How Much of Your Credit Card Should You Use?

Managing a credit card can feel like walking a tightrope. On one side, there’s the convenience of using credit to handle purchases, while on the...

3 min read

![]() First Alliance Credit Union

:

Oct 5, 2017 7:33:00 AM

First Alliance Credit Union

:

Oct 5, 2017 7:33:00 AM

There are many factors to take into account when looking at your credit score, which can make knowing exactly how to mange it a bit confusing sometimes. Here we have pulled together five key credit management tips to help you manage your score:

Loan repayment history is one of the most important components in your credit score. Lenders always check to see whether your credit payments have been made on time. One or two late payments may or may not be reflected in your score.

To maintain a solid repayment history:

Amounts owed are not necessarily a bad thing. The key is to be aware of how much is owed on revolving credit accounts such as credit cards. If you are too close to the limit on one or more of your credit cards, are you are close to "maxing out" your credit card limits, which may be an indicator that you have overextended yourself. However, low credit utilization is likely to have a positive impact on your credit score. For example, if you have a $5,000 credit card limit, and your balance is $500.00, you are using very little of your available limit.

Here are some ways to manage your amounts owed:

Keep balances low on credit cards and other revolving debt.

Pay off debt. Don't move it around. It may seem like a good idea o transfer balances from cards with a higher interest rate to a 0% interest credit card, and continue to hop from card to card, until the balance is paid off. It is actually smarter to keep your current card and pay more than the minimum payment, to pay down the balance. That way, you are also not adding too many credit card accounts too quickly, which can negatively impact your score.

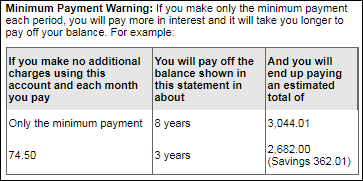

You have probably seen this image before on your credit card statement. This box is designed to let you know approximately how long it will take to pay off a balance when making only the minimum payment, or paying more. In this instance, the minimum payment is $70.00:

Length of credit history is another factor in calculating your credit score. A strong history of credit accounts paints a picture of how you have managed credit over the years, and indicates to lenders your loan repayment history. For instance, if you've had vehicle loans in the past, and each has been paid off, or you've had a credit card for a number of years, and use it occasionally or often, this begins to build credit history.

New credit accounts also have an impact on your credit score. This includes how many new accounts you have by account type, as well as how many of your total accounts are new accounts.

For instance, it can be really easy to apply for store credit cards, especially when you are offered discounts off your purchases. However, obtaining too many store cards, or any type of credit card to quickly, can negatively impact your score. This is especially true if you obtaining credit for the first time. You want to make sure that you are letting your credit age, so that you're building and maintaining a history.

Truth be told, if you have one to two credit cards, those cards are probably enough to help you cover major expenses, rent a car, cover emergency expenses and other purchases. Especially if you choose a rewards card, or similar type card that earns you perks for points for using the card.

Credit mix considers your combination of credit cards, installment loans (like personal loans and vehicle loans), finance company accounts and mortgages. You don't need to have each type of loan, but you also do not need to open credit accounts if you don't need them. Having credit cards and installment loans with good credit history will help to raise your score.

Your credit score plays a major role in your financial health, affecting everything from loan approvals to interest rates. But managing it doesn’t have to be complicated. Here’s what you need to know:

Pay on Time, Every Time – Late payments can hurt your score. Set up automatic payments or reminders to stay on track.

Keep Balances Low – Using too much of your available credit can signal financial trouble. Aim for a low credit utilization ratio.

Let Your Credit Age – The longer your accounts stay open and in good standing, the better your score. Avoid closing old accounts unnecessarily.

Be Cautious with New Credit – Opening too many new accounts at once can lower your score. Give your credit time to mature.

Maintain a Healthy Mix – A combination of credit cards, loans, and other accounts shows lenders you can handle different types of credit.

Managing your credit wisely can open doors to better financial opportunities. First Alliance Credit Union is here to help. Our experts will listen to your story, give you real advice, and help you achieve a higher credit score.

Managing a credit card can feel like walking a tightrope. On one side, there’s the convenience of using credit to handle purchases, while on the...

People often ask us, "How do I get a credit score?" If you do not have a credit score, building one is fairly easy. Here's the basics to building a...

Credit reports are an important determinant of a financial future, since the financial credibility of a person is often determined by their credit...