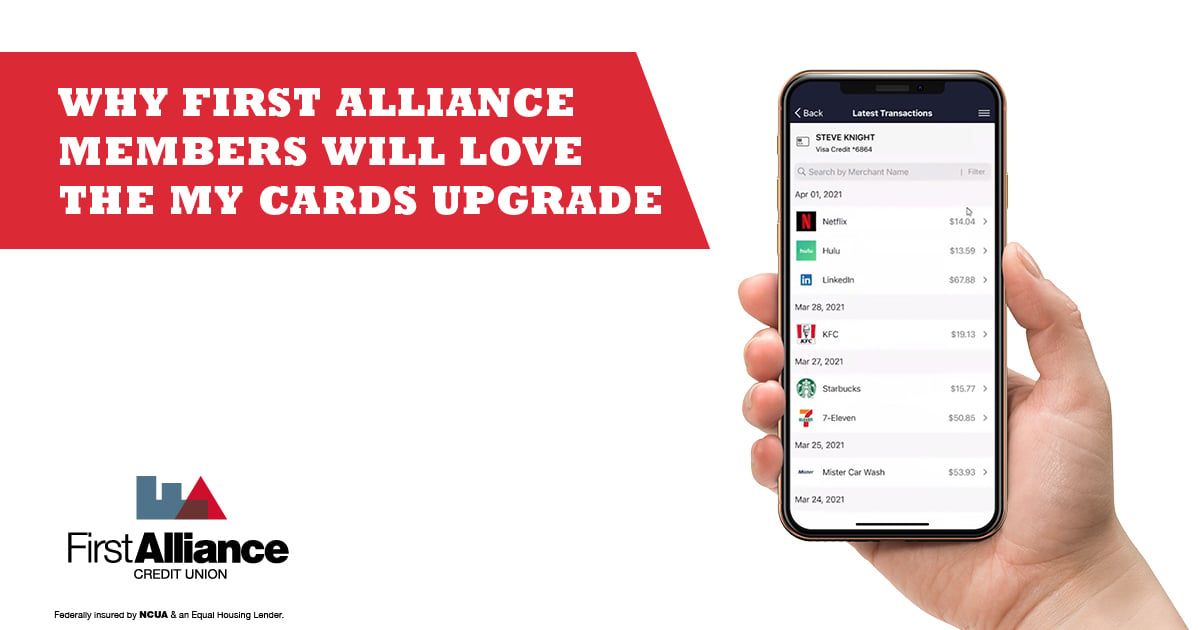

Why First Alliance Members will Love the My Cards Upgrade

If you’re a First Alliance Credit Union member, you might be aware of the My Cards feature. You might also know how it will let you know about all...

4 min read

Kamel LoveJoy

:

Aug 28, 2025 5:00:00 AM

Kamel LoveJoy

:

Aug 28, 2025 5:00:00 AM

Pay yourself first means you move money into savings the moment your paycheck arrives. It treats your future like a bill that must be paid on time. This flips the usual order of spend first and save later, which rarely works.

Meet Mia, a part-time barista who wants a small emergency fund. She sets an automatic transfer for ten dollars every payday into her savings at First Alliance Credit Union. She also turns on Round Up Savings so purchases round to the next dollar and the spare change lands in her savings. Three months in, Mia sees real progress and feels calmer about surprise expenses.

Most people try to save what is left after bills and shopping. Usually nothing is left. Paying yourself first locks in savings before anything else, so you build a cushion a little at a time.

This habit also helps when prices rise. That is how inflation affects people in everyday life, small increases that add up. You cannot control prices, but you can control your deposits and give your money time to grow.

Pick a number you can keep every payday. Five dollars is fine. Twenty dollars is great. The amount matters less than the consistency, because consistency builds confidence.

Set up an automatic transfer in online banking so your savings move the same day your direct deposit hits. Turn on Round Up Savings to add painless boosts from your everyday spending. Use the First Alliance Credit Union Budget Calculator to test a few amounts and find a number that fits your real life, not a perfect life.

