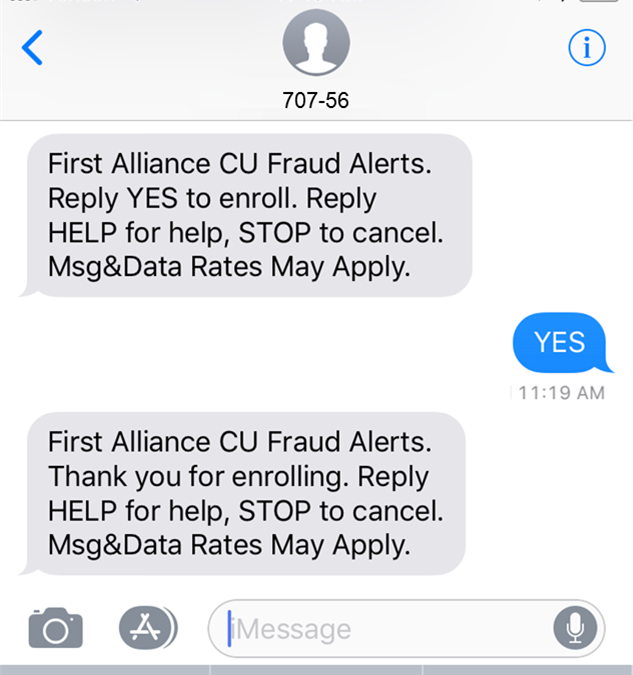

First Alliance Debit Card Fraud Notification Text Message Alerts

At First Alliance Credit Union we are committed to keeping your financial information secure. Which is why we are pleased to announce that the credit...

2 min read

Jenna Taubel

:

Jan 9, 2020 5:35:00 AM

Jenna Taubel

:

Jan 9, 2020 5:35:00 AM

You may have heard before that credit unions are “not-for-profit” business entities. That is not to be confused with a “nonprofit.” There are differences between the two types of organizations and it’s important to understand them.

Too often people hear “not-for-profit” and assume it’s interchangeable with “nonprofit.” This is not the case, especially for credit unions. These two entities do have a key similarity, though: they do not give profits to stockholders. What each entity is able to do with any funds received above operational costs (a.k.a. profits) are where the key differences between not-for-profit and nonprofit come into play.

A not-for-profit organization often operates like a typical business; however their primary goal is not to make a profit. Typically the primary goal of a not-for-profit institution is to provide services for a specific purpose or to benefit a group of people (i.e. financial services for credit union members).

The services provided can and usually do have costs associated with them. In the case of a credit union, for example, one cost would be the interest rates you pay on loans.

When revenue is made by a not-for-profit entity that income is reinvested back into the organization instead of paid back to stockholders. Again in the example of credit unions, the profits are reinvested back into the financial institution in order to keep deposit rates higher, lending rates lower and impose fewer fees than compared to those at a bank, which is for-profit.

While nonprofit entities are similar to not-for-profit entities in that neither exists to make a profit, a nonprofit organization operates with the goal of performing charitable works. This means any income made by the nonprofit organization must be used to further their charitable mission in some way.

Nonprofits typically rely solely on donations to fund their mission work, though some nonprofits do receive grants or government support as well. There are some nonprofits that are better at utilizing their funds than others, so it’s important to do your research before making a donation to a nonprofit.

Prime examples of nonprofits are food banks and animal rescue organizations. They exist only to serve a specific charitable purpose, feed people or house animals. All of the funding these charities receive goes directly to further the mission of the organization.

While it is understandable why many people conflate the terms nonprofit and not-for-profit, it is important to understand the difference between them, especially when it comes to credit unions. Credit unions are not-for-profit financial institutions. Banks are for-profit financial institutions.

Additionally, credit unions are not a nonprofit charity organization. They do not rely on donations to operate, nor do they only provide services to those struggling financially. Credit unions are full service, modern financial institutions that simply do not pay profits back to stockholders; all profits are reinvested back into the organization in order to directly benefit its member's wallets.

At First Alliance Credit Union we are committed to keeping your financial information secure. Which is why we are pleased to announce that the credit...

Paying at checkout has gotten faster and easier thanks to tap-to-pay technology. If you’ve noticed people quickly tapping their card on a payment...

The penny was first authorized in 1792, but as of November 12th, 2025 the United States has officially minted its final penny.