Debt Consolidation vs Bankruptcy: Which is the better option?

It is extremely stressful when you’re struggling to afford your payments every month. It’s natural to want to wipe the slate clean and start fresh....

1 min read

![]() First Alliance Credit Union

:

Oct 17, 2017 8:43:00 AM

First Alliance Credit Union

:

Oct 17, 2017 8:43:00 AM

Sometimes bankruptcy is unavoidable and really the best option. Divorce, job loss, and major health issues often contribute to the decision to file for bankruptcy.

However, you might start worrying about what happens to your finances after you've filed for bankruptcy, especially your credit score. Will you ever be able to apply for a credit card or a loan again? Will you even be able to open up a checking account?

Unfortunately, the answer to "Will bankruptcy hurt my credit?" is "Yes." However, you can rebuild your credit after bankruptcy it just takes patience, time and commitment.

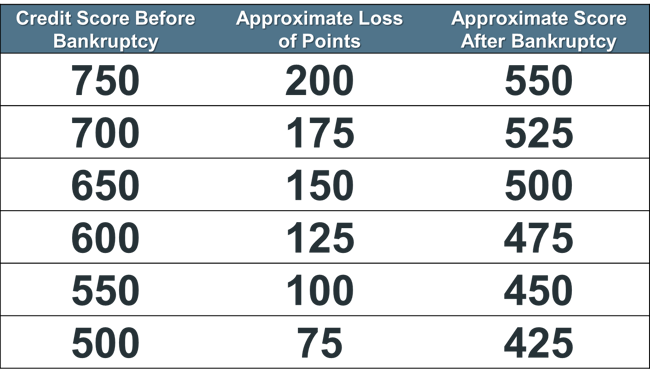

When you file for bankruptcy your credit score is likely to drop between 75 to 200 points, depending upon where your credit score was at to begin with. The new credit score will be based on how many points have been lost, the higher the score, the more points will be lost. For example if your credit score was close to 750 your new score would be close to 550, where as someone with a credit score starting closer to 550 would end up with a score around 450 after filing for bankruptcy. The chart below shows the approximate losses you can expect to see on your credit score you have at the time you file for bankruptcy.

To rebuild your credit score after a bankruptcy it will take some time. A bankruptcy stays on your credit report for ten years. If your bankruptcy just happened, maximum points to your credit score will be lost, as the chart above shows, but overtime the impact of the bankruptcy on your credit score will be less and less. Below are a few things you can do to begin to rebuild your credit after a bankruptcy:

Most importantly, have an honest conversation with your financial institution. Tell them your story, be honest and forthright about what lead you to bankruptcy. While you may not think it will help, they may have solutions to help get you back on track again. You can rebuild credit after bankruptcy, but it takes time and commitment.

It is extremely stressful when you’re struggling to afford your payments every month. It’s natural to want to wipe the slate clean and start fresh....

If you are struggling to pay your bills, it may be a good idea to look into bankruptcy. Generally speaking, this is the best option for someone who...

In the past, we’ve talked extensively about good money moves—steps you should take that put you on the path to financial success. We’ve covered...