficial Ownership Information report by January 1, 2025. However, a company that was created on or after January 1, 2024 and before January 1, 2025 must file a report within 90 calendar days of the date on which it was notified that its creation was effective.

If you’re starting up a small business, you may have heard of the benefits of forming a Limited Liability Company, also known as an LLC. You may know...

Your credit report is an important part of your financial health. However, for it to be a reliable source of information to creditors it needs to be...

Juan had been working hard all year, saving up for his dream car—a cool Honda Accord. After diligently setting aside money each month, he finally had...