debt to income ratio for mortgage: What you should know

Buying your first home can feel like a wild mix of excitement and nerves. Suddenly, you’re faced with terms like Debt-to-Income ratio (DTI), and if...

Debt-to-Income (DTI) ratio is a personal finance measure that helps in identifying your debt payments in comparison to your overall income. It is often the way a lender can determine your ability to repay the money that you have borrowed or are planning to borrow.

Debt-to-Income (DTI) ratio is a personal finance measure that helps in identifying your debt payments in comparison to your overall income. It is often the way a lender can determine your ability to repay the money that you have borrowed or are planning to borrow.

It is important that you do not confuse DTI with your credit card utilization, which is the amount of debt that you have accumulated in relation to your credit limits. Several lenders, especially mortgage or auto loan lenders, use your debt-to-income to determine your ability to pay them off responsibly. For example, a mortgage lender will use your DTI ratio to figure out how much of the mortgage you can afford to pay after all other monthly debts are paid off.

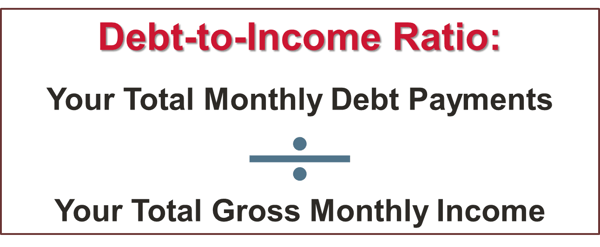

You can easily calculate your debt-to-income ratio to determine how much debt you have to pay off. To calculate your DTI ratio, add up all the monthly debt payments that you have and divide that sum by your gross monthly income. The gross monthly income that you accumulate is the money that you earn before taxes and other deductions are taken out.

The debt-to-income ratio has three levels, in the eyes of your lender your DTI falls into three categories: good, caution, or danger.

At this level, you have enough income to put towards your household expenses and even unexpected expenses can be covered with this percentage. This is considered a healthy level of DTI and most lenders will not have any issues lending to you with a ratio of 15% or less.

At this level, you can probably keep your head above water, it is always better to be safe than sorry. At this level, you will probably need to get a self-payment method like the debt ladder or debt snowball (paying off small debt first and working your way up) and to discipline yourself to stay above the debt. Slipping to this level can make it difficult to recover from unexpected expenses. Some lender may not lend to you at this ratio, others will require additional assurances for your payments, such as a co-signer or collateral.

This level is the most dangerous level a consumer can fall into. At this level, it will become clear to you that your financial situation is not healthy. If your DTI is 20 percent or above, you have more debt than you can actually afford. At this level, it is always best to get help from a trusted financial institution to help you develop a payment plan.

There are two ways of lowering your DTI ratio:

A low DTI ratio indicates a good balance between your debt and income. A high DTI ratio gives you a bad reputation of having a higher debt than the amount of gross monthly income. Studies show that a consumer with a lower debt-to-income ratio is more likely to be successful in paying off their debts monthly.

Mortgage lenders use your DTI ratio to measure your ability to make payments in a timely manner every month. When you are applying for a mortgage, the lender will first go through your finances before approving your request. Your finances will include your credit history, gross income monthly, and the amount of money you have on hand for a down payment. Your DTI ratio will be reviewed to figure out how much you can afford to pay every month on your mortgage payment. A lender can deny your application based on your monthly expenses being higher than your monthly income.

A credit score is a number that helps lenders estimate the risk of extending you credit. Your DTI ratio doesn’t affect your credit score directly, as the credit agencies are unaware of your monthly income. However, they do look over your debt-to-credit ratio. This is calculated in the same way, dividing your credit card balance with your credit limit. This means that if a person owes more than their credit limit, then their credit score will be lower. Both your debt-to-income and debt-to-credit ratios are used to conclude whether you qualify for a mortgage or not, but only the debt-to-credit directly affects your credit score.

Being aware of your debt-to-income (DTI) ratio can help you to determine whether you can afford more debt or not, or whether you are spending more than you are earning. Keeping your DTI healthy is also very important if you plan on getting a loan or a mortgage, as lenders will look at your DTI ratio determine if they will extend a loan to you.

Buying your first home can feel like a wild mix of excitement and nerves. Suddenly, you’re faced with terms like Debt-to-Income ratio (DTI), and if...

Telling your friends and family "I'm buying my first car!" is one of life’s most memorable moments. Being a first time car buyer gives you countless...

When you look at interest rates, you’ll see two abbreviations pop up over and over again—APR and APY. Some financial institutions will show both the...