Your basic savings account is the first stop. It is perfect for an emergency fund since the money is easy to reach when a tire blows or a phone breaks. Give it a nickname like Emergency Fund so you always remember the purpose.

A money market account can work well once your balance grows. What is a money market account? It is a savings account that may offer higher dividends when you keep a larger balance, while still letting you move money if needed. People often ask, are money market accounts worth it. They can be if you keep more money parked for medium goals like car repairs or moving costs.

If your goal has a specific deadline, consider certificates of deposit. What is a certificate of deposit? It is a savings account with a set term, such as six or twelve months, that rewards you for leaving the money alone. Certificates of deposit can help you avoid spending early when you know you will need the money at a certain time, like next summer’s class fees or a laptop replacement.

There are many budgeting techniques. The best one is the one you will actually follow. A simple option is the 50, 30, 20 idea where needs get about half, wants get some, and savings plus debt payments get the rest. If your numbers do not fit that model, start lower and raise your savings amount later.

Digital envelopes can help too. You set amounts for groceries, gas, and phone, then stop when the category is empty. Paying yourself first becomes the first envelope you fill. The Budget Calculator at First Alliance Credit Union can help you set the amounts and see where to trim without stress.

You do not need a big income to begin. You only need a clear plan and a few clicks. Read the steps below, imagine how they fit your next paycheck, and commit to trying them for one month. This plan builds the habit, which is the real win. If a step feels too large, cut it in half rather than skipping it.

Open or rename a savings bucket at First Alliance Credit Union so the purpose is clear. Set an automatic transfer for a small, repeatable amount on each payday.

Turn on Round Up Savings to send spare change from debit card purchases into savings. Let small amounts stack up in the background.

Use the Budget Calculator to choose a number you can keep every time. Adjust your categories until the math feels realistic and kind.

Add a second bucket that fits your goal. Try a money market account for flexible access with a higher balance, or a short certificate of deposit if you have a set date.

Pick a review date every two months. Increase your automatic transfer by a few dollars, or send part of a raise or tax refund to savings first.

Saving works best when the plan fits your real life. The goal is to keep the habit alive, not to chase a perfect number. If you find yourself stopping and starting, adjust the plan so it is easier to keep.

Pitfall 1: Trying to save more than you can afford

It is common to pick a number that looks good on paper and hurts in real life. When savings feels too tight, people cancel the transfer and lose momentum. Start smaller than you think, prove you can keep it, then step up slowly.

Try this fix: begin with one percent of take-home pay or a flat five to twenty dollars per payday. If that still feels tight, cut it in half for a month rather than turning it off. Add a tiny bump, like two to five dollars, every other month.

Pitfall 2: Skipping small goals

Big goals can feel far away, which makes it easy to quit. Small milestones give you quick wins and a reason to keep going. They also help you see progress even in busy seasons.

Try this fix: name each account for its purpose and set micro targets with dates. For example, “Emergency Fund: 100 dollars by the 15th,” then “250 dollars by next month.” Celebrate each checkpoint and roll forward to the next.

Before you add any new goals, review your numbers with the Budget Calculator and keep the automatic transfer running at a level you can maintain. If life gets bumpy, lower the amount for a month, do not pause it. Consistent deposits, even tiny ones, are what build the habit and the balance.

Small steps today can change your whole year. Set one automatic transfer, name your goal, and let Round Up Savings do the quiet work in the background. The emergencies feel smaller, the goals feel closer, and you feel more in control. Visit First Alliance Credit Union online or at a branch to open your savings, set up automatic transfers and Round Up Savings, and use the Budget Calculator to pick a number that fits your life.

If you’re a First Alliance Credit Union member, you might be aware of the My Cards feature. You might also know how it will let you know about all...

As a credit union, pretty much everyone knows the kind of services First Alliance Credit Union provides, such as savings accounts, checking accounts...

Buying a home may signify different things for many different people. However, the most common of those things is the dream of owning a home, a place...